- Poland

- /

- Entertainment

- /

- WSE:PCF

PCF Group Spólka Akcyjna (WSE:PCF) Might Not Be As Mispriced As It Looks After Plunging 30%

PCF Group Spólka Akcyjna (WSE:PCF) shares have retraced a considerable 30% in the last month, reversing a fair amount of their solid recent performance. The drop over the last 30 days has capped off a tough year for shareholders, with the share price down 45% in that time.

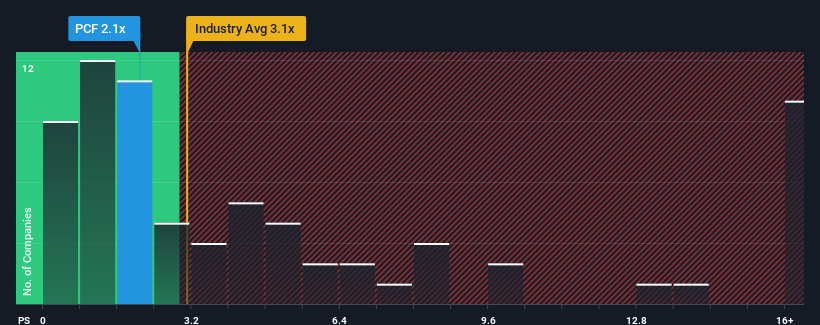

Following the heavy fall in price, PCF Group Spólka Akcyjna may be sending bullish signals at the moment with its price-to-sales (or "P/S") ratio of 2.1x, since almost half of all companies in the Entertainment industry in Poland have P/S ratios greater than 3.1x and even P/S higher than 7x are not unusual. Nonetheless, we'd need to dig a little deeper to determine if there is a rational basis for the reduced P/S.

View our latest analysis for PCF Group Spólka Akcyjna

How PCF Group Spólka Akcyjna Has Been Performing

PCF Group Spólka Akcyjna certainly has been doing a good job lately as its revenue growth has been positive while most other companies have been seeing their revenue go backwards. One possibility is that the P/S ratio is low because investors think the company's revenue is going to fall away like everyone else's soon. Those who are bullish on PCF Group Spólka Akcyjna will be hoping that this isn't the case and the company continues to beat out the industry.

Want the full picture on analyst estimates for the company? Then our free report on PCF Group Spólka Akcyjna will help you uncover what's on the horizon.Is There Any Revenue Growth Forecasted For PCF Group Spólka Akcyjna?

The only time you'd be truly comfortable seeing a P/S as low as PCF Group Spólka Akcyjna's is when the company's growth is on track to lag the industry.

If we review the last year of revenue growth, the company posted a worthy increase of 12%. The solid recent performance means it was also able to grow revenue by 9.3% in total over the last three years. So we can start by confirming that the company has actually done a good job of growing revenue over that time.

Turning to the outlook, the next three years should generate growth of 45% per annum as estimated by the three analysts watching the company. With the industry predicted to deliver 48% growth per annum, the company is positioned for a comparable revenue result.

With this information, we find it odd that PCF Group Spólka Akcyjna is trading at a P/S lower than the industry. Apparently some shareholders are doubtful of the forecasts and have been accepting lower selling prices.

What Does PCF Group Spólka Akcyjna's P/S Mean For Investors?

PCF Group Spólka Akcyjna's P/S has taken a dip along with its share price. Using the price-to-sales ratio alone to determine if you should sell your stock isn't sensible, however it can be a practical guide to the company's future prospects.

Our examination of PCF Group Spólka Akcyjna's revealed that its P/S remains low despite analyst forecasts of revenue growth matching the wider industry. When we see middle-of-the-road revenue growth like this, we assume it must be the potential risks that are what is placing pressure on the P/S ratio. However, if you agree with the analysts' forecasts, you may be able to pick up the stock at an attractive price.

And what about other risks? Every company has them, and we've spotted 2 warning signs for PCF Group Spólka Akcyjna (of which 1 is significant!) you should know about.

If companies with solid past earnings growth is up your alley, you may wish to see this free collection of other companies with strong earnings growth and low P/E ratios.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About WSE:PCF

PCF Group Spólka Akcyjna

Engages in the development and production of video games in Poland and internationally.

High growth potential with mediocre balance sheet.

Market Insights

Community Narratives