- Poland

- /

- Interactive Media and Services

- /

- WSE:LEG

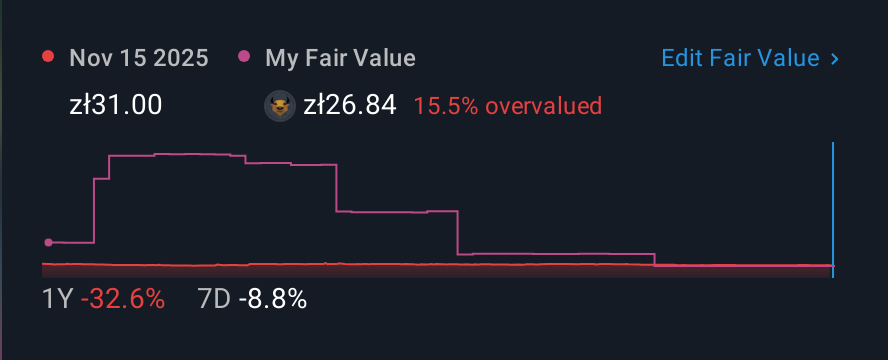

Does Legimi (WSE:LEG) Deserve A Spot On Your Watchlist?

For beginners, it can seem like a good idea (and an exciting prospect) to buy a company that tells a good story to investors, even if it currently lacks a track record of revenue and profit. Sometimes these stories can cloud the minds of investors, leading them to invest with their emotions rather than on the merit of good company fundamentals. While a well funded company may sustain losses for years, it will need to generate a profit eventually, or else investors will move on and the company will wither away.

If this kind of company isn't your style, you like companies that generate revenue, and even earn profits, then you may well be interested in Legimi (WSE:LEG). Even if this company is fairly valued by the market, investors would agree that generating consistent profits will continue to provide Legimi with the means to add long-term value to shareholders.

Legimi's Earnings Per Share Are Growing

If you believe that markets are even vaguely efficient, then over the long term you'd expect a company's share price to follow its earnings per share (EPS) outcomes. That means EPS growth is considered a real positive by most successful long-term investors. Shareholders will be happy to know that Legimi's EPS has grown 33% each year, compound, over three years. As a general rule, we'd say that if a company can keep up that sort of growth, shareholders will be beaming.

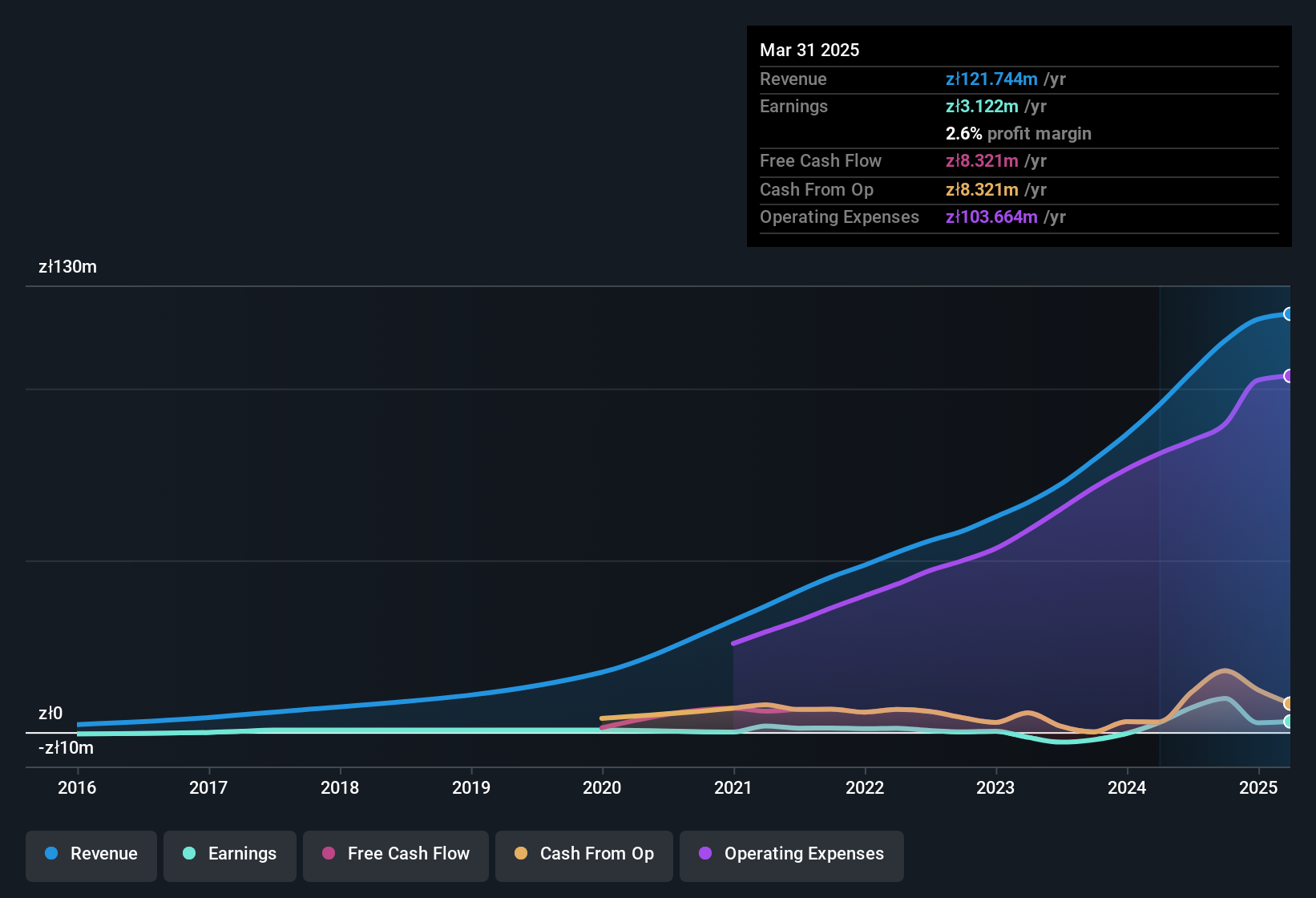

It's often helpful to take a look at earnings before interest and tax (EBIT) margins, as well as revenue growth, to get another take on the quality of the company's growth. Legimi maintained stable EBIT margins over the last year, all while growing revenue 28% to zł122m. That's progress.

The chart below shows how the company's bottom and top lines have progressed over time. For finer detail, click on the image.

Check out our latest analysis for Legimi

Since Legimi is no giant, with a market capitalisation of zł71m, you should definitely check its cash and debt before getting too excited about its prospects.

Are Legimi Insiders Aligned With All Shareholders?

Theory would suggest that it's an encouraging sign to see high insider ownership of a company, since it ties company performance directly to the financial success of its management. So those who are interested in Legimi will be delighted to know that insiders have shown their belief, holding a large proportion of the company's shares. Actually, with 42% of the company to their names, insiders are profoundly invested in the business. Those who are comforted by solid insider ownership like this should be happy, as it implies that those running the business are genuinely motivated to create shareholder value. Valued at only zł71m Legimi is really small for a listed company. So despite a large proportional holding, insiders only have zł30m worth of stock. That might not be a huge sum but it should be enough to keep insiders motivated!

Does Legimi Deserve A Spot On Your Watchlist?

If you believe that share price follows earnings per share you should definitely be delving further into Legimi's strong EPS growth. Further, the high level of insider ownership is impressive and suggests that the management appreciates the EPS growth and has faith in Legimi's continuing strength. On the balance of its merits, solid EPS growth and company insiders who are aligned with the shareholders would indicate a business that is worthy of further research. You should always think about risks though. Case in point, we've spotted 2 warning signs for Legimi you should be aware of.

Although Legimi certainly looks good, it may appeal to more investors if insiders were buying up shares. If you like to see companies with more skin in the game, then check out this handpicked selection of Polish companies that not only boast of strong growth but have strong insider backing.

Please note the insider transactions discussed in this article refer to reportable transactions in the relevant jurisdiction.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About WSE:LEG

Excellent balance sheet and slightly overvalued.

Market Insights

Community Narratives