STIF Société Anonyme And 2 Other Undiscovered Gems In Europe

Reviewed by Simply Wall St

As Europe's major stock indexes show mixed returns, with the pan-European STOXX Europe 600 Index remaining relatively flat and Eurozone inflation hitting its target, investors are increasingly turning their attention to smaller-cap companies that may offer untapped potential. In this environment, identifying stocks that can thrive amid steady economic indicators and cautious monetary policies becomes crucial for those seeking opportunities beyond the well-trodden paths of larger indices.

Top 10 Undiscovered Gems With Strong Fundamentals In Europe

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| Caisse Régionale de Crédit Agricole Mutuel Brie Picardie Société coopérative | 26.90% | 4.14% | 7.22% | ★★★★★★ |

| La Forestière Equatoriale | NA | -65.30% | 37.55% | ★★★★★★ |

| Linc | NA | 101.28% | 29.81% | ★★★★★★ |

| Decora | 18.47% | 11.59% | 10.86% | ★★★★★☆ |

| va-Q-tec | 43.54% | 8.03% | -34.33% | ★★★★★☆ |

| Viohalco | 93.48% | 11.98% | 14.19% | ★★★★☆☆ |

| Evergent Investments | 5.39% | 9.41% | 21.17% | ★★★★☆☆ |

| Darwin | 3.03% | 84.88% | 5.63% | ★★★★☆☆ |

| Eurofins-Cerep | 0.46% | 6.80% | 6.93% | ★★★★☆☆ |

| MCH Group | 124.09% | 12.40% | 43.58% | ★★★★☆☆ |

Let's review some notable picks from our screened stocks.

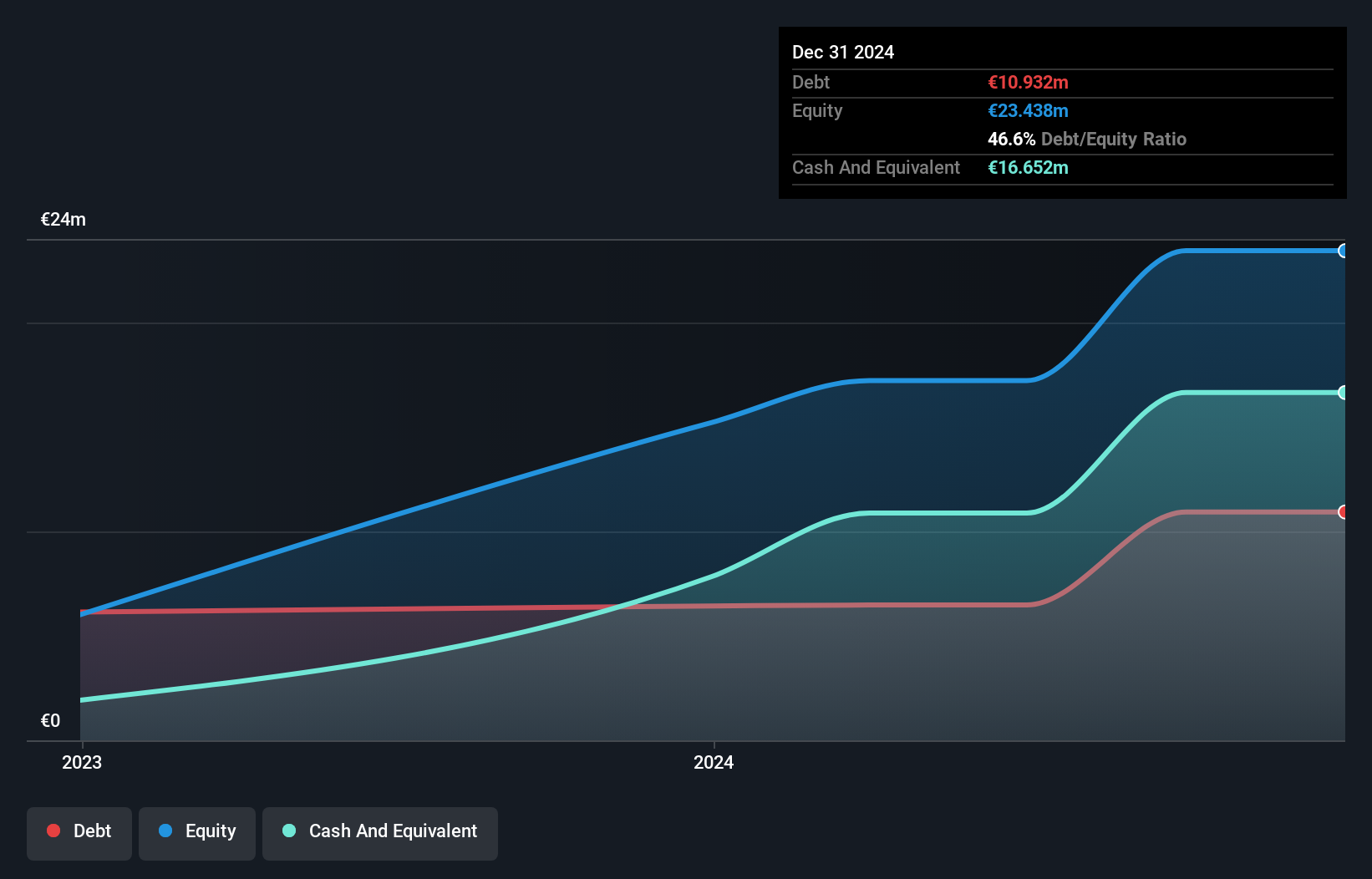

STIF Société anonyme (ENXTPA:ALSTI)

Simply Wall St Value Rating: ★★★★☆☆

Overview: STIF Société anonyme specializes in manufacturing and selling components for the handling of bulk products in France, with a market capitalization of €362.56 million.

Operations: The company's revenue is primarily derived from its Machinery & Industrial Equipment segment, amounting to €63.70 million.

STIF Société anonyme, a small player in its sector, has demonstrated impressive financial performance with earnings soaring by 384% over the past year, significantly outpacing the Machinery industry's growth of 18%. Trading at 28.5% below its estimated fair value suggests potential undervaluation. The company's interest payments are well covered by EBIT at a robust 64.7 times coverage, indicating strong operational efficiency and high-quality earnings. However, recent volatility in share price may concern some investors. Future prospects appear promising with forecasted earnings growth of 20% annually, positioning it as an intriguing opportunity for those seeking hidden gems in Europe.

- Dive into the specifics of STIF Société anonyme here with our thorough health report.

Assess STIF Société anonyme's past performance with our detailed historical performance reports.

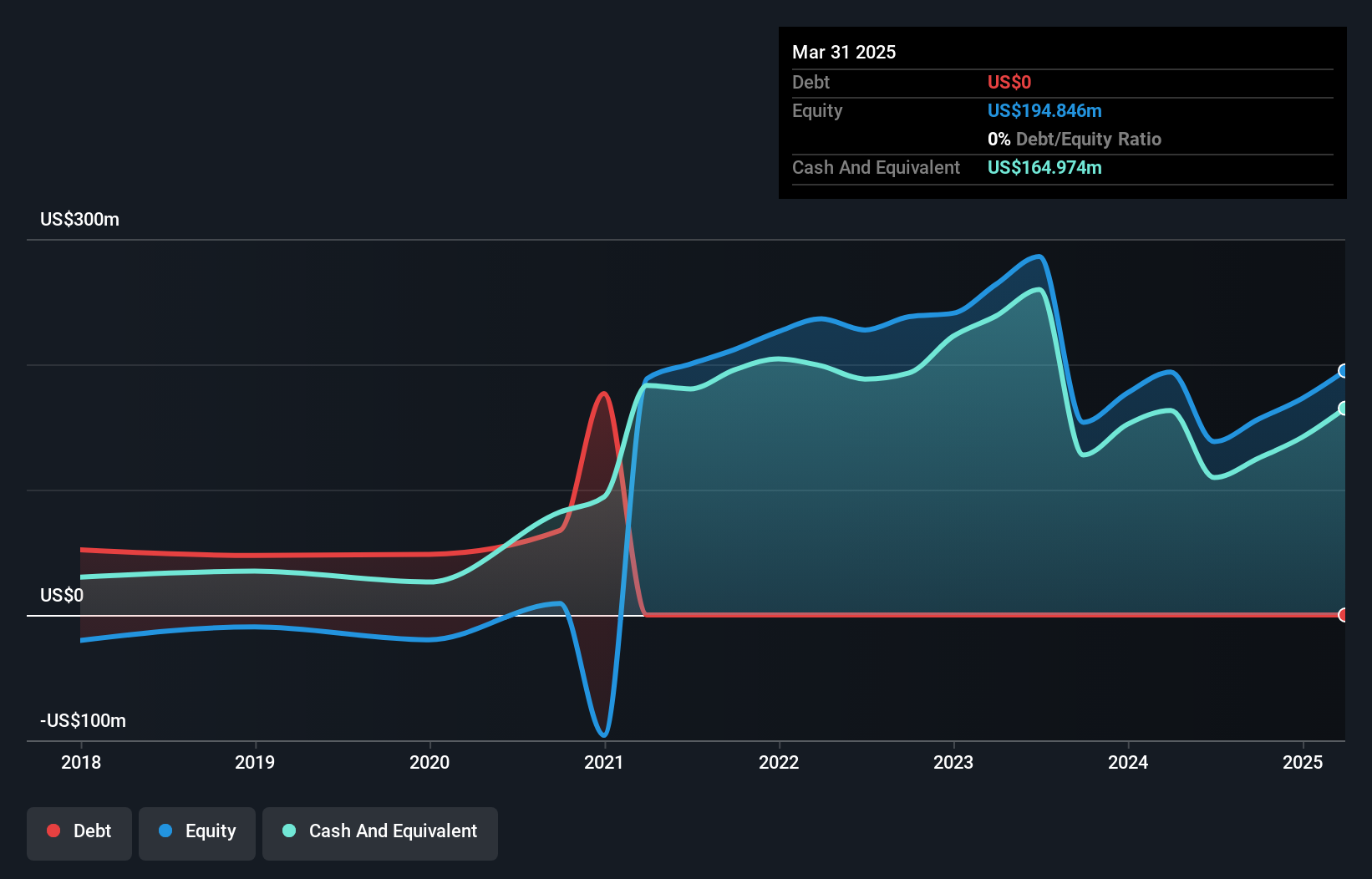

BW Offshore (OB:BWO)

Simply Wall St Value Rating: ★★★★★☆

Overview: BW Offshore Limited specializes in the engineering of offshore production solutions across various regions including the Americas, Europe, Africa, Asia, and the Pacific with a market capitalization of NOK5.74 billion.

Operations: BW Offshore generates revenue primarily from its offshore production solutions, with a focus on engineering services across multiple regions. The company's net profit margin has shown variability over recent periods.

BW Offshore is making waves with its strategic push in FPSO projects and floating wind energy, aiming to diversify revenue streams and tap into low-carbon solutions. Over the past five years, its debt-to-equity ratio impressively decreased from 124.1% to 17.6%, showcasing financial discipline. While earnings grew 59.2% annually over five years, recent growth of 22.2% lagged behind the industry’s robust performance of 60.1%. Trading at a notable discount of 39% below estimated fair value, BW Offshore presents potential upside despite forecasted earnings declines averaging 8.7% annually for the next three years due to project dependencies and contract uncertainties.

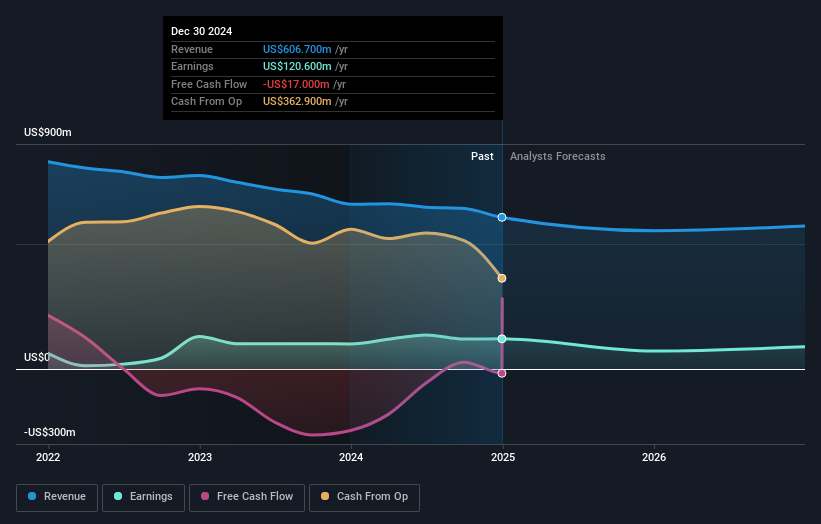

Huuuge (WSE:HUG)

Simply Wall St Value Rating: ★★★★★★

Overview: Huuuge, Inc. is a free-to-play games developer and publisher on mobile platforms with operations in North America, Europe, the Asia Pacific, and internationally, and it has a market capitalization of PLN1.10 billion.

Operations: The primary revenue stream for Huuuge, Inc. comes from its online mobile games segment, generating $246.24 million. The company has a market capitalization of PLN1.10 billion.

Huuuge, Inc. presents a complex picture with its recent performance and financial metrics. Despite being debt-free, the company reported a decrease in sales to US$62.39 million for Q1 2025 from US$66.98 million the previous year, while net income rose to US$19.81 million from US$16.54 million, showcasing improved profitability with basic earnings per share climbing to US$0.35 from US$0.26. The company's levered free cash flow has been robust, reaching approximately $70 million recently, indicating strong operational efficiency despite negative earnings growth of -10% over the past year compared to industry averages of -5%.

- Take a closer look at Huuuge's potential here in our health report.

Evaluate Huuuge's historical performance by accessing our past performance report.

Summing It All Up

- Get an in-depth perspective on all 323 European Undiscovered Gems With Strong Fundamentals by using our screener here.

- Invested in any of these stocks? Simplify your portfolio management with Simply Wall St and stay ahead with our alerts for any critical updates on your stocks.

- Unlock the power of informed investing with Simply Wall St, your free guide to navigating stock markets worldwide.

Contemplating Other Strategies?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About ENXTPA:ALSTI

STIF Société anonyme

Manufactures and sells components for the handling of bulk products in France.

Exceptional growth potential with proven track record.

Market Insights

Community Narratives