- Poland

- /

- Entertainment

- /

- WSE:BBT

BoomBit S.A.'s (WSE:BBT) Dismal Stock Performance Reflects Weak Fundamentals

With its stock down 20% over the past three months, it is easy to disregard BoomBit (WSE:BBT). To decide if this trend could continue, we decided to look at its weak fundamentals as they shape the long-term market trends. In this article, we decided to focus on BoomBit's ROE.

Return on equity or ROE is a key measure used to assess how efficiently a company's management is utilizing the company's capital. In other words, it is a profitability ratio which measures the rate of return on the capital provided by the company's shareholders.

Check out our latest analysis for BoomBit

How Is ROE Calculated?

ROE can be calculated by using the formula:

Return on Equity = Net Profit (from continuing operations) ÷ Shareholders' Equity

So, based on the above formula, the ROE for BoomBit is:

9.8% = zł7.3m ÷ zł74m (Based on the trailing twelve months to March 2023).

The 'return' is the income the business earned over the last year. Another way to think of that is that for every PLN1 worth of equity, the company was able to earn PLN0.10 in profit.

What Has ROE Got To Do With Earnings Growth?

So far, we've learned that ROE is a measure of a company's profitability. Depending on how much of these profits the company reinvests or "retains", and how effectively it does so, we are then able to assess a company’s earnings growth potential. Assuming all else is equal, companies that have both a higher return on equity and higher profit retention are usually the ones that have a higher growth rate when compared to companies that don't have the same features.

BoomBit's Earnings Growth And 9.8% ROE

On the face of it, BoomBit's ROE is not much to talk about. We then compared the company's ROE to the broader industry and were disappointed to see that the ROE is lower than the industry average of 17%. BoomBit was still able to see a decent net income growth of 17% over the past five years. So, there might be other aspects that are positively influencing the company's earnings growth. For example, it is possible that the company's management has made some good strategic decisions, or that the company has a low payout ratio.

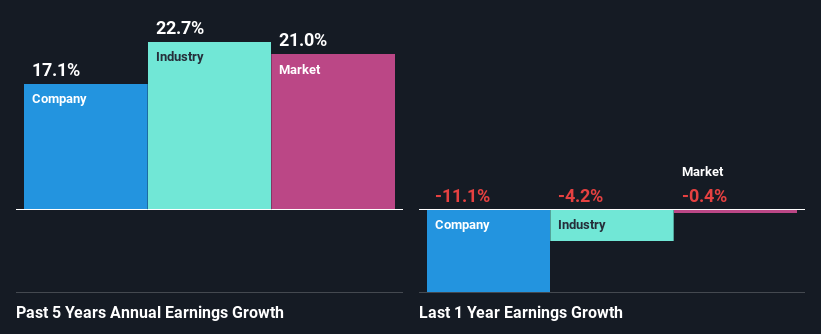

We then compared BoomBit's net income growth with the industry and found that the company's growth figure is lower than the average industry growth rate of 23% in the same period, which is a bit concerning.

Earnings growth is a huge factor in stock valuation. It’s important for an investor to know whether the market has priced in the company's expected earnings growth (or decline). By doing so, they will have an idea if the stock is headed into clear blue waters or if swampy waters await. One good indicator of expected earnings growth is the P/E ratio which determines the price the market is willing to pay for a stock based on its earnings prospects. So, you may want to check if BoomBit is trading on a high P/E or a low P/E, relative to its industry.

Is BoomBit Using Its Retained Earnings Effectively?

The really high three-year median payout ratio of 107% for BoomBit suggests that the company is paying its shareholders more than what it is earning. However, this hasn't really hampered its ability to grow as we saw earlier. That being said, the high payout ratio could be worth keeping an eye on in case the company is unable to keep up its current growth momentum. You can see the 2 risks we have identified for BoomBit by visiting our risks dashboard for free on our platform here.

Along with seeing a growth in earnings, BoomBit only recently started paying dividends. Its quite possible that the company was looking to impress its shareholders.

Conclusion

In total, we would have a hard think before deciding on any investment action concerning BoomBit. While the company has posted decent earnings growth, the company is retaining little to no profits and is reinvesting those profits at a low rate of return. This makes us doubtful if that growth could continue, especially if by any chance the business is faced with any sort of risk. So far, we've only made a quick discussion around the company's earnings growth. So it may be worth checking this free detailed graph of BoomBit's past earnings, as well as revenue and cash flows to get a deeper insight into the company's performance.

Valuation is complex, but we're here to simplify it.

Discover if BoomBit might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About WSE:BBT

BoomBit

Develops and publishes computer games in North America, Europe, Asia, Africa, South America, Australia, and Oceania.

Excellent balance sheet with low risk.

Market Insights

Weekly Picks

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

Fiducian: Compliance Clouds or Value Opportunity?

Willamette Valley Vineyards (WVVI): Not-So-Great Value

Recently Updated Narratives

ADNOC Gas future shines with a 21.4% revenue surge

Watch Pulse Seismic Outperform with 13.6% Revenue Growth in the Coming Years

Significantly undervalued gold explorer in Timmins, finally getting traction

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026