Today, we'll introduce the concept of the P/E ratio for those who are learning about investing. To keep it practical, we'll show how Standrew S.A.'s (WSE:STD) P/E ratio could help you assess the value on offer. What is Standrew's P/E ratio? Well, based on the last twelve months it is 31.57. That means that at current prices, buyers pay PLN31.57 for every PLN1 in trailing yearly profits.

View our latest analysis for Standrew

How Do I Calculate A Price To Earnings Ratio?

The formula for P/E is:

Price to Earnings Ratio = Share Price ÷ Earnings per Share (EPS)

Or for Standrew:

P/E of 31.57 = PLN9.2 ÷ PLN0.29 (Based on the trailing twelve months to March 2019.)

Is A High P/E Ratio Good?

A higher P/E ratio implies that investors pay a higher price for the earning power of the business. That isn't necessarily good or bad, but a high P/E implies relatively high expectations of what a company can achieve in the future.

How Does Standrew's P/E Ratio Compare To Its Peers?

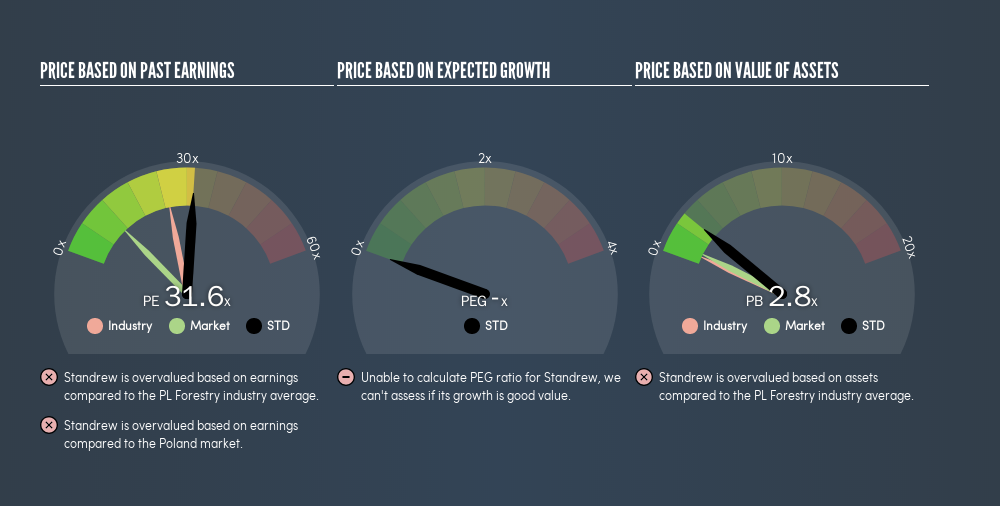

The P/E ratio indicates whether the market has higher or lower expectations of a company. The image below shows that Standrew has a higher P/E than the average (25.3) P/E for companies in the forestry industry.

Its relatively high P/E ratio indicates that Standrew shareholders think it will perform better than other companies in its industry classification.

How Growth Rates Impact P/E Ratios

If earnings fall then in the future the 'E' will be lower. Therefore, even if you pay a low multiple of earnings now, that multiple will become higher in the future. Then, a higher P/E might scare off shareholders, pushing the share price down.

Standrew's earnings per share were pretty steady over the last year. And over the longer term (5 years) earnings per share have decreased 7.2% annually. So you wouldn't expect a very high P/E.

Don't Forget: The P/E Does Not Account For Debt or Bank Deposits

One drawback of using a P/E ratio is that it considers market capitalization, but not the balance sheet. So it won't reflect the advantage of cash, or disadvantage of debt. Hypothetically, a company could reduce its future P/E ratio by spending its cash (or taking on debt) to achieve higher earnings.

Such spending might be good or bad, overall, but the key point here is that you need to look at debt to understand the P/E ratio in context.

So What Does Standrew's Balance Sheet Tell Us?

Net debt totals 16% of Standrew's market cap. That's enough debt to impact the P/E ratio a little; so keep it in mind if you're comparing it to companies without debt.

The Verdict On Standrew's P/E Ratio

Standrew trades on a P/E ratio of 31.6, which is above its market average of 10.9. Given the debt is only modest, and earnings are already moving in the right direction, it's not surprising that the market expects continued improvement.

When the market is wrong about a stock, it gives savvy investors an opportunity. People often underestimate remarkable growth -- so investors can make money when fast growth is not fully appreciated. Although we don't have analyst forecasts, you could get a better understanding of its growth by checking out this more detailed historical graph of earnings, revenue and cash flow.

You might be able to find a better buy than Standrew. If you want a selection of possible winners, check out this free list of interesting companies that trade on a P/E below 20 (but have proven they can grow earnings).

We aim to bring you long-term focused research analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material.

If you spot an error that warrants correction, please contact the editor at editorial-team@simplywallst.com. This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. Simply Wall St has no position in the stocks mentioned. Thank you for reading.

About WSE:STD

Slight risk with imperfect balance sheet.

Market Insights

Weekly Picks

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

Fiducian: Compliance Clouds or Value Opportunity?

Willamette Valley Vineyards (WVVI): Not-So-Great Value

Recently Updated Narratives

The "Molecular Pencil": Why Beam's Technology is Built to Win

ADNOC Gas future shines with a 21.4% revenue surge

Watch Pulse Seismic Outperform with 13.6% Revenue Growth in the Coming Years

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026