Is Fabryka Farb i Lakierów Sniezka (WSE:SKA) A Risky Investment?

The external fund manager backed by Berkshire Hathaway's Charlie Munger, Li Lu, makes no bones about it when he says 'The biggest investment risk is not the volatility of prices, but whether you will suffer a permanent loss of capital.' So it seems the smart money knows that debt - which is usually involved in bankruptcies - is a very important factor, when you assess how risky a company is. Importantly, Fabryka Farb i Lakierów Sniezka SA (WSE:SKA) does carry debt. But is this debt a concern to shareholders?

Why Does Debt Bring Risk?

Debt and other liabilities become risky for a business when it cannot easily fulfill those obligations, either with free cash flow or by raising capital at an attractive price. Ultimately, if the company can't fulfill its legal obligations to repay debt, shareholders could walk away with nothing. However, a more usual (but still expensive) situation is where a company must dilute shareholders at a cheap share price simply to get debt under control. Of course, plenty of companies use debt to fund growth, without any negative consequences. When we examine debt levels, we first consider both cash and debt levels, together.

Check out our latest analysis for Fabryka Farb i Lakierów Sniezka

What Is Fabryka Farb i Lakierów Sniezka's Debt?

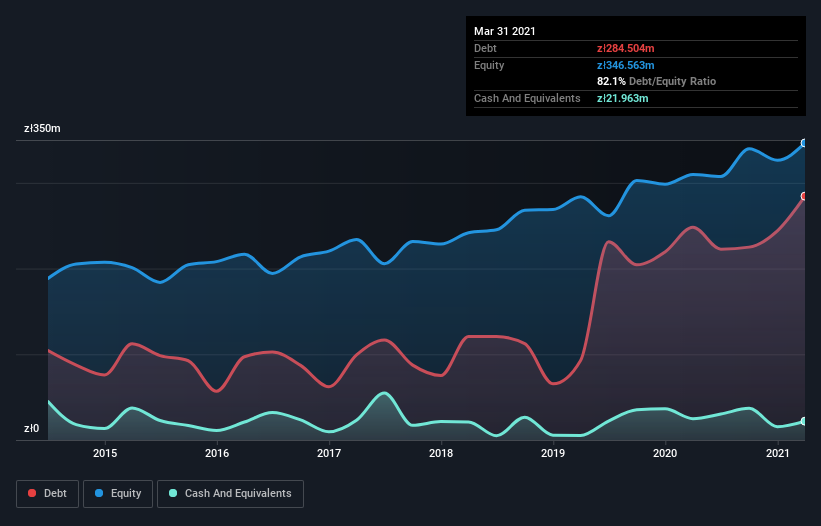

As you can see below, at the end of March 2021, Fabryka Farb i Lakierów Sniezka had zł284.5m of debt, up from zł248.2m a year ago. Click the image for more detail. On the flip side, it has zł22.0m in cash leading to net debt of about zł262.5m.

How Healthy Is Fabryka Farb i Lakierów Sniezka's Balance Sheet?

The latest balance sheet data shows that Fabryka Farb i Lakierów Sniezka had liabilities of zł306.6m due within a year, and liabilities of zł161.3m falling due after that. Offsetting these obligations, it had cash of zł22.0m as well as receivables valued at zł149.1m due within 12 months. So its liabilities outweigh the sum of its cash and (near-term) receivables by zł296.8m.

Fabryka Farb i Lakierów Sniezka has a market capitalization of zł1.09b, so it could very likely raise cash to ameliorate its balance sheet, if the need arose. However, it is still worthwhile taking a close look at its ability to pay off debt.

We use two main ratios to inform us about debt levels relative to earnings. The first is net debt divided by earnings before interest, tax, depreciation, and amortization (EBITDA), while the second is how many times its earnings before interest and tax (EBIT) covers its interest expense (or its interest cover, for short). This way, we consider both the absolute quantum of the debt, as well as the interest rates paid on it.

We'd say that Fabryka Farb i Lakierów Sniezka's moderate net debt to EBITDA ratio ( being 1.9), indicates prudence when it comes to debt. And its commanding EBIT of 84.9 times its interest expense, implies the debt load is as light as a peacock feather. Also relevant is that Fabryka Farb i Lakierów Sniezka has grown its EBIT by a very respectable 27% in the last year, thus enhancing its ability to pay down debt. The balance sheet is clearly the area to focus on when you are analysing debt. But it is Fabryka Farb i Lakierów Sniezka's earnings that will influence how the balance sheet holds up in the future. So if you're keen to discover more about its earnings, it might be worth checking out this graph of its long term earnings trend.

Finally, while the tax-man may adore accounting profits, lenders only accept cold hard cash. So we clearly need to look at whether that EBIT is leading to corresponding free cash flow. In the last three years, Fabryka Farb i Lakierów Sniezka created free cash flow amounting to 10% of its EBIT, an uninspiring performance. That limp level of cash conversion undermines its ability to manage and pay down debt.

Our View

Both Fabryka Farb i Lakierów Sniezka's ability to to cover its interest expense with its EBIT and its EBIT growth rate gave us comfort that it can handle its debt. On the other hand, its conversion of EBIT to free cash flow makes us a little less comfortable about its debt. Considering this range of data points, we think Fabryka Farb i Lakierów Sniezka is in a good position to manage its debt levels. Having said that, the load is sufficiently heavy that we would recommend any shareholders keep a close eye on it. There's no doubt that we learn most about debt from the balance sheet. But ultimately, every company can contain risks that exist outside of the balance sheet. For instance, we've identified 2 warning signs for Fabryka Farb i Lakierów Sniezka that you should be aware of.

If, after all that, you're more interested in a fast growing company with a rock-solid balance sheet, then check out our list of net cash growth stocks without delay.

When trading Fabryka Farb i Lakierów Sniezka or any other investment, use the platform considered by many to be the Professional's Gateway to the Worlds Market, Interactive Brokers. You get the lowest-cost* trading on stocks, options, futures, forex, bonds and funds worldwide from a single integrated account. Promoted

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

About WSE:SKA

Fabryka Farb i Lakierów Sniezka

Engages in the manufacture and sale of decorative paints in Poland, Hungary, Ukraine, Belarus, and internationally.

Flawless balance sheet with solid track record.

Similar Companies

Market Insights

Weekly Picks

Solutions by stc: 34% Upside in Saudi's Digital Transformation Leader

The AI Infrastructure Giant Grows Into Its Valuation

Recently Updated Narratives

Not a Bubble, But the "Industrial Revolution 4.0" Engine

The "David vs. Goliath" AI Trade – Why Second Place is Worth Billions

The "Sleeping Giant" Wakes Up – Efficiency & Monetization

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026