Howard Marks put it nicely when he said that, rather than worrying about share price volatility, 'The possibility of permanent loss is the risk I worry about... and every practical investor I know worries about.' When we think about how risky a company is, we always like to look at its use of debt, since debt overload can lead to ruin. We note that PCC Rokita SA (WSE:PCR) does have debt on its balance sheet. But the real question is whether this debt is making the company risky.

What Risk Does Debt Bring?

Debt and other liabilities become risky for a business when it cannot easily fulfill those obligations, either with free cash flow or by raising capital at an attractive price. Part and parcel of capitalism is the process of 'creative destruction' where failed businesses are mercilessly liquidated by their bankers. However, a more frequent (but still costly) occurrence is where a company must issue shares at bargain-basement prices, permanently diluting shareholders, just to shore up its balance sheet. Of course, plenty of companies use debt to fund growth, without any negative consequences. When we think about a company's use of debt, we first look at cash and debt together.

See our latest analysis for PCC Rokita

How Much Debt Does PCC Rokita Carry?

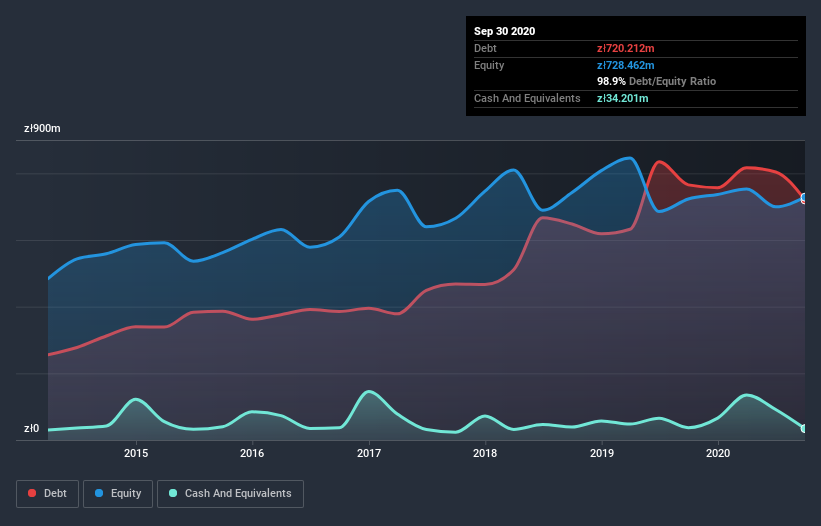

As you can see below, PCC Rokita had zł720.2m of debt at September 2020, down from zł765.5m a year prior. However, it also had zł34.2m in cash, and so its net debt is zł686.0m.

How Healthy Is PCC Rokita's Balance Sheet?

We can see from the most recent balance sheet that PCC Rokita had liabilities of zł374.1m falling due within a year, and liabilities of zł821.8m due beyond that. Offsetting this, it had zł34.2m in cash and zł157.5m in receivables that were due within 12 months. So its liabilities total zł1.00b more than the combination of its cash and short-term receivables.

This is a mountain of leverage relative to its market capitalization of zł1.12b. This suggests shareholders would be heavily diluted if the company needed to shore up its balance sheet in a hurry.

In order to size up a company's debt relative to its earnings, we calculate its net debt divided by its earnings before interest, tax, depreciation, and amortization (EBITDA) and its earnings before interest and tax (EBIT) divided by its interest expense (its interest cover). This way, we consider both the absolute quantum of the debt, as well as the interest rates paid on it.

PCC Rokita has a debt to EBITDA ratio of 2.8 and its EBIT covered its interest expense 5.8 times. Taken together this implies that, while we wouldn't want to see debt levels rise, we think it can handle its current leverage. Shareholders should be aware that PCC Rokita's EBIT was down 43% last year. If that earnings trend continues then paying off its debt will be about as easy as herding cats on to a roller coaster. There's no doubt that we learn most about debt from the balance sheet. But ultimately the future profitability of the business will decide if PCC Rokita can strengthen its balance sheet over time. So if you're focused on the future you can check out this free report showing analyst profit forecasts.

Finally, a business needs free cash flow to pay off debt; accounting profits just don't cut it. So we always check how much of that EBIT is translated into free cash flow. In the last three years, PCC Rokita's free cash flow amounted to 42% of its EBIT, less than we'd expect. That's not great, when it comes to paying down debt.

Our View

Mulling over PCC Rokita's attempt at (not) growing its EBIT, we're certainly not enthusiastic. But at least its interest cover is not so bad. Overall, it seems to us that PCC Rokita's balance sheet is really quite a risk to the business. For this reason we're pretty cautious about the stock, and we think shareholders should keep a close eye on its liquidity. When analysing debt levels, the balance sheet is the obvious place to start. But ultimately, every company can contain risks that exist outside of the balance sheet. Consider risks, for instance. Every company has them, and we've spotted 4 warning signs for PCC Rokita you should know about.

If, after all that, you're more interested in a fast growing company with a rock-solid balance sheet, then check out our list of net cash growth stocks without delay.

When trading PCC Rokita or any other investment, use the platform considered by many to be the Professional's Gateway to the Worlds Market, Interactive Brokers. You get the lowest-cost* trading on stocks, options, futures, forex, bonds and funds worldwide from a single integrated account. Promoted

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

About WSE:PCR

PCC Rokita

Designs, produces, and sells chemical products in Poland and internationally.

Flawless balance sheet average dividend payer.

Similar Companies

Market Insights

Community Narratives