- Poland

- /

- Metals and Mining

- /

- WSE:ODL

Odlewnie Polskie S.A.'s (WSE:ODL) Stock Is Going Strong: Have Financials A Role To Play?

Most readers would already be aware that Odlewnie Polskie's (WSE:ODL) stock increased significantly by 24% over the past three months. We wonder if and what role the company's financials play in that price change as a company's long-term fundamentals usually dictate market outcomes. In this article, we decided to focus on Odlewnie Polskie's ROE.

ROE or return on equity is a useful tool to assess how effectively a company can generate returns on the investment it received from its shareholders. Put another way, it reveals the company's success at turning shareholder investments into profits.

See our latest analysis for Odlewnie Polskie

How Do You Calculate Return On Equity?

The formula for ROE is:

Return on Equity = Net Profit (from continuing operations) ÷ Shareholders' Equity

So, based on the above formula, the ROE for Odlewnie Polskie is:

10% = zł15m ÷ zł145m (Based on the trailing twelve months to September 2024).

The 'return' is the profit over the last twelve months. That means that for every PLN1 worth of shareholders' equity, the company generated PLN0.10 in profit.

What Has ROE Got To Do With Earnings Growth?

So far, we've learned that ROE is a measure of a company's profitability. Depending on how much of these profits the company reinvests or "retains", and how effectively it does so, we are then able to assess a company’s earnings growth potential. Assuming all else is equal, companies that have both a higher return on equity and higher profit retention are usually the ones that have a higher growth rate when compared to companies that don't have the same features.

Odlewnie Polskie's Earnings Growth And 10% ROE

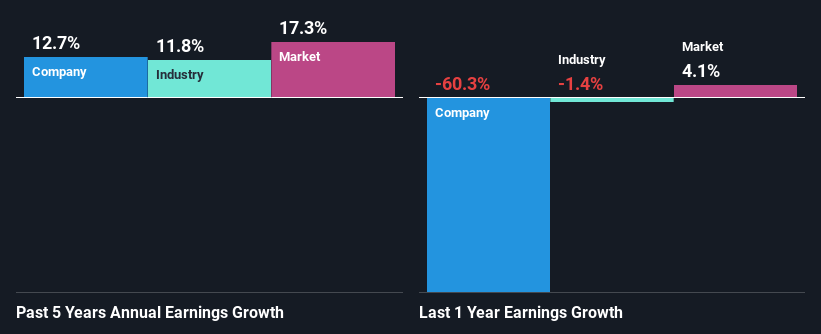

When you first look at it, Odlewnie Polskie's ROE doesn't look that attractive. However, given that the company's ROE is similar to the average industry ROE of 9.2%, we may spare it some thought. Even so, Odlewnie Polskie has shown a fairly decent growth in its net income which grew at a rate of 13%. Taking into consideration that the ROE is not particularly high, we reckon that there could also be other factors at play which could be influencing the company's growth. Such as - high earnings retention or an efficient management in place.

As a next step, we compared Odlewnie Polskie's net income growth with the industry and found that the company has a similar growth figure when compared with the industry average growth rate of 12% in the same period.

The basis for attaching value to a company is, to a great extent, tied to its earnings growth. It’s important for an investor to know whether the market has priced in the company's expected earnings growth (or decline). This then helps them determine if the stock is placed for a bright or bleak future. If you're wondering about Odlewnie Polskie's's valuation, check out this gauge of its price-to-earnings ratio, as compared to its industry.

Is Odlewnie Polskie Efficiently Re-investing Its Profits?

Odlewnie Polskie has a healthy combination of a moderate three-year median payout ratio of 31% (or a retention ratio of 69%) and a respectable amount of growth in earnings as we saw above, meaning that the company has been making efficient use of its profits.

Besides, Odlewnie Polskie has been paying dividends over a period of eight years. This shows that the company is committed to sharing profits with its shareholders.

Summary

On the whole, we do feel that Odlewnie Polskie has some positive attributes. Despite its low rate of return, the fact that the company reinvests a very high portion of its profits into its business, no doubt contributed to its high earnings growth. While we won't completely dismiss the company, what we would do, is try to ascertain how risky the business is to make a more informed decision around the company. To know the 4 risks we have identified for Odlewnie Polskie visit our risks dashboard for free.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About WSE:ODL

Odlewnie Polskie

Produces and sells castings in Germany, the Czech Republic, the Netherlands, Sweden, Hungary, Great Britain, Austria, Slovakia, Denmark, Turkey, Ireland, Spain, Italy, Switzerland, France, China, and Serbia.

Flawless balance sheet slight.

Market Insights

Community Narratives