- Poland

- /

- Metals and Mining

- /

- WSE:ODL

Odlewnie Polskie S.A.'s (WSE:ODL) 31% Share Price Surge Not Quite Adding Up

Odlewnie Polskie S.A. (WSE:ODL) shareholders have had their patience rewarded with a 31% share price jump in the last month. But the gains over the last month weren't enough to make shareholders whole, as the share price is still down 4.6% in the last twelve months.

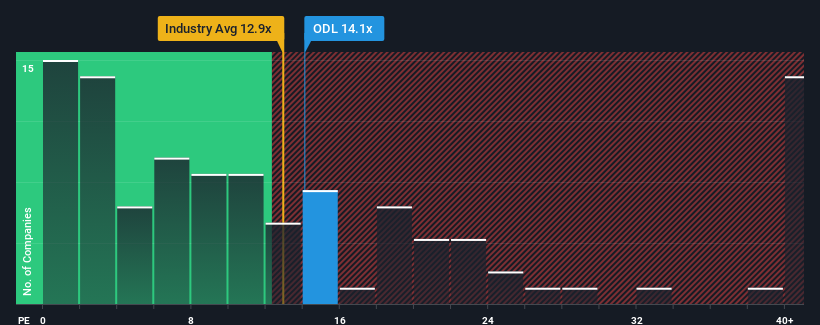

Although its price has surged higher, you could still be forgiven for feeling indifferent about Odlewnie Polskie's P/E ratio of 14.1x, since the median price-to-earnings (or "P/E") ratio in Poland is also close to 13x. Although, it's not wise to simply ignore the P/E without explanation as investors may be disregarding a distinct opportunity or a costly mistake.

For instance, Odlewnie Polskie's receding earnings in recent times would have to be some food for thought. It might be that many expect the company to put the disappointing earnings performance behind them over the coming period, which has kept the P/E from falling. If not, then existing shareholders may be a little nervous about the viability of the share price.

View our latest analysis for Odlewnie Polskie

Does Growth Match The P/E?

The only time you'd be comfortable seeing a P/E like Odlewnie Polskie's is when the company's growth is tracking the market closely.

Retrospectively, the last year delivered a frustrating 60% decrease to the company's bottom line. As a result, earnings from three years ago have also fallen 9.4% overall. So unfortunately, we have to acknowledge that the company has not done a great job of growing earnings over that time.

Weighing that medium-term earnings trajectory against the broader market's one-year forecast for expansion of 12% shows it's an unpleasant look.

In light of this, it's somewhat alarming that Odlewnie Polskie's P/E sits in line with the majority of other companies. Apparently many investors in the company are way less bearish than recent times would indicate and aren't willing to let go of their stock right now. Only the boldest would assume these prices are sustainable as a continuation of recent earnings trends is likely to weigh on the share price eventually.

The Final Word

Its shares have lifted substantially and now Odlewnie Polskie's P/E is also back up to the market median. Typically, we'd caution against reading too much into price-to-earnings ratios when settling on investment decisions, though it can reveal plenty about what other market participants think about the company.

We've established that Odlewnie Polskie currently trades on a higher than expected P/E since its recent earnings have been in decline over the medium-term. When we see earnings heading backwards and underperforming the market forecasts, we suspect the share price is at risk of declining, sending the moderate P/E lower. If recent medium-term earnings trends continue, it will place shareholders' investments at risk and potential investors in danger of paying an unnecessary premium.

It's always necessary to consider the ever-present spectre of investment risk. We've identified 4 warning signs with Odlewnie Polskie (at least 1 which doesn't sit too well with us), and understanding them should be part of your investment process.

If P/E ratios interest you, you may wish to see this free collection of other companies with strong earnings growth and low P/E ratios.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About WSE:ODL

Odlewnie Polskie

Produces and sells castings in Germany, the Czech Republic, the Netherlands, Sweden, Hungary, Great Britain, Austria, Slovakia, Denmark, Turkey, Ireland, Spain, Italy, Switzerland, France, China, and Serbia.

Flawless balance sheet with acceptable track record.

Market Insights

Community Narratives

Recently Updated Narratives

No miracle in sight

Q3 Outlook modestly optimistic

Alphabet: The Under-appreciated Compounder Hiding in Plain Sight

Popular Narratives

The company that turned a verb into a global necessity and basically runs the modern internet, digital ads, smartphones, maps, and AI.

MicroVision will explode future revenue by 380.37% with a vision towards success