- Poland

- /

- Metals and Mining

- /

- WSE:JSW

Things Look Grim For Jastrzebska Spólka Weglowa S.A. (WSE:JSW) After Today's Downgrade

Today is shaping up negative for Jastrzebska Spólka Weglowa S.A. (WSE:JSW) shareholders, with the analysts delivering a substantial negative revision to this year's forecasts. Both revenue and earnings per share (EPS) forecasts went under the knife, suggesting the analysts have soured majorly on the business.

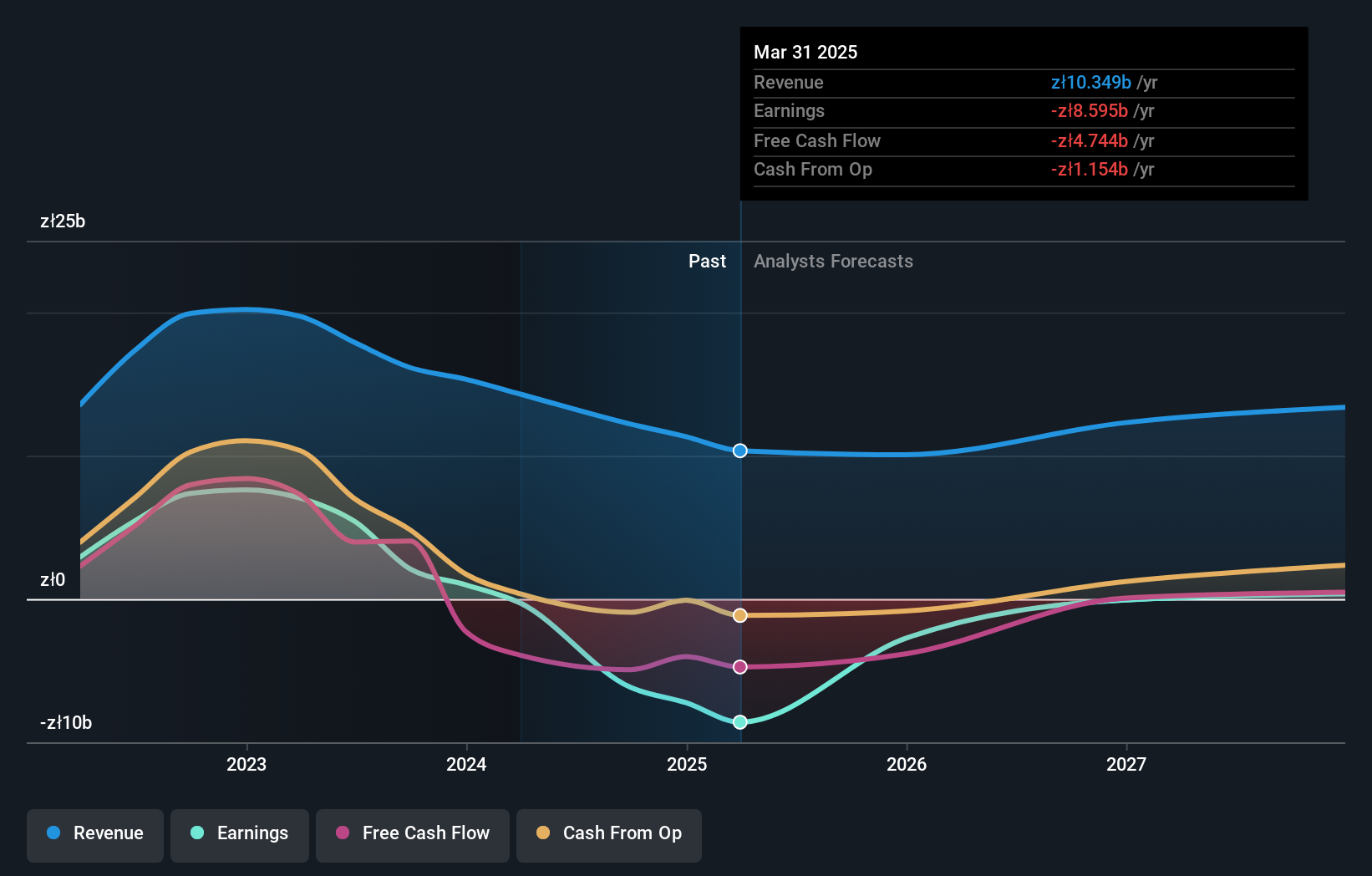

Following the downgrade, the consensus from four analysts covering Jastrzebska Spólka Weglowa is for revenues of zł10b in 2025, implying a noticeable 2.7% decline in sales compared to the last 12 months. The loss per share is anticipated to greatly reduce in the near future, narrowing 66% to zł24.91. Yet before this consensus update, the analysts had been forecasting revenues of zł11b and losses of zł13.04 per share in 2025. So there's been quite a change-up of views after the recent consensus updates, with the analysts making a serious cut to their revenue forecasts while also expecting losses per share to increase.

View our latest analysis for Jastrzebska Spólka Weglowa

The consensus price target fell 15% to zł15.66, with the analysts clearly concerned about the company following the weaker revenue and earnings outlook.

One way to get more context on these forecasts is to look at how they compare to both past performance, and how other companies in the same industry are performing. These estimates imply that sales are expected to slow, with a forecast annualised revenue decline of 3.6% by the end of 2025. This indicates a significant reduction from annual growth of 13% over the last five years. By contrast, our data suggests that other companies (with analyst coverage) in the same industry are forecast to see their revenue grow 5.5% annually for the foreseeable future. It's pretty clear that Jastrzebska Spólka Weglowa's revenues are expected to perform substantially worse than the wider industry.

The Bottom Line

The most important thing to take away is that analysts increased their loss per share estimates for this year. Regrettably, they also downgraded their revenue estimates, and the latest forecasts imply the business will grow sales slower than the wider market. With a serious cut to this year's expectations and a falling price target, we wouldn't be surprised if investors were becoming wary of Jastrzebska Spólka Weglowa.

With that said, the long-term trajectory of the company's earnings is a lot more important than next year. At Simply Wall St, we have a full range of analyst estimates for Jastrzebska Spólka Weglowa going out to 2027, and you can see them free on our platform here.

Of course, seeing company management invest large sums of money in a stock can be just as useful as knowing whether analysts are downgrading their estimates. So you may also wish to search this free list of stocks with high insider ownership.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About WSE:JSW

Jastrzebska Spólka Weglowa

Engages in the extraction, production, and sale of coal, coke, and hydrocarbons in Poland, Austria, the Czech Republic, Germany, Slovakia, Belgium, Spain, Norway, Switzerland, Romania, Singapore, Italy, Luxembourg, Holland, France, and internationally.

Good value with reasonable growth potential.

Similar Companies

Market Insights

Weekly Picks

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

Fiducian: Compliance Clouds or Value Opportunity?

Willamette Valley Vineyards (WVVI): Not-So-Great Value

Recently Updated Narratives

Watch Pulse Seismic Outperform with 13.6% Revenue Growth in the Coming Years

Significantly undervalued gold explorer in Timmins, finally getting traction

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026