If You Had Bought IZOBLOK (WSE:IZB) Stock Three Years Ago, You'd Be Sitting On A 83% Loss, Today

Want to participate in a short research study? Help shape the future of investing tools and you could win a $250 gift card!

As every investor would know, not every swing hits the sweet spot. But you have a problem if you face massive losses more than once in a while. So consider, for a moment, the misfortune of IZOBLOK S.A. (WSE:IZB) investors who have held the stock for three years as it declined a whopping 83%. That'd be enough to cause even the strongest minds some disquiet. And more recent buyers are having a tough time too, with a drop of 47% in the last year. On the other hand, we note it's up 8.5% in about a month. However, this may be a matter of broader market optimism, since stocks are up 3.4% in the same time.

We really hope anyone holding through that price crash has a diversified portfolio. Even when you lose money, you don't have to lose the lesson.

View our latest analysis for IZOBLOK

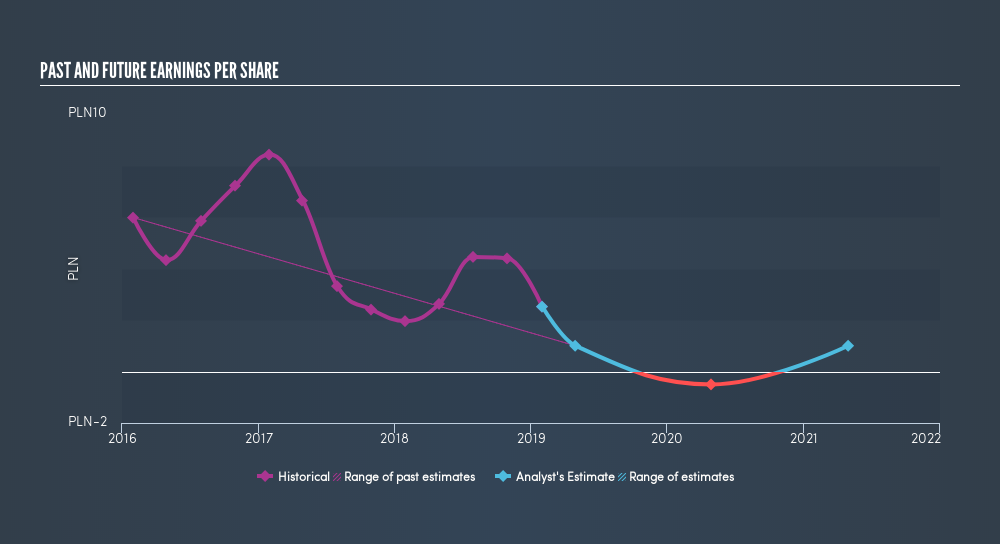

While markets are a powerful pricing mechanism, share prices reflect investor sentiment, not just underlying business performance. One imperfect but simple way to consider how the market perception of a company has shifted is to compare the change in the earnings per share (EPS) with the share price movement.

During the three years that the share price fell, IZOBLOK's earnings per share (EPS) dropped by 25% each year. The share price decline of 45% is actually steeper than the EPS slippage. So it seems the market was too confident about the business, in the past. This increased caution is also evident in the rather low P/E ratio, which is sitting at 10.62.

The company's earnings per share (over time) is depicted in the image below (click to see the exact numbers).

We know that IZOBLOK has improved its bottom line lately, but is it going to grow revenue? Check if analysts think IZOBLOK will grow revenue in the future.

A Different Perspective

Investors in IZOBLOK had a tough year, with a total loss of 47%, against a market gain of about 1.2%. However, keep in mind that even the best stocks will sometimes underperform the market over a twelve month period. Regrettably, last year's performance caps off a bad run, with the shareholders facing a total loss of 20% per year over five years. Generally speaking long term share price weakness can be a bad sign, though contrarian investors might want to research the stock in hope of a turnaround. Before forming an opinion on IZOBLOK you might want to consider these 3 valuation metrics.

For those who like to find winning investments this free list of growing companies with recent insider purchasing, could be just the ticket.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on PL exchanges.

We aim to bring you long-term focused research analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material.

If you spot an error that warrants correction, please contact the editor at editorial-team@simplywallst.com. This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. Simply Wall St has no position in the stocks mentioned. Thank you for reading.

About WSE:IZB

IZOBLOK

Provides expanded polypropylene (EPP) components to the automotive industry worldwide.

Excellent balance sheet and good value.

Market Insights

Community Narratives