- Italy

- /

- Capital Markets

- /

- BIT:ANIM

3 European Dividend Stocks With Yields Up To 7.4%

Reviewed by Simply Wall St

As European markets navigate a landscape marked by geopolitical tensions and economic uncertainties, investors continue to seek stability through dividend stocks. In this environment, selecting stocks with robust dividend yields can offer a measure of reassurance and potential income, making them an appealing choice for those looking to balance risk and reward.

Top 10 Dividend Stocks In Europe

| Name | Dividend Yield | Dividend Rating |

| Zurich Insurance Group (SWX:ZURN) | 4.56% | ★★★★★★ |

| Teleperformance (ENXTPA:TEP) | 5.52% | ★★★★★★ |

| Rubis (ENXTPA:RUI) | 7.46% | ★★★★★★ |

| OVB Holding (XTRA:O4B) | 4.46% | ★★★★★★ |

| Mapfre (BME:MAP) | 4.86% | ★★★★★★ |

| Julius Bär Gruppe (SWX:BAER) | 5.07% | ★★★★★★ |

| Holcim (SWX:HOLN) | 5.71% | ★★★★★★ |

| HEXPOL (OM:HPOL B) | 4.89% | ★★★★★★ |

| Banque Cantonale Vaudoise (SWX:BCVN) | 4.87% | ★★★★★★ |

| Allianz (XTRA:ALV) | 4.58% | ★★★★★★ |

Click here to see the full list of 240 stocks from our Top European Dividend Stocks screener.

Here we highlight a subset of our preferred stocks from the screener.

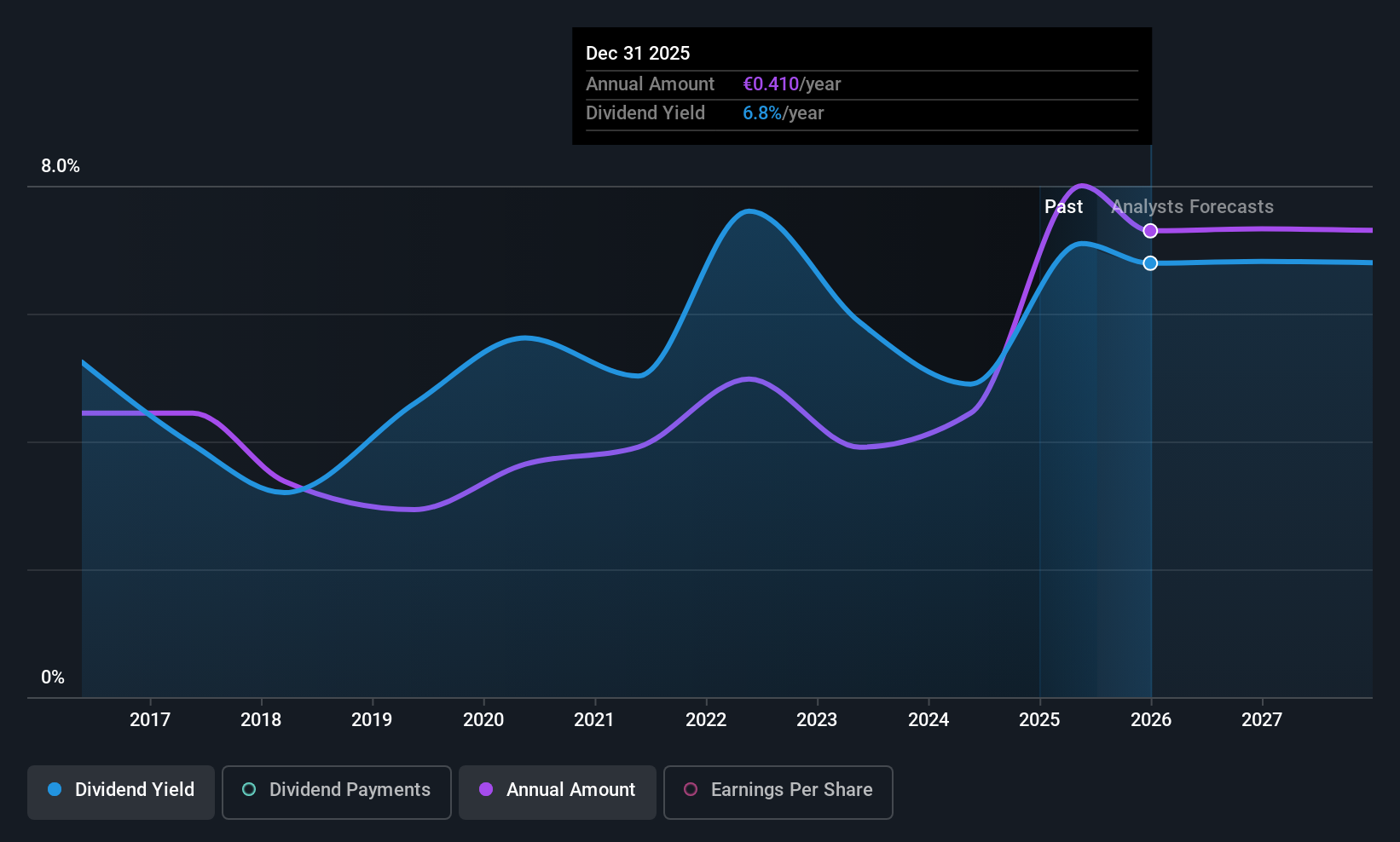

Anima Holding (BIT:ANIM)

Simply Wall St Dividend Rating: ★★★★★☆

Overview: Anima Holding S.p.A. is a publicly owned investment manager with a market cap of €1.91 billion.

Operations: Anima Holding S.p.A. generates its revenue primarily from Asset Management, amounting to €1.32 billion.

Dividend Yield: 7.4%

Anima Holding's dividend is well-covered by both earnings, with a payout ratio of 57.2%, and cash flows, with a cash payout ratio of 38.5%. Its dividend yield stands at 7.44%, placing it in the top quartile among Italian dividend payers. However, its dividends have been unreliable and volatile over the past decade despite recent growth in payments. Anima was recently acquired by Banco BPM Vita for €1.5 billion, potentially impacting future dividend policies and stability.

- Dive into the specifics of Anima Holding here with our thorough dividend report.

- The analysis detailed in our Anima Holding valuation report hints at an deflated share price compared to its estimated value.

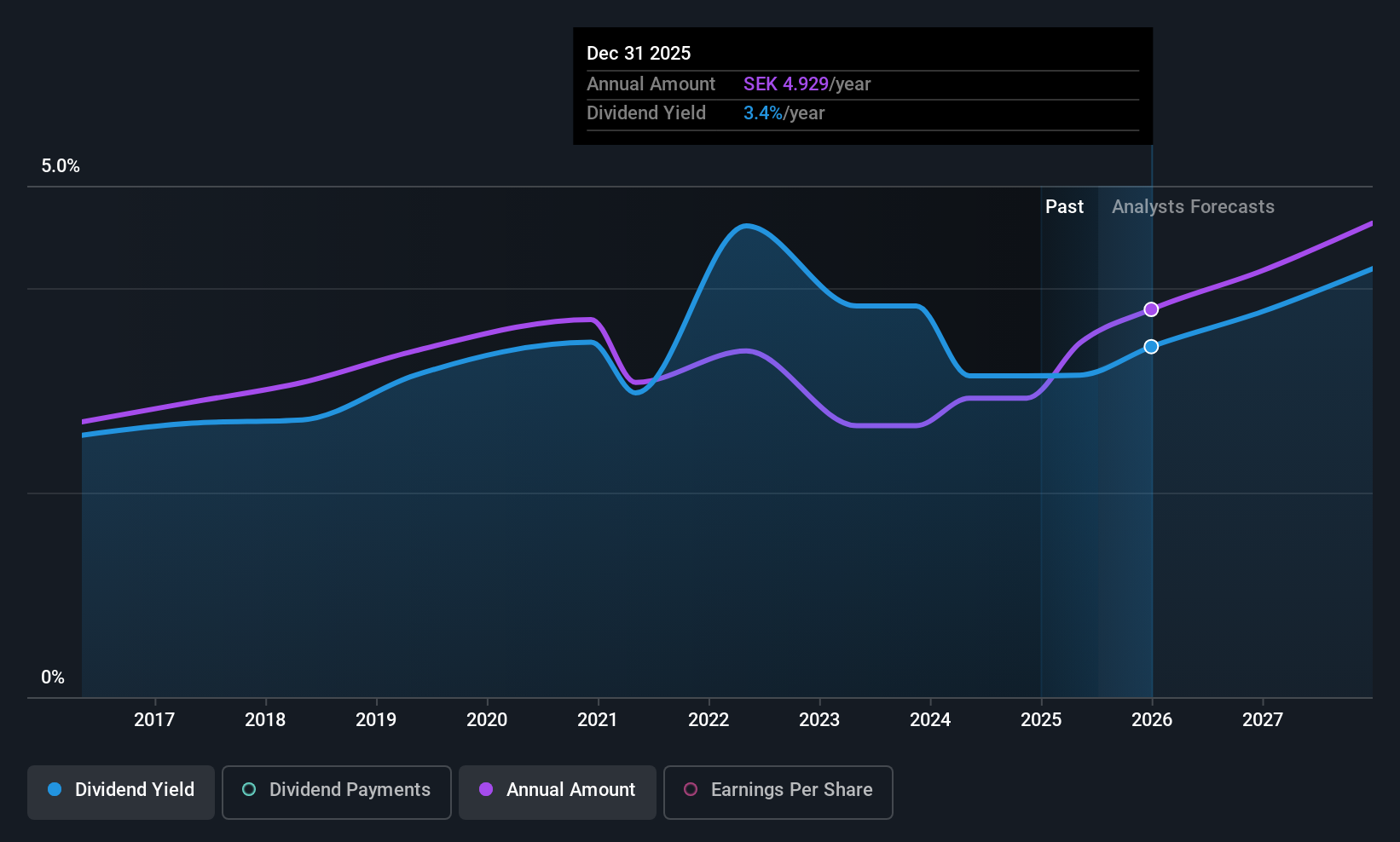

Securitas (OM:SECU B)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Securitas AB (publ) offers security services across North America, Europe, Latin America, Africa, the Middle East, Asia, and Australia with a market cap of SEK80.72 billion.

Operations: Securitas AB (publ) generates revenue from its segments with Securitas Europe contributing SEK70.02 billion, Securitas Ibero-America providing SEK14.91 billion, and Securitas North America accounting for SEK64.76 billion.

Dividend Yield: 3.2%

Securitas's dividend payments are well-covered by earnings and cash flows, with payout ratios of 47.6% and 42.7%, respectively, though they have been volatile over the past decade. The company recently approved a SEK 4.50 per share dividend for distribution in two parts this year. Despite its good relative value compared to peers, Securitas's debt level remains high, and its current yield of 3.19% is below the top tier in Sweden's market.

- Unlock comprehensive insights into our analysis of Securitas stock in this dividend report.

- Upon reviewing our latest valuation report, Securitas' share price might be too pessimistic.

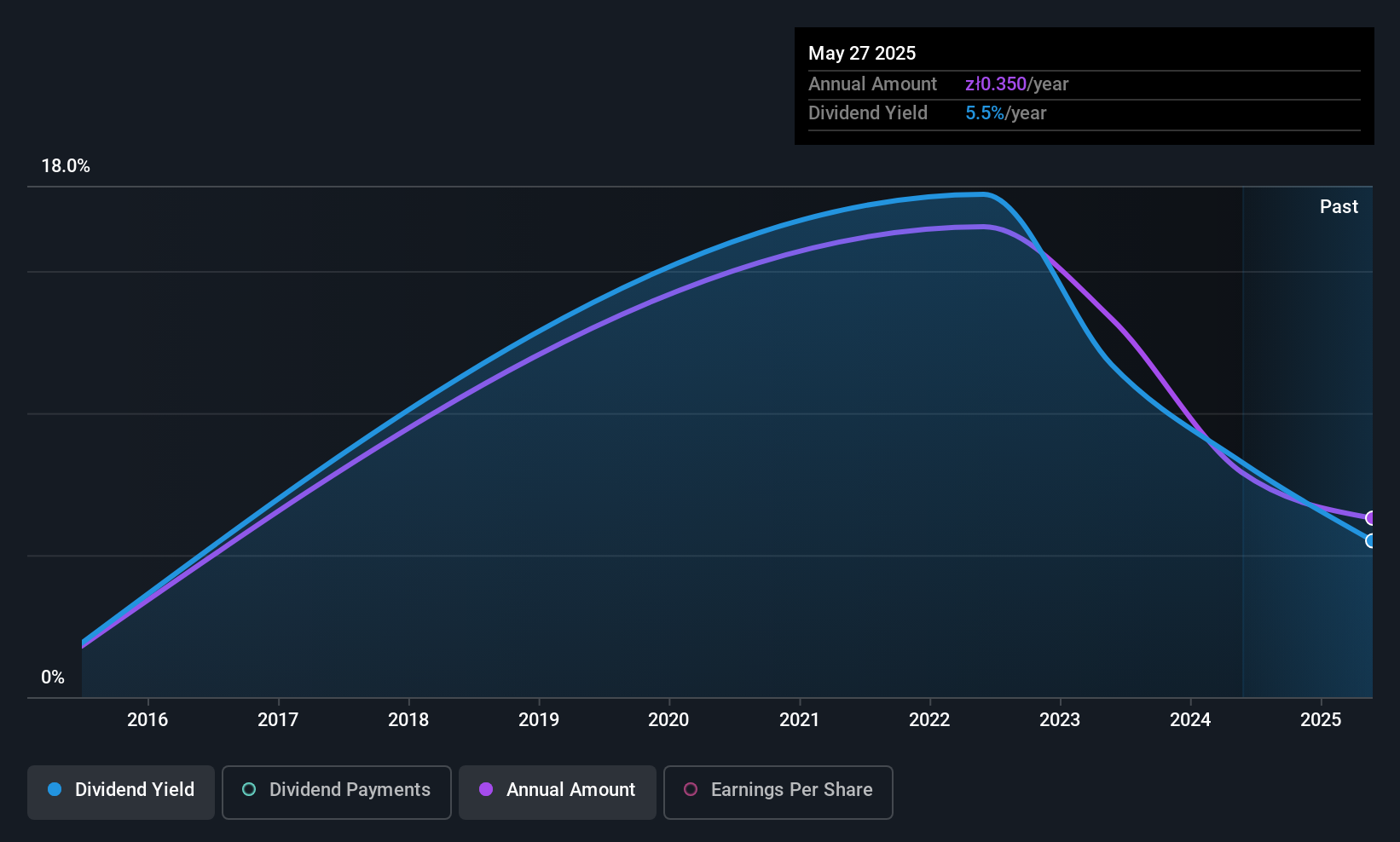

Boryszew (WSE:BRS)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Boryszew S.A. operates in the automotive, metals and chemical industries both in Poland and internationally, with a market cap of PLN1.49 billion.

Operations: Boryszew S.A.'s revenue is primarily derived from its Metals segment at PLN2.82 billion, followed by the Motorization segment at PLN1.54 billion, and the Chemistry segment contributing PLN153.55 million.

Dividend Yield: 4.8%

Boryszew's dividends are supported by earnings and cash flows, with payout ratios of 64.3% and 45.4%, respectively, though they have been inconsistent over the past decade. The recent annual dividend was set at PLN 0.35 per share, reflecting a decrease amid stable earnings reports. Despite a favorable price-to-earnings ratio of 13.6x compared to industry averages, its dividend yield of 4.81% is below Poland's top-tier payers, and share price volatility remains high.

- Delve into the full analysis dividend report here for a deeper understanding of Boryszew.

- Our expertly prepared valuation report Boryszew implies its share price may be too high.

Summing It All Up

- Click through to start exploring the rest of the 237 Top European Dividend Stocks now.

- Already own these companies? Bring clarity to your investment decisions by linking up your portfolio with Simply Wall St, where you can monitor all the vital signs of your stocks effortlessly.

- Simply Wall St is your key to unlocking global market trends, a free user-friendly app for forward-thinking investors.

Looking For Alternative Opportunities?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

The New Payments ETF Is Live on NASDAQ:

Money is moving to real-time rails, and a newly listed ETF now gives investors direct exposure. Fast settlement. Institutional custody. Simple access.

Explore how this launch could reshape portfolios

Sponsored ContentNew: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About BIT:ANIM

Anima Holding

Anima Holding S.p.A. is a publicly owned investment manager.

Flawless balance sheet established dividend payer.

Similar Companies

Market Insights

Weekly Picks

Early mover in a fast growing industry. Likely to experience share price volatility as they scale

A case for CA$31.80 (undiluted), aka 8,616% upside from CA$0.37 (an 86 bagger!).

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Recently Updated Narratives

Meta’s Bold Bet on AI Pays Off

ADP Stock: Solid Fundamentals, But AI Investments Test Its Margin Resilience

Visa Stock: The Toll Booth at the Center of Global Commerce

Popular Narratives

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026

The AI Infrastructure Giant Grows Into Its Valuation

Trending Discussion