- Poland

- /

- Paper and Forestry Products

- /

- WSE:BFC

How Does Biofactory S.A. (WSE:BFC) Fare As A Dividend Stock?

Today we'll take a closer look at Biofactory S.A. (WSE:BFC) from a dividend investor's perspective. Owning a strong business and reinvesting the dividends is widely seen as an attractive way of growing your wealth. Yet sometimes, investors buy a stock for its dividend and lose money because the share price falls by more than they earned in dividend payments.

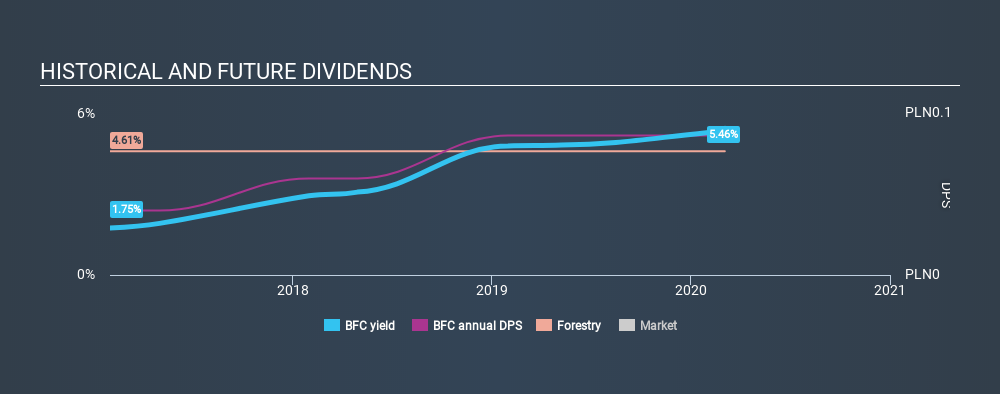

Biofactory pays a 5.5% dividend yield, and has been paying dividends for the past three years. A 5.5% yield does look good. Could the short payment history hint at future dividend growth? There are a few simple ways to reduce the risks of buying Biofactory for its dividend, and we'll go through these below.

Click the interactive chart for our full dividend analysis

Payout ratios

Companies (usually) pay dividends out of their earnings. If a company is paying more than it earns, the dividend might have to be cut. As a result, we should always investigate whether a company can afford its dividend, measured as a percentage of a company's net income after tax. Looking at the data, we can see that 53% of Biofactory's profits were paid out as dividends in the last 12 months. This is a fairly normal payout ratio among most businesses. It allows a higher dividend to be paid to shareholders, but does limit the capital retained in the business - which could be good or bad.

We also measure dividends paid against a company's levered free cash flow, to see if enough cash was generated to cover the dividend. The company paid out 51% of its free cash flow, which is not bad per se, but does start to limit the amount of cash Biofactory has available to meet other needs. It's positive to see that Biofactory's dividend is covered by both profits and cash flow, since this is generally a sign that the dividend is sustainable, and a lower payout ratio usually suggests a greater margin of safety before the dividend gets cut.

Is Biofactory's Balance Sheet Risky?

As Biofactory has a meaningful amount of debt, we need to check its balance sheet to see if the company might have debt risks. A quick check of its financial situation can be done with two ratios: net debt divided by EBITDA (earnings before interest, tax, depreciation and amortisation), and net interest cover. Net debt to EBITDA measures total debt load relative to company earnings (lower = less debt), while net interest cover measures the ability to pay interest on the debt (higher = greater ability to pay interest costs). With net debt of 3.77 times its EBITDA, investors are starting to take on a meaningful amount of risk, should the business enter a downturn.

We calculated its interest cover by measuring its earnings before interest and tax (EBIT), and dividing this by the company's net interest expense. With EBIT of 2.63 times its interest expense, Biofactory's interest cover is starting to look a bit thin.

We update our data on Biofactory every 24 hours, so you can always get our latest analysis of its financial health, here.

Dividend Volatility

One of the major risks of relying on dividend income, is the potential for a company to struggle financially and cut its dividend. Not only is your income cut, but the value of your investment declines as well - nasty. The dividend has not fluctuated much, but with a relatively short payment history, we can't be sure this is sustainable across a full market cycle. During the past three-year period, the first annual payment was zł0.06 in 2017, compared to zł0.13 last year. Dividends per share have grown at approximately 29% per year over this time.

Biofactory has been growing its dividend quite rapidly, which is exciting. However, the short payment history makes us question whether this performance will persist across a full market cycle.

Dividend Growth Potential

Dividend payments have been consistent over the past few years, but we should always check if earnings per share (EPS) are growing, as this will help maintain the purchasing power of the dividend. It's good to see Biofactory has been growing its earnings per share at 12% a year over the past five years. Biofactory's earnings per share have grown rapidly in recent years, although more than half of its profits are being paid out as dividends, which makes us wonder if the company has a limited number of reinvestment opportunities in its business.

Conclusion

When we look at a dividend stock, we need to form a judgement on whether the dividend will grow, if the company is able to maintain it in a wide range of economic circumstances, and if the dividend payout is sustainable. Biofactory's is paying out more than half its income as dividends, but at least the dividend is covered by both reported earnings and cashflow. We were also glad to see it growing earnings, although its dividend history is not as long as we'd like. While we're not hugely bearish on it, overall we think there are potentially better dividend stocks than Biofactory out there.

See if management have their own wealth at stake, by checking insider shareholdings in Biofactory stock.

We have also put together a list of global stocks with a market capitalisation above $1bn and yielding more 3%.

If you spot an error that warrants correction, please contact the editor at editorial-team@simplywallst.com. This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. Simply Wall St has no position in the stocks mentioned.

We aim to bring you long-term focused research analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Thank you for reading.

About WSE:BFC

Medium with mediocre balance sheet.

Market Insights

Community Narratives