Grupa Azoty's(WSE:ATT) Share Price Is Down 72% Over The Past Five Years.

It is a pleasure to report that the Grupa Azoty S.A. (WSE:ATT) is up 38% in the last quarter. But spare a thought for the long term holders, who have held the stock as it bled value over the last five years. Like a ship taking on water, the share price has sunk 72% in that time. It's true that the recent bounce could signal the company is turning over a new leaf, but we are not so sure. The million dollar question is whether the company can justify a long term recovery.

View our latest analysis for Grupa Azoty

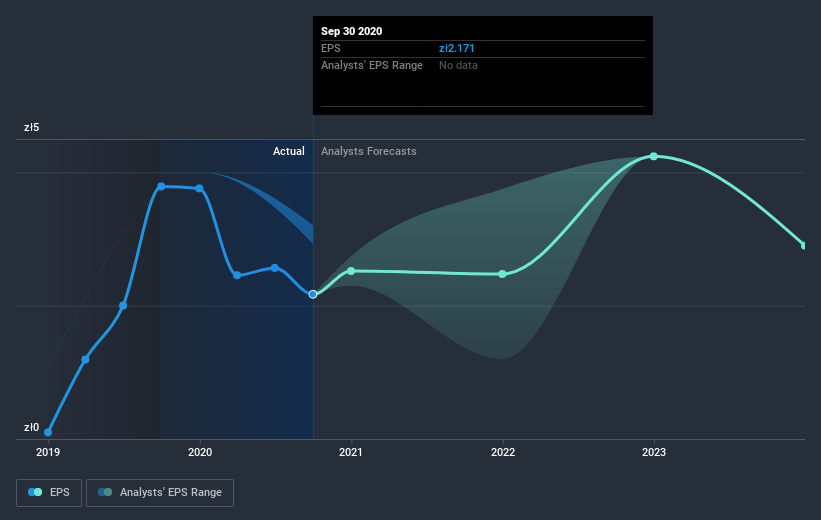

While markets are a powerful pricing mechanism, share prices reflect investor sentiment, not just underlying business performance. One flawed but reasonable way to assess how sentiment around a company has changed is to compare the earnings per share (EPS) with the share price.

During the five years over which the share price declined, Grupa Azoty's earnings per share (EPS) dropped by 15% each year. This reduction in EPS is less than the 22% annual reduction in the share price. This implies that the market is more cautious about the business these days.

You can see below how EPS has changed over time (discover the exact values by clicking on the image).

Dive deeper into Grupa Azoty's key metrics by checking this interactive graph of Grupa Azoty's earnings, revenue and cash flow.

A Different Perspective

It's nice to see that Grupa Azoty shareholders have received a total shareholder return of 4.8% over the last year. Notably the five-year annualised TSR loss of 11% per year compares very unfavourably with the recent share price performance. We generally put more weight on the long term performance over the short term, but the recent improvement could hint at a (positive) inflection point within the business. It's always interesting to track share price performance over the longer term. But to understand Grupa Azoty better, we need to consider many other factors. Case in point: We've spotted 3 warning signs for Grupa Azoty you should be aware of.

Of course Grupa Azoty may not be the best stock to buy. So you may wish to see this free collection of growth stocks.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on PL exchanges.

If you’re looking to trade Grupa Azoty, open an account with the lowest-cost* platform trusted by professionals, Interactive Brokers. Their clients from over 200 countries and territories trade stocks, options, futures, forex, bonds and funds worldwide from a single integrated account. Promoted

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

About WSE:ATT

Grupa Azoty

Manufactures and sells fertilizers, plastics, and other chemicals in Poland, Germany, South America, Asia, other European Union countries, and internationally.

Undervalued with moderate growth potential.

Market Insights

Community Narratives