- Poland

- /

- Personal Products

- /

- WSE:HRP

These 4 Measures Indicate That Harper Hygienics (WSE:HRP) Is Using Debt In A Risky Way

Some say volatility, rather than debt, is the best way to think about risk as an investor, but Warren Buffett famously said that 'Volatility is far from synonymous with risk.' When we think about how risky a company is, we always like to look at its use of debt, since debt overload can lead to ruin. Importantly, Harper Hygienics S.A. (WSE:HRP) does carry debt. But the real question is whether this debt is making the company risky.

When Is Debt A Problem?

Debt and other liabilities become risky for a business when it cannot easily fulfill those obligations, either with free cash flow or by raising capital at an attractive price. In the worst case scenario, a company can go bankrupt if it cannot pay its creditors. However, a more usual (but still expensive) situation is where a company must dilute shareholders at a cheap share price simply to get debt under control. By replacing dilution, though, debt can be an extremely good tool for businesses that need capital to invest in growth at high rates of return. When we think about a company's use of debt, we first look at cash and debt together.

See our latest analysis for Harper Hygienics

What Is Harper Hygienics's Net Debt?

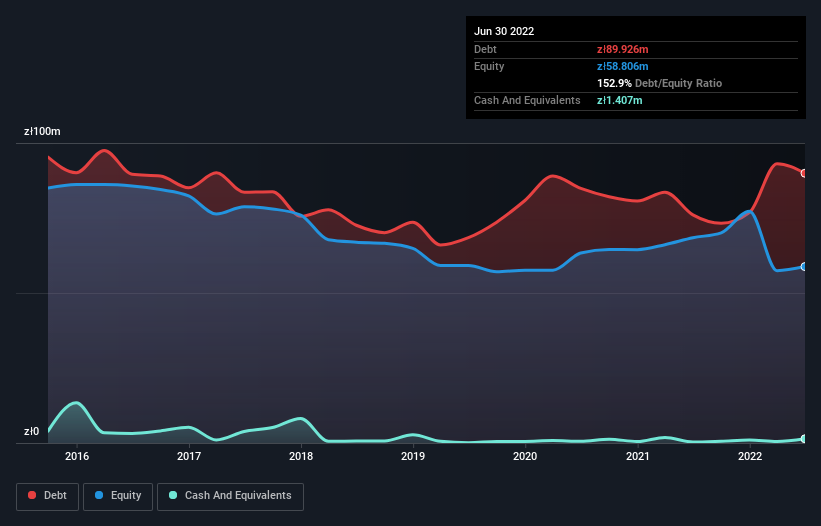

As you can see below, at the end of June 2022, Harper Hygienics had zł89.9m of debt, up from zł76.0m a year ago. Click the image for more detail. And it doesn't have much cash, so its net debt is about the same.

A Look At Harper Hygienics' Liabilities

We can see from the most recent balance sheet that Harper Hygienics had liabilities of zł136.8m falling due within a year, and liabilities of zł100.9m due beyond that. Offsetting these obligations, it had cash of zł1.41m as well as receivables valued at zł77.3m due within 12 months. So it has liabilities totalling zł159.0m more than its cash and near-term receivables, combined.

This deficit casts a shadow over the zł30.8m company, like a colossus towering over mere mortals. So we definitely think shareholders need to watch this one closely. At the end of the day, Harper Hygienics would probably need a major re-capitalization if its creditors were to demand repayment.

In order to size up a company's debt relative to its earnings, we calculate its net debt divided by its earnings before interest, tax, depreciation, and amortization (EBITDA) and its earnings before interest and tax (EBIT) divided by its interest expense (its interest cover). This way, we consider both the absolute quantum of the debt, as well as the interest rates paid on it.

Harper Hygienics shareholders face the double whammy of a high net debt to EBITDA ratio (9.7), and fairly weak interest coverage, since EBIT is just 0.027 times the interest expense. The debt burden here is substantial. Worse, Harper Hygienics's EBIT was down 98% over the last year. If earnings continue to follow that trajectory, paying off that debt load will be harder than convincing us to run a marathon in the rain. There's no doubt that we learn most about debt from the balance sheet. But you can't view debt in total isolation; since Harper Hygienics will need earnings to service that debt. So if you're keen to discover more about its earnings, it might be worth checking out this graph of its long term earnings trend.

Finally, a company can only pay off debt with cold hard cash, not accounting profits. So we clearly need to look at whether that EBIT is leading to corresponding free cash flow. Over the last three years, Harper Hygienics saw substantial negative free cash flow, in total. While investors are no doubt expecting a reversal of that situation in due course, it clearly does mean its use of debt is more risky.

Our View

On the face of it, Harper Hygienics's EBIT growth rate left us tentative about the stock, and its level of total liabilities was no more enticing than the one empty restaurant on the busiest night of the year. And furthermore, its interest cover also fails to instill confidence. It looks to us like Harper Hygienics carries a significant balance sheet burden. If you play with fire you risk getting burnt, so we'd probably give this stock a wide berth. When analysing debt levels, the balance sheet is the obvious place to start. However, not all investment risk resides within the balance sheet - far from it. These risks can be hard to spot. Every company has them, and we've spotted 2 warning signs for Harper Hygienics you should know about.

At the end of the day, it's often better to focus on companies that are free from net debt. You can access our special list of such companies (all with a track record of profit growth). It's free.

Valuation is complex, but we're here to simplify it.

Discover if Harper Hygienics might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About WSE:HRP

Harper Hygienics

Produces and sells cosmetic hygienic skin care products for women, infants, and children in Poland.

Excellent balance sheet and good value.

Market Insights

Community Narratives