SeSa And 2 Other Stocks That May Be Priced Below Estimated Value

Reviewed by Simply Wall St

As global markets show signs of recovery with major U.S. indexes nearing record highs and positive economic indicators like falling jobless claims, investors are increasingly on the lookout for stocks that may be undervalued amidst this optimism. In such a climate, identifying stocks priced below their estimated value can offer potential opportunities for growth, making it crucial to focus on fundamental strengths and market positioning.

Top 10 Undervalued Stocks Based On Cash Flows

| Name | Current Price | Fair Value (Est) | Discount (Est) |

| Victory Capital Holdings (NasdaqGS:VCTR) | US$72.24 | US$144.03 | 49.8% |

| NBT Bancorp (NasdaqGS:NBTB) | US$50.12 | US$99.93 | 49.8% |

| Synovus Financial (NYSE:SNV) | US$57.97 | US$115.67 | 49.9% |

| CS Wind (KOSE:A112610) | ₩42100.00 | ₩83493.57 | 49.6% |

| Tongqinglou Catering (SHSE:605108) | CN¥21.71 | CN¥43.37 | 49.9% |

| Intermedical Care and Lab Hospital (SET:IMH) | THB4.94 | THB9.85 | 49.8% |

| EuroGroup Laminations (BIT:EGLA) | €2.728 | €5.42 | 49.7% |

| Nidaros Sparebank (OB:NISB) | NOK100.00 | NOK198.62 | 49.7% |

| Nutanix (NasdaqGS:NTNX) | US$72.35 | US$143.99 | 49.8% |

| VerticalScope Holdings (TSX:FORA) | CA$9.01 | CA$18.01 | 50% |

Let's dive into some prime choices out of the screener.

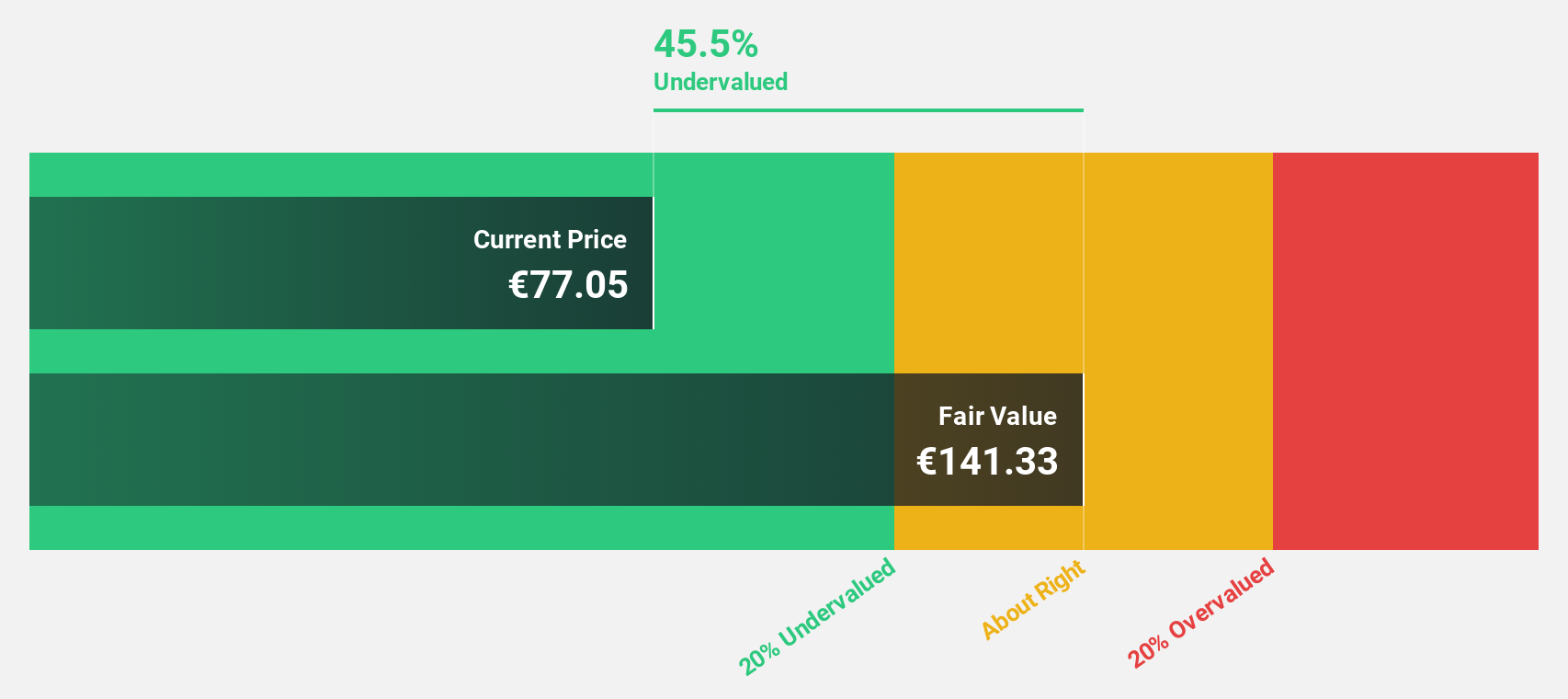

SeSa (BIT:SES)

Overview: SeSa S.p.A., along with its subsidiaries, distributes value-added IT software and technologies both in Italy and internationally, with a market cap of €1.19 billion.

Operations: The company's revenue segments include Business Services at €114.50 million, Corporate Segment at €50.10 million, and Software and System Integration at €844.70 million.

Estimated Discount To Fair Value: 48.8%

SeSa S.p.A. appears undervalued, trading at €77.15, significantly below its estimated fair value of €150.73 and 48.8% under our fair value estimate, indicating a strong relative value compared to peers and industry standards. Despite modest Q1 earnings of €21.25 million slightly down from the previous year, SeSa's revenue is projected to grow at 9.6% annually, outpacing the Italian market's 4%, with earnings growth forecasted at 13.8% per year.

- The growth report we've compiled suggests that SeSa's future prospects could be on the up.

- Unlock comprehensive insights into our analysis of SeSa stock in this financial health report.

Jamieson Wellness (TSX:JWEL)

Overview: Jamieson Wellness Inc. is a company that develops, manufactures, distributes, markets, and sells branded and customer-branded health products for humans in Canada, the United States, China, and internationally with a market cap of CA$1.53 billion.

Operations: The company's revenue segments consist of CA$607.13 million from Jamieson Brands and CA$102.23 million from Strategic Partners.

Estimated Discount To Fair Value: 36.7%

Jamieson Wellness is trading at CA$36.46, well below its estimated fair value of CA$57.58, suggesting it may be undervalued based on cash flows. Despite debt not being fully covered by operating cash flow, earnings are forecast to grow significantly at 61.8% annually over the next three years, outpacing the Canadian market's growth rate. Recent third-quarter sales increased to CA$176.16 million from last year's CA$151.51 million, with net income rising to CA$10.56 million from CA$8.22 million a year ago.

- The analysis detailed in our Jamieson Wellness growth report hints at robust future financial performance.

- Delve into the full analysis health report here for a deeper understanding of Jamieson Wellness.

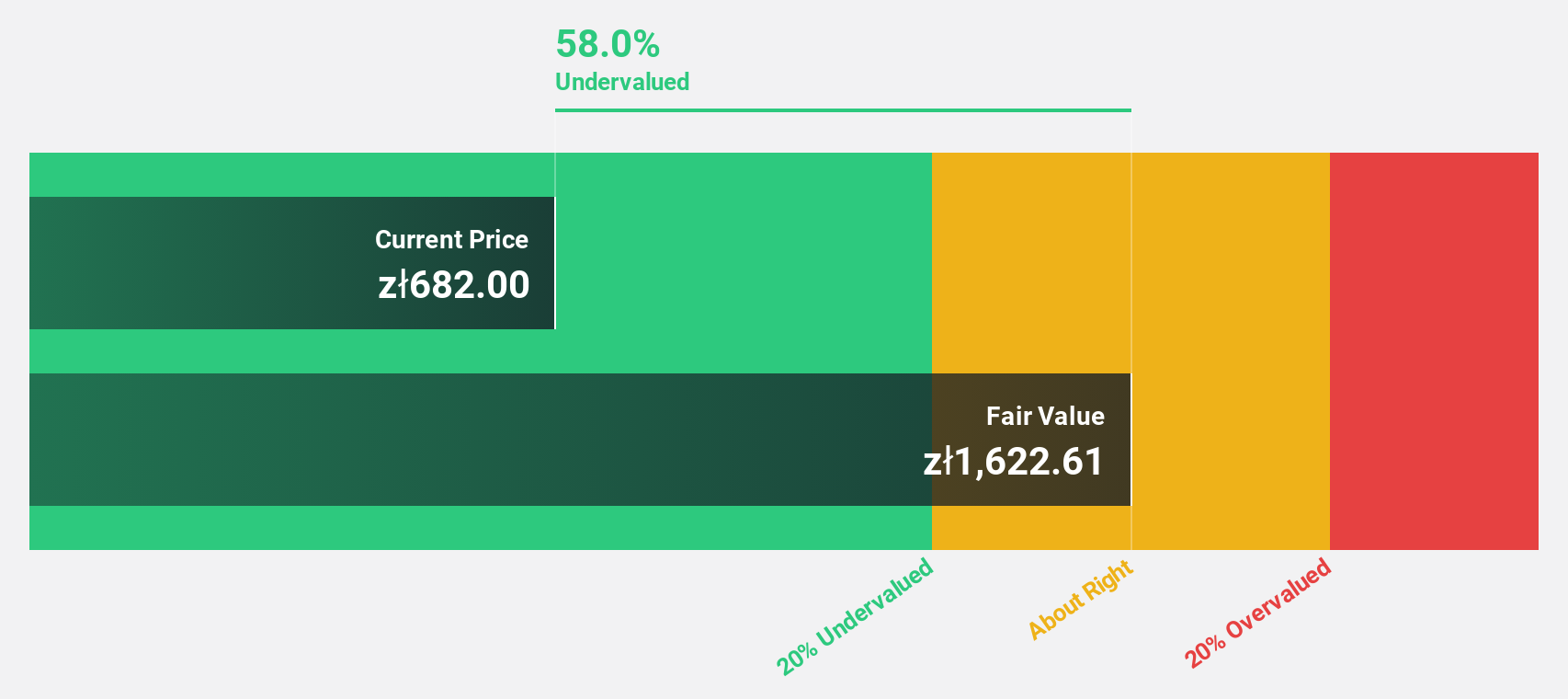

NEUCA (WSE:NEU)

Overview: NEUCA S.A. is involved in the wholesale distribution of pharmaceuticals in Poland, with a market capitalization of PLN3.49 billion.

Operations: The company's revenue segments include Pharmaceutical Wholesale (Including Marketing Services) at PLN11.35 billion, Clinical Studies generating PLN438.30 million, Medical Operator contributing PLN435.48 million, Insurance Business with PLN179.83 million, and Pharmaceutical Manufacturing at PLN387.67 million.

Estimated Discount To Fair Value: 39.9%

NEUCA is trading at PLN 781, significantly below its estimated fair value of PLN 1,299.75, highlighting its potential undervaluation based on cash flows. Despite a modest revenue growth forecast of 4.4% annually, earnings are expected to grow substantially at 25.6% per year over the next three years, surpassing the Polish market's growth rate. Recent third-quarter results show sales increased to PLN 3.19 billion from last year's PLN 2.97 billion, while net income decreased slightly to PLN 41.87 million from PLN 45.09 million a year ago.

- According our earnings growth report, there's an indication that NEUCA might be ready to expand.

- Dive into the specifics of NEUCA here with our thorough financial health report.

Next Steps

- Navigate through the entire inventory of 916 Undervalued Stocks Based On Cash Flows here.

- Have you diversified into these companies? Leverage the power of Simply Wall St's portfolio to keep a close eye on market movements affecting your investments.

- Simply Wall St is your key to unlocking global market trends, a free user-friendly app for forward-thinking investors.

Seeking Other Investments?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About BIT:SES

SeSa

Distributes value-added information technology (IT) software and technologies in Italy and internationally.

Good value with adequate balance sheet.

Market Insights

Community Narratives