Some say volatility, rather than debt, is the best way to think about risk as an investor, but Warren Buffett famously said that 'Volatility is far from synonymous with risk.' It's only natural to consider a company's balance sheet when you examine how risky it is, since debt is often involved when a business collapses. We note that BioMaxima S.A. (WSE:BMX) does have debt on its balance sheet. But should shareholders be worried about its use of debt?

Why Does Debt Bring Risk?

Debt is a tool to help businesses grow, but if a business is incapable of paying off its lenders, then it exists at their mercy. Part and parcel of capitalism is the process of 'creative destruction' where failed businesses are mercilessly liquidated by their bankers. However, a more usual (but still expensive) situation is where a company must dilute shareholders at a cheap share price simply to get debt under control. Of course, plenty of companies use debt to fund growth, without any negative consequences. The first thing to do when considering how much debt a business uses is to look at its cash and debt together.

View our latest analysis for BioMaxima

What Is BioMaxima's Net Debt?

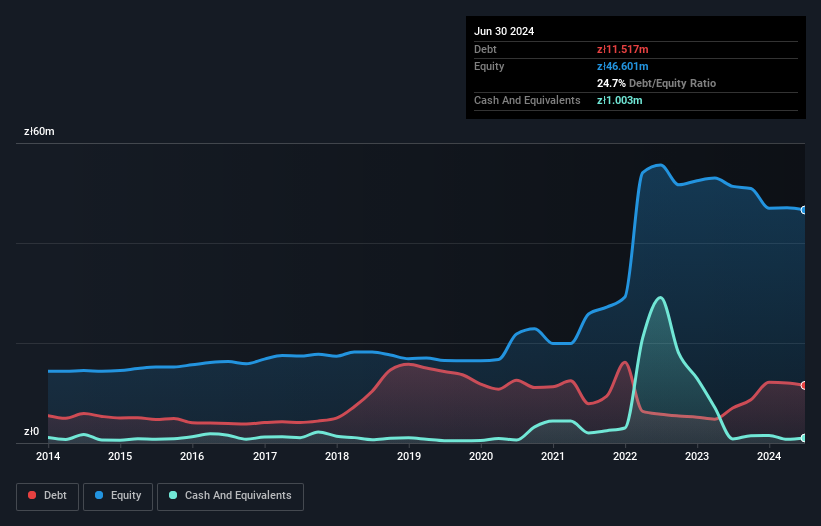

You can click the graphic below for the historical numbers, but it shows that as of June 2024 BioMaxima had zł11.5m of debt, an increase on zł7.01m, over one year. However, it does have zł1.00m in cash offsetting this, leading to net debt of about zł10.5m.

How Strong Is BioMaxima's Balance Sheet?

The latest balance sheet data shows that BioMaxima had liabilities of zł12.9m due within a year, and liabilities of zł14.8m falling due after that. On the other hand, it had cash of zł1.00m and zł9.03m worth of receivables due within a year. So its liabilities total zł17.6m more than the combination of its cash and short-term receivables.

While this might seem like a lot, it is not so bad since BioMaxima has a market capitalization of zł51.8m, and so it could probably strengthen its balance sheet by raising capital if it needed to. But it's clear that we should definitely closely examine whether it can manage its debt without dilution. When analysing debt levels, the balance sheet is the obvious place to start. But you can't view debt in total isolation; since BioMaxima will need earnings to service that debt. So if you're keen to discover more about its earnings, it might be worth checking out this graph of its long term earnings trend.

In the last year BioMaxima's revenue was pretty flat, and it made a negative EBIT. While that hardly impresses, its not too bad either.

Caveat Emptor

Importantly, BioMaxima had an earnings before interest and tax (EBIT) loss over the last year. Indeed, it lost zł634k at the EBIT level. When we look at that and recall the liabilities on its balance sheet, relative to cash, it seems unwise to us for the company to have any debt. Quite frankly we think the balance sheet is far from match-fit, although it could be improved with time. Another cause for caution is that is bled zł5.0m in negative free cash flow over the last twelve months. So suffice it to say we consider the stock very risky. When analysing debt levels, the balance sheet is the obvious place to start. However, not all investment risk resides within the balance sheet - far from it. For example BioMaxima has 2 warning signs (and 1 which is significant) we think you should know about.

At the end of the day, it's often better to focus on companies that are free from net debt. You can access our special list of such companies (all with a track record of profit growth). It's free.

Valuation is complex, but we're here to simplify it.

Discover if BioMaxima might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About WSE:BMX

BioMaxima

Manufactures and distributes microbiological media, reagents, and equipment for in vitro diagnostics in Poland.

Proven track record with adequate balance sheet.

Market Insights

Community Narratives