Imagine Owning Wawel (WSE:WWL) And Wondering If The 35% Share Price Slide Is Justified

For many investors, the main point of stock picking is to generate higher returns than the overall market. But if you try your hand at stock picking, your risk returning less than the market. Unfortunately, that's been the case for longer term Wawel S.A. (WSE:WWL) shareholders, since the share price is down 35% in the last three years, falling well short of the market return of around 22%. And the ride hasn't got any smoother in recent times over the last year, with the price 29% lower in that time. Shareholders have had an even rougher run lately, with the share price down 24% in the last 90 days.

Check out our latest analysis for Wawel

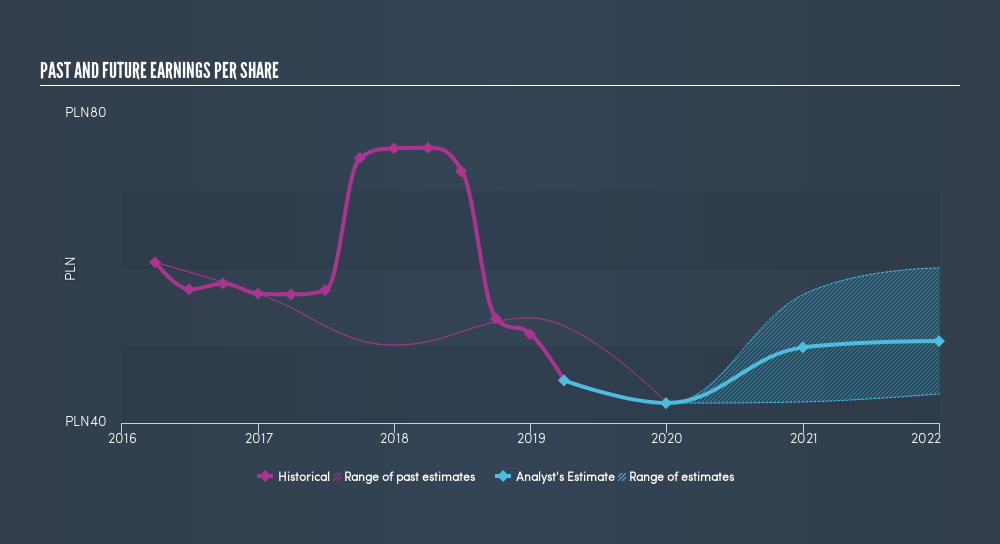

There is no denying that markets are sometimes efficient, but prices do not always reflect underlying business performance. By comparing earnings per share (EPS) and share price changes over time, we can get a feel for how investor attitudes to a company have morphed over time.

During the three years that the share price fell, Wawel's earnings per share (EPS) dropped by 9.2% each year. The share price decline of 13% is actually steeper than the EPS slippage. So it's likely that the EPS decline has disappointed the market, leaving investors hesitant to buy.

Dive deeper into Wawel's key metrics by checking this interactive graph of Wawel's earnings, revenue and cash flow.

What About Dividends?

As well as measuring the share price return, investors should also consider the total shareholder return (TSR). The TSR is a return calculation that accounts for the value of cash dividends (assuming that any dividend received was reinvested) and the calculated value of any discounted capital raisings and spin-offs. Arguably, the TSR gives a more comprehensive picture of the return generated by a stock. As it happens, Wawel's TSR for the last 3 years was -29%, which exceeds the share price return mentioned earlier. This is largely a result of its dividend payments!

A Different Perspective

Investors in Wawel had a tough year, with a total loss of 26% (including dividends), against a market gain of about 4.8%. Even the share prices of good stocks drop sometimes, but we want to see improvements in the fundamental metrics of a business, before getting too interested. Regrettably, last year's performance caps off a bad run, with the shareholders facing a total loss of 5.8% per year over five years. Generally speaking long term share price weakness can be a bad sign, though contrarian investors might want to research the stock in hope of a turnaround. Keeping this in mind, a solid next step might be to take a look at Wawel's dividend track record. This free interactive graph is a great place to start.

If you would prefer to check out another company -- one with potentially superior financials -- then do not miss this free list of companies that have proven they can grow earnings.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on PL exchanges.

We aim to bring you long-term focused research analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material.

If you spot an error that warrants correction, please contact the editor at editorial-team@simplywallst.com. This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. Simply Wall St has no position in the stocks mentioned. Thank you for reading.

About WSE:WWL

Wawel

Produces and sells cocoa, chocolate, and confectionary products in Poland.

Flawless balance sheet and fair value.

Market Insights

Community Narratives