David Iben put it well when he said, 'Volatility is not a risk we care about. What we care about is avoiding the permanent loss of capital.' So it seems the smart money knows that debt - which is usually involved in bankruptcies - is a very important factor, when you assess how risky a company is. We note that Gobarto S.A. (WSE:GOB) does have debt on its balance sheet. But the real question is whether this debt is making the company risky.

What Risk Does Debt Bring?

Debt is a tool to help businesses grow, but if a business is incapable of paying off its lenders, then it exists at their mercy. If things get really bad, the lenders can take control of the business. While that is not too common, we often do see indebted companies permanently diluting shareholders because lenders force them to raise capital at a distressed price. Having said that, the most common situation is where a company manages its debt reasonably well - and to its own advantage. When we examine debt levels, we first consider both cash and debt levels, together.

View our latest analysis for Gobarto

What Is Gobarto's Debt?

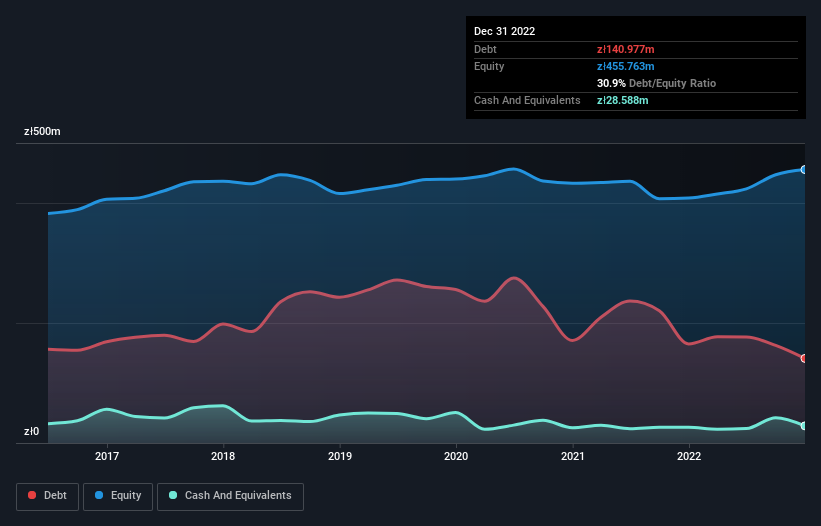

As you can see below, Gobarto had zł141.0m of debt at December 2022, down from zł165.1m a year prior. However, because it has a cash reserve of zł28.6m, its net debt is less, at about zł112.4m.

How Healthy Is Gobarto's Balance Sheet?

Zooming in on the latest balance sheet data, we can see that Gobarto had liabilities of zł479.4m due within 12 months and liabilities of zł161.1m due beyond that. On the other hand, it had cash of zł28.6m and zł268.3m worth of receivables due within a year. So its liabilities outweigh the sum of its cash and (near-term) receivables by zł343.6m.

When you consider that this deficiency exceeds the company's zł333.6m market capitalization, you might well be inclined to review the balance sheet intently. In the scenario where the company had to clean up its balance sheet quickly, it seems likely shareholders would suffer extensive dilution.

We use two main ratios to inform us about debt levels relative to earnings. The first is net debt divided by earnings before interest, tax, depreciation, and amortization (EBITDA), while the second is how many times its earnings before interest and tax (EBIT) covers its interest expense (or its interest cover, for short). Thus we consider debt relative to earnings both with and without depreciation and amortization expenses.

Looking at its net debt to EBITDA of 0.94 and interest cover of 2.8 times, it seems to us that Gobarto is probably using debt in a pretty reasonable way. So we'd recommend keeping a close eye on the impact financing costs are having on the business. Notably, Gobarto made a loss at the EBIT level, last year, but improved that to positive EBIT of zł70m in the last twelve months. The balance sheet is clearly the area to focus on when you are analysing debt. But it is Gobarto's earnings that will influence how the balance sheet holds up in the future. So when considering debt, it's definitely worth looking at the earnings trend. Click here for an interactive snapshot.

Finally, a business needs free cash flow to pay off debt; accounting profits just don't cut it. So it's worth checking how much of the earnings before interest and tax (EBIT) is backed by free cash flow. In the last year, Gobarto's free cash flow amounted to 45% of its EBIT, less than we'd expect. That weak cash conversion makes it more difficult to handle indebtedness.

Our View

On the face of it, Gobarto's level of total liabilities left us tentative about the stock, and its interest cover was no more enticing than the one empty restaurant on the busiest night of the year. But on the bright side, its net debt to EBITDA is a good sign, and makes us more optimistic. Looking at the balance sheet and taking into account all these factors, we do believe that debt is making Gobarto stock a bit risky. That's not necessarily a bad thing, but we'd generally feel more comfortable with less leverage. When analysing debt levels, the balance sheet is the obvious place to start. However, not all investment risk resides within the balance sheet - far from it. To that end, you should learn about the 3 warning signs we've spotted with Gobarto (including 2 which are potentially serious) .

If you're interested in investing in businesses that can grow profits without the burden of debt, then check out this free list of growing businesses that have net cash on the balance sheet.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About WSE:GOB

Gobarto

Engages in breeding, purchasing, slaughtering, cutting, and packaging of pork in Poland and internationally.

Flawless balance sheet and slightly overvalued.

Market Insights

Community Narratives