Did You Participate In Any Of Ambra's (WSE:AMB) Fantastic 263% Return ?

The most you can lose on any stock (assuming you don't use leverage) is 100% of your money. But on the bright side, you can make far more than 100% on a really good stock. Long term Ambra S.A. (WSE:AMB) shareholders would be well aware of this, since the stock is up 179% in five years. Also pleasing for shareholders was the 18% gain in the last three months. But this could be related to the strong market, which is up 14% in the last three months.

See our latest analysis for Ambra

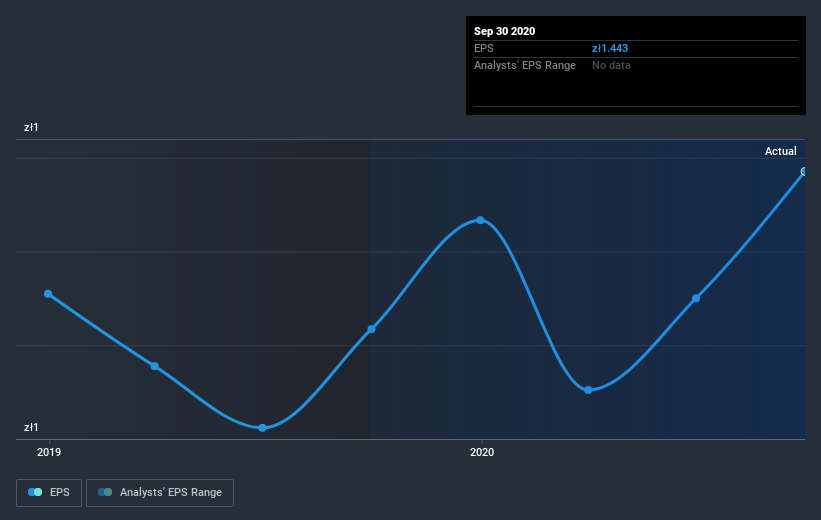

While the efficient markets hypothesis continues to be taught by some, it has been proven that markets are over-reactive dynamic systems, and investors are not always rational. By comparing earnings per share (EPS) and share price changes over time, we can get a feel for how investor attitudes to a company have morphed over time.

Over half a decade, Ambra managed to grow its earnings per share at 16% a year. This EPS growth is lower than the 23% average annual increase in the share price. So it's fair to assume the market has a higher opinion of the business than it did five years ago. That's not necessarily surprising considering the five-year track record of earnings growth.

The image below shows how EPS has tracked over time (if you click on the image you can see greater detail).

This free interactive report on Ambra's earnings, revenue and cash flow is a great place to start, if you want to investigate the stock further.

What About Dividends?

It is important to consider the total shareholder return, as well as the share price return, for any given stock. The TSR is a return calculation that accounts for the value of cash dividends (assuming that any dividend received was reinvested) and the calculated value of any discounted capital raisings and spin-offs. So for companies that pay a generous dividend, the TSR is often a lot higher than the share price return. As it happens, Ambra's TSR for the last 5 years was 263%, which exceeds the share price return mentioned earlier. And there's no prize for guessing that the dividend payments largely explain the divergence!

A Different Perspective

It's good to see that Ambra has rewarded shareholders with a total shareholder return of 4.8% in the last twelve months. That's including the dividend. However, that falls short of the 29% TSR per annum it has made for shareholders, each year, over five years. The pessimistic view would be that be that the stock has its best days behind it, but on the other hand the price might simply be moderating while the business itself continues to execute. Before forming an opinion on Ambra you might want to consider the cold hard cash it pays as a dividend. This free chart tracks its dividend over time.

If you would prefer to check out another company -- one with potentially superior financials -- then do not miss this free list of companies that have proven they can grow earnings.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on PL exchanges.

If you’re looking to trade Ambra, open an account with the lowest-cost* platform trusted by professionals, Interactive Brokers. Their clients from over 200 countries and territories trade stocks, options, futures, forex, bonds and funds worldwide from a single integrated account. Promoted

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

About WSE:AMB

Ambra

Engages in the manufacture, import, and distribution of grape wines in Poland, the Czech Republic, Slovakia, and Romania.

Flawless balance sheet established dividend payer.

Market Insights

Community Narratives