- Poland

- /

- Capital Markets

- /

- WSE:XTB

Why We Think Shareholders May Be Considering Bumping Up XTB S.A.'s (WSE:XTB) CEO Compensation

Key Insights

- XTB will host its Annual General Meeting on 14th of May

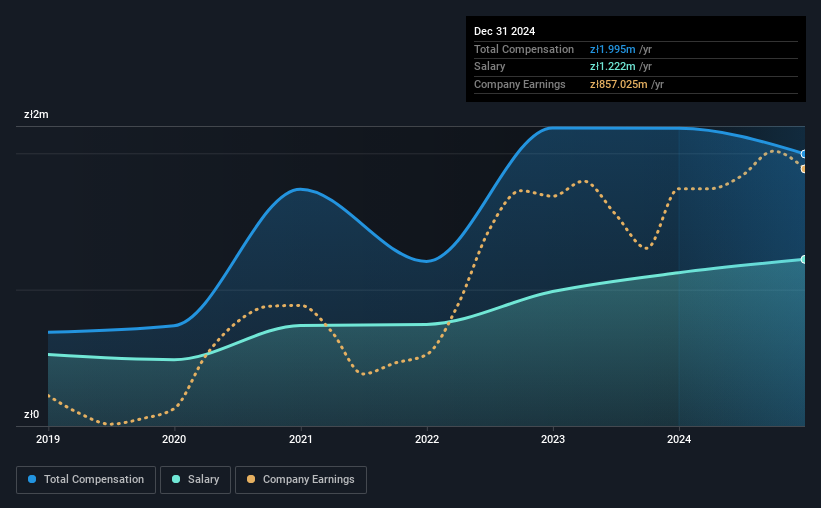

- CEO Omar Arnaout's total compensation includes salary of zł1.22m

- The total compensation is 77% less than the average for the industry

- XTB's EPS grew by 53% over the past three years while total shareholder return over the past three years was 451%

The impressive results at XTB S.A. (WSE:XTB) recently will be great news for shareholders. At the upcoming AGM on 14th of May, they would be interested to hear about the company strategy going forward and get a chance to cast their votes on resolutions such as executive remuneration and other company matters. Here we will show why we think CEO compensation is appropriate and discuss the case for a pay rise.

View our latest analysis for XTB

Comparing XTB S.A.'s CEO Compensation With The Industry

According to our data, XTB S.A. has a market capitalization of zł10.0b, and paid its CEO total annual compensation worth zł2.0m over the year to December 2024. That's a notable decrease of 8.6% on last year. In particular, the salary of zł1.22m, makes up a huge portion of the total compensation being paid to the CEO.

On examining similar-sized companies in the Poland Capital Markets industry with market capitalizations between zł7.5b and zł24b, we discovered that the median CEO total compensation of that group was zł8.8m. That is to say, Omar Arnaout is paid under the industry median. Furthermore, Omar Arnaout directly owns zł4.3m worth of shares in the company, implying that they are deeply invested in the company's success.

| Component | 2024 | 2023 | Proportion (2024) |

| Salary | zł1.2m | zł1.1m | 61% |

| Other | zł773k | zł1.1m | 39% |

| Total Compensation | zł2.0m | zł2.2m | 100% |

Speaking on an industry level, salary and non-salary portions, both make up 50% each of the total remuneration. XTB pays out 61% of remuneration in the form of a salary, significantly higher than the industry average. If salary is the major component in total compensation, it suggests that the CEO receives a higher fixed proportion of the total compensation, regardless of performance.

XTB S.A.'s Growth

XTB S.A. has seen its earnings per share (EPS) increase by 53% a year over the past three years. Its revenue is up 16% over the last year.

Shareholders would be glad to know that the company has improved itself over the last few years. It's a real positive to see this sort of revenue growth in a single year. That suggests a healthy and growing business. Moving away from current form for a second, it could be important to check this free visual depiction of what analysts expect for the future.

Has XTB S.A. Been A Good Investment?

Most shareholders would probably be pleased with XTB S.A. for providing a total return of 451% over three years. As a result, some may believe the CEO should be paid more than is normal for companies of similar size.

In Summary...

The company's solid performance might have made most shareholders happy, possibly making CEO remuneration the least of the matters to be discussed in the AGM. However, investors will get the chance to engage on key strategic initiatives and future growth opportunities for the company and set their longer-term expectations.

CEO compensation is an important area to keep your eyes on, but we've also need to pay attention to other attributes of the company. We identified 2 warning signs for XTB (1 shouldn't be ignored!) that you should be aware of before investing here.

Of course, you might find a fantastic investment by looking at a different set of stocks. So take a peek at this free list of interesting companies.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About WSE:XTB

XTB

Provides ETF, currency derivatives, commodities, indices, stocks, and bonds brokerage services in Central and Eastern Europe, Western Europe, Latin America, and the Middle East.

Undervalued with adequate balance sheet.

Similar Companies

Market Insights

Community Narratives