- Poland

- /

- Capital Markets

- /

- WSE:SKH

Skarbiec Holding's (WSE:SKH) underlying earnings growth outpaced the favorable return generated for shareholders over the past three years

Skarbiec Holding S.A. (WSE:SKH) shareholders might be concerned after seeing the share price drop 12% in the last quarter. On the other hand the share price is higher than it was three years ago. However, it's unlikely many shareholders are elated with the share price gain of 28% over that time, given the rising market.

While the stock has fallen 12% this week, it's worth focusing on the longer term and seeing if the stocks historical returns have been driven by the underlying fundamentals.

See our latest analysis for Skarbiec Holding

In his essay The Superinvestors of Graham-and-Doddsville Warren Buffett described how share prices do not always rationally reflect the value of a business. By comparing earnings per share (EPS) and share price changes over time, we can get a feel for how investor attitudes to a company have morphed over time.

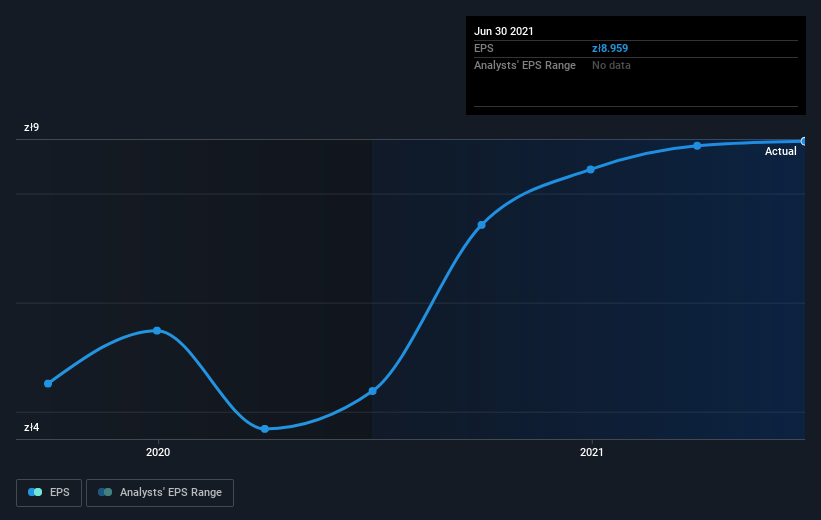

During three years of share price growth, Skarbiec Holding achieved compound earnings per share growth of 46% per year. This EPS growth is higher than the 9% average annual increase in the share price. So one could reasonably conclude that the market has cooled on the stock. This cautious sentiment is reflected in its (fairly low) P/E ratio of 3.42.

The graphic below depicts how EPS has changed over time (unveil the exact values by clicking on the image).

It's probably worth noting that the CEO is paid less than the median at similar sized companies. But while CEO remuneration is always worth checking, the really important question is whether the company can grow earnings going forward. Before buying or selling a stock, we always recommend a close examination of historic growth trends, available here..

What about the Total Shareholder Return (TSR)?

We'd be remiss not to mention the difference between Skarbiec Holding's total shareholder return (TSR) and its share price return. Arguably the TSR is a more complete return calculation because it accounts for the value of dividends (as if they were reinvested), along with the hypothetical value of any discounted capital that have been offered to shareholders. Dividends have been really beneficial for Skarbiec Holding shareholders, and that cash payout contributed to why its TSR of 32%, over the last 3 years, is better than the share price return.

A Different Perspective

Skarbiec Holding provided a TSR of 15% over the last twelve months. But that return falls short of the market. On the bright side, that's still a gain, and it's actually better than the average return of 5% over half a decade This suggests the company might be improving over time. It's always interesting to track share price performance over the longer term. But to understand Skarbiec Holding better, we need to consider many other factors. For instance, we've identified 1 warning sign for Skarbiec Holding that you should be aware of.

If you would prefer to check out another company -- one with potentially superior financials -- then do not miss this free list of companies that have proven they can grow earnings.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on PL exchanges.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

About WSE:SKH

Skarbiec Holding

Engages in creation and management of investment funds in Poland.

Flawless balance sheet with proven track record.

Market Insights

Community Narratives