- Poland

- /

- Consumer Finance

- /

- WSE:KPI

Optimistic Investors Push Kancelaria Prawna-Inkaso WEC Spólka Akcyjna (WSE:KPI) Shares Up 27% But Growth Is Lacking

Kancelaria Prawna-Inkaso WEC Spólka Akcyjna (WSE:KPI) shareholders have had their patience rewarded with a 27% share price jump in the last month. The last 30 days bring the annual gain to a very sharp 49%.

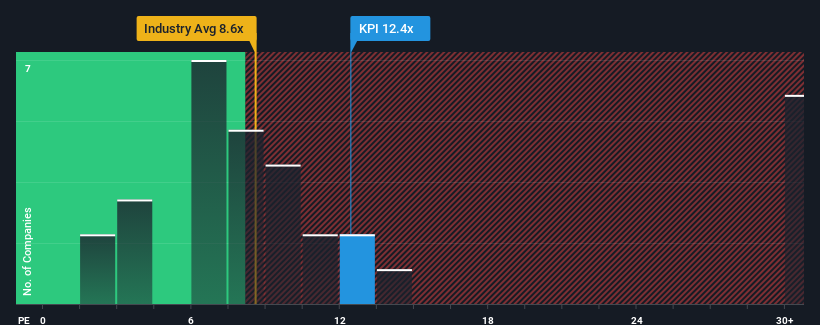

In spite of the firm bounce in price, you could still be forgiven for feeling indifferent about Kancelaria Prawna-Inkaso WEC Spólka Akcyjna's P/E ratio of 12.4x, since the median price-to-earnings (or "P/E") ratio in Poland is also close to 13x. However, investors might be overlooking a clear opportunity or potential setback if there is no rational basis for the P/E.

The earnings growth achieved at Kancelaria Prawna-Inkaso WEC Spólka Akcyjna over the last year would be more than acceptable for most companies. It might be that many expect the respectable earnings performance to wane, which has kept the P/E from rising. If that doesn't eventuate, then existing shareholders probably aren't too pessimistic about the future direction of the share price.

View our latest analysis for Kancelaria Prawna-Inkaso WEC Spólka Akcyjna

How Is Kancelaria Prawna-Inkaso WEC Spólka Akcyjna's Growth Trending?

Kancelaria Prawna-Inkaso WEC Spólka Akcyjna's P/E ratio would be typical for a company that's only expected to deliver moderate growth, and importantly, perform in line with the market.

Taking a look back first, we see that the company managed to grow earnings per share by a handy 11% last year. However, due to its less than impressive performance prior to this period, EPS growth is practically non-existent over the last three years overall. Accordingly, shareholders probably wouldn't have been overly satisfied with the unstable medium-term growth rates.

Weighing that recent medium-term earnings trajectory against the broader market's one-year forecast for expansion of 10% shows it's noticeably less attractive on an annualised basis.

With this information, we find it interesting that Kancelaria Prawna-Inkaso WEC Spólka Akcyjna is trading at a fairly similar P/E to the market. It seems most investors are ignoring the fairly limited recent growth rates and are willing to pay up for exposure to the stock. They may be setting themselves up for future disappointment if the P/E falls to levels more in line with recent growth rates.

The Bottom Line On Kancelaria Prawna-Inkaso WEC Spólka Akcyjna's P/E

Kancelaria Prawna-Inkaso WEC Spólka Akcyjna's stock has a lot of momentum behind it lately, which has brought its P/E level with the market. It's argued the price-to-earnings ratio is an inferior measure of value within certain industries, but it can be a powerful business sentiment indicator.

Our examination of Kancelaria Prawna-Inkaso WEC Spólka Akcyjna revealed its three-year earnings trends aren't impacting its P/E as much as we would have predicted, given they look worse than current market expectations. When we see weak earnings with slower than market growth, we suspect the share price is at risk of declining, sending the moderate P/E lower. If recent medium-term earnings trends continue, it will place shareholders' investments at risk and potential investors in danger of paying an unnecessary premium.

It's always necessary to consider the ever-present spectre of investment risk. We've identified 4 warning signs with Kancelaria Prawna-Inkaso WEC Spólka Akcyjna (at least 3 which are significant), and understanding them should be part of your investment process.

If you're unsure about the strength of Kancelaria Prawna-Inkaso WEC Spólka Akcyjna's business, why not explore our interactive list of stocks with solid business fundamentals for some other companies you may have missed.

Valuation is complex, but we're here to simplify it.

Discover if Kancelaria Prawna-Inkaso WEC Spólka Akcyjna might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About WSE:KPI

Kancelaria Prawna-Inkaso WEC Spólka Akcyjna

Engages in the debt collection and monitoring business in Poland.

Moderate with questionable track record.

Market Insights

Community Narratives