- Poland

- /

- Food and Staples Retail

- /

- WSE:BIP

Here's Why Bio Planet (WSE:BIP) Can Manage Its Debt Responsibly

Some say volatility, rather than debt, is the best way to think about risk as an investor, but Warren Buffett famously said that 'Volatility is far from synonymous with risk.' So it might be obvious that you need to consider debt, when you think about how risky any given stock is, because too much debt can sink a company. Importantly, Bio Planet S.A. (WSE:BIP) does carry debt. But should shareholders be worried about its use of debt?

What Risk Does Debt Bring?

Debt assists a business until the business has trouble paying it off, either with new capital or with free cash flow. Part and parcel of capitalism is the process of 'creative destruction' where failed businesses are mercilessly liquidated by their bankers. However, a more frequent (but still costly) occurrence is where a company must issue shares at bargain-basement prices, permanently diluting shareholders, just to shore up its balance sheet. Of course, plenty of companies use debt to fund growth, without any negative consequences. The first step when considering a company's debt levels is to consider its cash and debt together.

What Is Bio Planet's Debt?

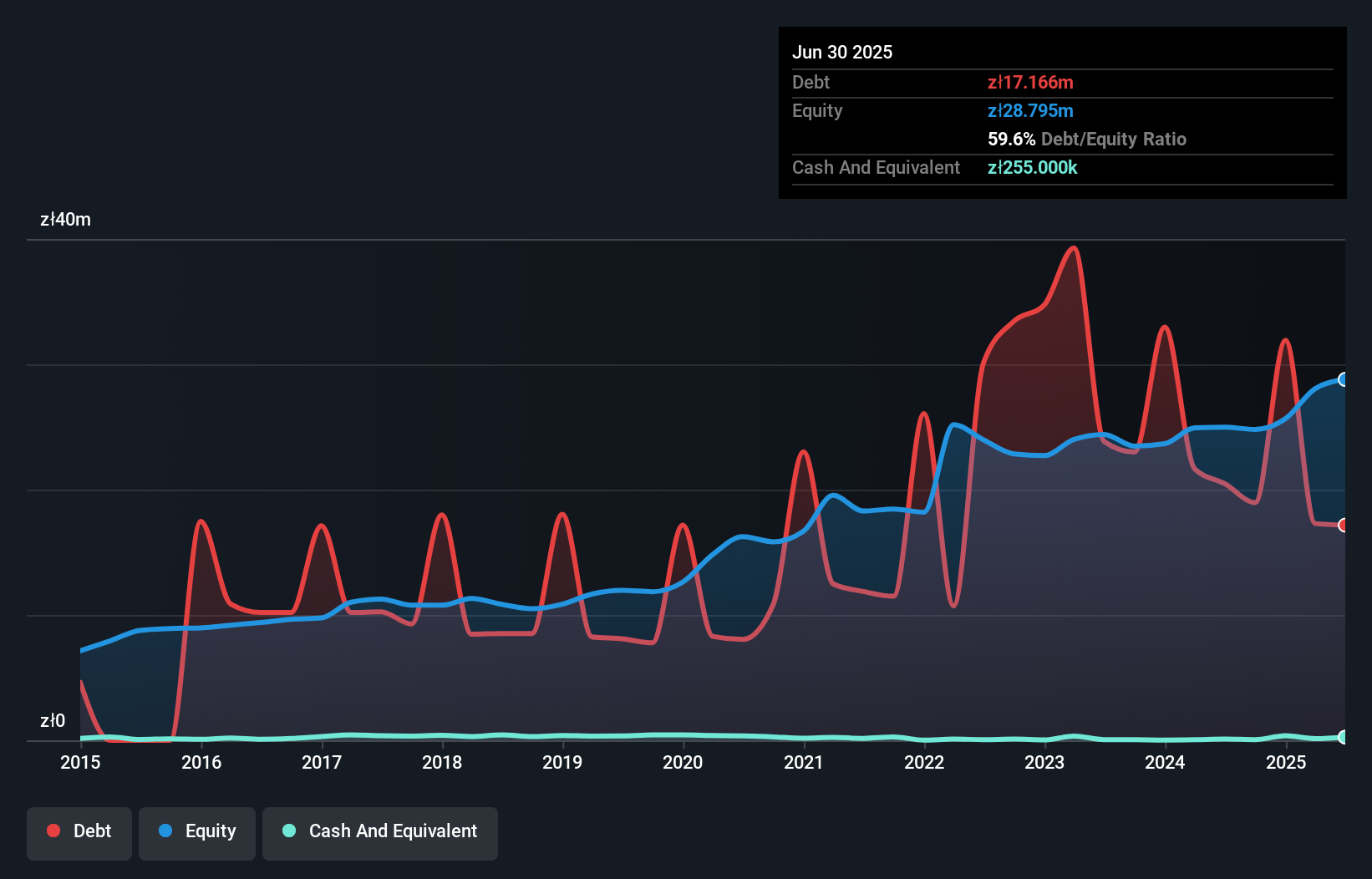

As you can see below, Bio Planet had zł17.2m of debt at June 2025, down from zł20.5m a year prior. And it doesn't have much cash, so its net debt is about the same.

How Strong Is Bio Planet's Balance Sheet?

We can see from the most recent balance sheet that Bio Planet had liabilities of zł59.3m falling due within a year, and liabilities of zł19.8m due beyond that. Offsetting these obligations, it had cash of zł255.0k as well as receivables valued at zł29.6m due within 12 months. So it has liabilities totalling zł49.3m more than its cash and near-term receivables, combined.

This deficit is considerable relative to its market capitalization of zł57.0m, so it does suggest shareholders should keep an eye on Bio Planet's use of debt. Should its lenders demand that it shore up the balance sheet, shareholders would likely face severe dilution.

See our latest analysis for Bio Planet

We use two main ratios to inform us about debt levels relative to earnings. The first is net debt divided by earnings before interest, tax, depreciation, and amortization (EBITDA), while the second is how many times its earnings before interest and tax (EBIT) covers its interest expense (or its interest cover, for short). This way, we consider both the absolute quantum of the debt, as well as the interest rates paid on it.

Bio Planet has net debt worth 1.6 times EBITDA, which isn't too much, but its interest cover looks a bit on the low side, with EBIT at only 3.4 times the interest expense. While that doesn't worry us too much, it does suggest the interest payments are somewhat of a burden. Pleasingly, Bio Planet is growing its EBIT faster than former Australian PM Bob Hawke downs a yard glass, boasting a 295% gain in the last twelve months. There's no doubt that we learn most about debt from the balance sheet. But you can't view debt in total isolation; since Bio Planet will need earnings to service that debt. So if you're keen to discover more about its earnings, it might be worth checking out this graph of its long term earnings trend.

Finally, while the tax-man may adore accounting profits, lenders only accept cold hard cash. So it's worth checking how much of that EBIT is backed by free cash flow. During the last three years, Bio Planet produced sturdy free cash flow equating to 74% of its EBIT, about what we'd expect. This free cash flow puts the company in a good position to pay down debt, when appropriate.

Our View

Both Bio Planet's ability to to grow its EBIT and its conversion of EBIT to free cash flow gave us comfort that it can handle its debt. Having said that, its interest cover somewhat sensitizes us to potential future risks to the balance sheet. Considering this range of data points, we think Bio Planet is in a good position to manage its debt levels. Having said that, the load is sufficiently heavy that we would recommend any shareholders keep a close eye on it. The balance sheet is clearly the area to focus on when you are analysing debt. However, not all investment risk resides within the balance sheet - far from it. We've identified 3 warning signs with Bio Planet (at least 1 which is significant) , and understanding them should be part of your investment process.

At the end of the day, it's often better to focus on companies that are free from net debt. You can access our special list of such companies (all with a track record of profit growth). It's free.

Valuation is complex, but we're here to simplify it.

Discover if Bio Planet might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About WSE:BIP

Bio Planet

Produces and distributes organic food products in Poland and internationally.

Proven track record with slight risk.

Market Insights

Community Narratives

Recently Updated Narratives

Astor Enerji will surge with a fair value of $140.43 in the next 3 years

Proximus: The State-Backed Backup Plan with 7% Gross Yield and 15% Currency Upside.

A case for for IMPACT Silver Corp (TSXV:IPT) to reach USD $4.52 (CAD $6.16) in 2026 (23 bagger in 1 year) and USD $5.76 (CAD $7.89) by 2030

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

The company that turned a verb into a global necessity and basically runs the modern internet, digital ads, smartphones, maps, and AI.