- Poland

- /

- Food and Staples Retail

- /

- WSE:BIP

Bio Planet S.A. (WSE:BIP) Stocks Shoot Up 25% But Its P/S Still Looks Reasonable

Bio Planet S.A. (WSE:BIP) shareholders are no doubt pleased to see that the share price has bounced 25% in the last month, although it is still struggling to make up recently lost ground. Looking back a bit further, it's encouraging to see the stock is up 52% in the last year.

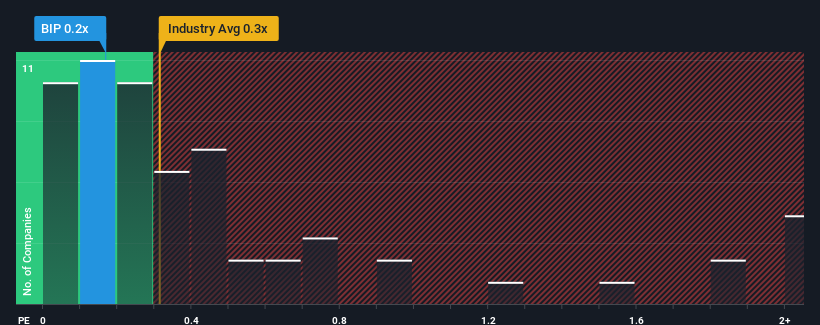

Even after such a large jump in price, there still wouldn't be many who think Bio Planet's price-to-sales (or "P/S") ratio of 0.2x is worth a mention when it essentially matches the median P/S in Poland's Consumer Retailing industry. While this might not raise any eyebrows, if the P/S ratio is not justified investors could be missing out on a potential opportunity or ignoring looming disappointment.

Check out our latest analysis for Bio Planet

How Bio Planet Has Been Performing

Revenue has risen firmly for Bio Planet recently, which is pleasing to see. One possibility is that the P/S is moderate because investors think this respectable revenue growth might not be enough to outperform the broader industry in the near future. Those who are bullish on Bio Planet will be hoping that this isn't the case, so that they can pick up the stock at a lower valuation.

We don't have analyst forecasts, but you can see how recent trends are setting up the company for the future by checking out our free report on Bio Planet's earnings, revenue and cash flow.What Are Revenue Growth Metrics Telling Us About The P/S?

Bio Planet's P/S ratio would be typical for a company that's only expected to deliver moderate growth, and importantly, perform in line with the industry.

Taking a look back first, we see that the company grew revenue by an impressive 18% last year. As a result, it also grew revenue by 25% in total over the last three years. Therefore, it's fair to say the revenue growth recently has been respectable for the company.

Weighing that recent medium-term revenue trajectory against the broader industry's one-year forecast for expansion of 6.0% shows it's about the same on an annualised basis.

With this information, we can see why Bio Planet is trading at a fairly similar P/S to the industry. Apparently shareholders are comfortable to simply hold on assuming the company will continue keeping a low profile.

What Does Bio Planet's P/S Mean For Investors?

Its shares have lifted substantially and now Bio Planet's P/S is back within range of the industry median. While the price-to-sales ratio shouldn't be the defining factor in whether you buy a stock or not, it's quite a capable barometer of revenue expectations.

It appears to us that Bio Planet maintains its moderate P/S off the back of its recent three-year growth being in line with the wider industry forecast. Currently, with a past revenue trend that aligns closely wit the industry outlook, shareholders are confident the company's future revenue outlook won't contain any major surprises. Given the current circumstances, it seems improbable that the share price will experience any significant movement in either direction in the near future if recent medium-term revenue trends persist.

There are also other vital risk factors to consider and we've discovered 3 warning signs for Bio Planet (1 can't be ignored!) that you should be aware of before investing here.

If these risks are making you reconsider your opinion on Bio Planet, explore our interactive list of high quality stocks to get an idea of what else is out there.

Valuation is complex, but we're here to simplify it.

Discover if Bio Planet might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About WSE:BIP

Bio Planet

Produces and distributes organic food products in Poland and internationally.

Proven track record with slight risk.

Market Insights

Weekly Picks

Solutions by stc: 34% Upside in Saudi's Digital Transformation Leader

The AI Infrastructure Giant Grows Into Its Valuation

Recently Updated Narratives

Many trends acting at the same time

Engineered for Stability. Positioned for Growth.

Staggered by dilution; positions for growth

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026