Legendary fund manager Li Lu (who Charlie Munger backed) once said, 'The biggest investment risk is not the volatility of prices, but whether you will suffer a permanent loss of capital.' So it might be obvious that you need to consider debt, when you think about how risky any given stock is, because too much debt can sink a company. Importantly, Werth-Holz S.A. (WSE:WHH) does carry debt. But is this debt a concern to shareholders?

What Risk Does Debt Bring?

Debt is a tool to help businesses grow, but if a business is incapable of paying off its lenders, then it exists at their mercy. In the worst case scenario, a company can go bankrupt if it cannot pay its creditors. However, a more usual (but still expensive) situation is where a company must dilute shareholders at a cheap share price simply to get debt under control. Of course, plenty of companies use debt to fund growth, without any negative consequences. The first step when considering a company's debt levels is to consider its cash and debt together.

See our latest analysis for Werth-Holz

What Is Werth-Holz's Debt?

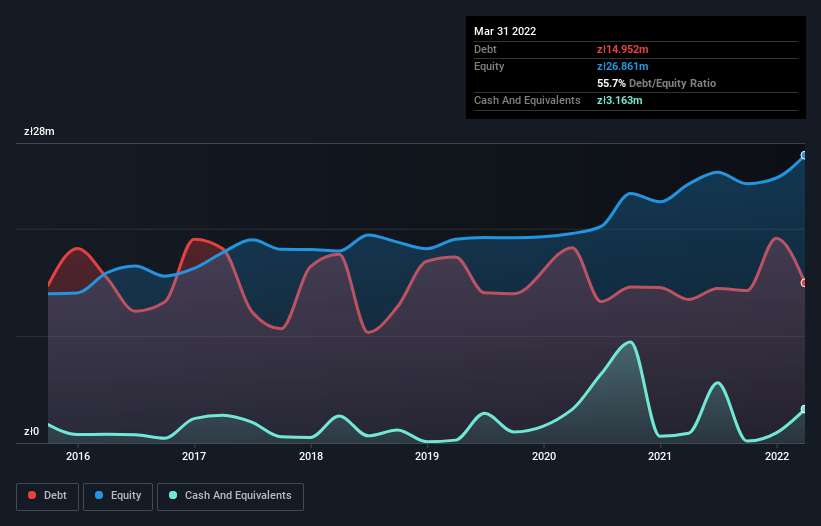

The image below, which you can click on for greater detail, shows that at March 2022 Werth-Holz had debt of zł15.0m, up from zł13.4m in one year. However, because it has a cash reserve of zł3.16m, its net debt is less, at about zł11.8m.

How Strong Is Werth-Holz's Balance Sheet?

According to the last reported balance sheet, Werth-Holz had liabilities of zł28.1m due within 12 months, and liabilities of zł2.19m due beyond 12 months. Offsetting this, it had zł3.16m in cash and zł9.00m in receivables that were due within 12 months. So it has liabilities totalling zł18.1m more than its cash and near-term receivables, combined.

This deficit is considerable relative to its market capitalization of zł28.1m, so it does suggest shareholders should keep an eye on Werth-Holz's use of debt. This suggests shareholders would be heavily diluted if the company needed to shore up its balance sheet in a hurry.

We measure a company's debt load relative to its earnings power by looking at its net debt divided by its earnings before interest, tax, depreciation, and amortization (EBITDA) and by calculating how easily its earnings before interest and tax (EBIT) cover its interest expense (interest cover). The advantage of this approach is that we take into account both the absolute quantum of debt (with net debt to EBITDA) and the actual interest expenses associated with that debt (with its interest cover ratio).

Werth-Holz has net debt worth 1.6 times EBITDA, which isn't too much, but its interest cover looks a bit on the low side, with EBIT at only 2.6 times the interest expense. While that doesn't worry us too much, it does suggest the interest payments are somewhat of a burden. Pleasingly, Werth-Holz is growing its EBIT faster than former Australian PM Bob Hawke downs a yard glass, boasting a 132% gain in the last twelve months. When analysing debt levels, the balance sheet is the obvious place to start. But you can't view debt in total isolation; since Werth-Holz will need earnings to service that debt. So if you're keen to discover more about its earnings, it might be worth checking out this graph of its long term earnings trend.

Finally, a business needs free cash flow to pay off debt; accounting profits just don't cut it. So the logical step is to look at the proportion of that EBIT that is matched by actual free cash flow. Looking at the most recent three years, Werth-Holz recorded free cash flow of 47% of its EBIT, which is weaker than we'd expect. That weak cash conversion makes it more difficult to handle indebtedness.

Our View

When it comes to the balance sheet, the standout positive for Werth-Holz was the fact that it seems able to grow its EBIT confidently. But the other factors we noted above weren't so encouraging. In particular, interest cover gives us cold feet. When we consider all the factors mentioned above, we do feel a bit cautious about Werth-Holz's use of debt. While debt does have its upside in higher potential returns, we think shareholders should definitely consider how debt levels might make the stock more risky. There's no doubt that we learn most about debt from the balance sheet. However, not all investment risk resides within the balance sheet - far from it. These risks can be hard to spot. Every company has them, and we've spotted 3 warning signs for Werth-Holz you should know about.

If, after all that, you're more interested in a fast growing company with a rock-solid balance sheet, then check out our list of net cash growth stocks without delay.

Valuation is complex, but we're here to simplify it.

Discover if Werth-Holz might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About WSE:WHH

Werth-Holz

Engages in the manufacture and sale of wooden garden architecture products.

Moderate risk with mediocre balance sheet.

Market Insights

Weekly Picks

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

Fiducian: Compliance Clouds or Value Opportunity?

Willamette Valley Vineyards (WVVI): Not-So-Great Value

Recently Updated Narratives

THE KINGDOM OF BROWN GOODS: WHY MGPI IS BEING CRUSHED BY INVENTORY & PRIMED FOR RESURRECTION

The "Molecular Pencil": Why Beam's Technology is Built to Win

ADNOC Gas future shines with a 21.4% revenue surge

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026