Imagine Owning Interma Trade (WSE:ITM) And Taking A 96% Loss Square On The Chin

Every investor on earth makes bad calls sometimes. But you have a problem if you face massive losses more than once in a while. So spare a thought for the long term shareholders of Interma Trade S.A. (WSE:ITM); the share price is down a whopping 96% in the last three years. That might cause some serious doubts about the merits of the initial decision to buy the stock, to put it mildly. And the ride hasn't got any smoother in recent times over the last year, with the price 44% lower in that time. Even worse, it's down 40% in about a month, which isn't fun at all.

We really feel for shareholders in this scenario. It's a good reminder of the importance of diversification, and it's worth keeping in mind there's more to life than money, anyway.

See our latest analysis for Interma Trade

Interma Trade wasn't profitable in the last twelve months, it is unlikely we'll see a strong correlation between its share price and its earnings per share (EPS). Arguably revenue is our next best option. Shareholders of unprofitable companies usually expect strong revenue growth. Some companies are willing to postpone profitability to grow revenue faster, but in that case one does expect good top-line growth.

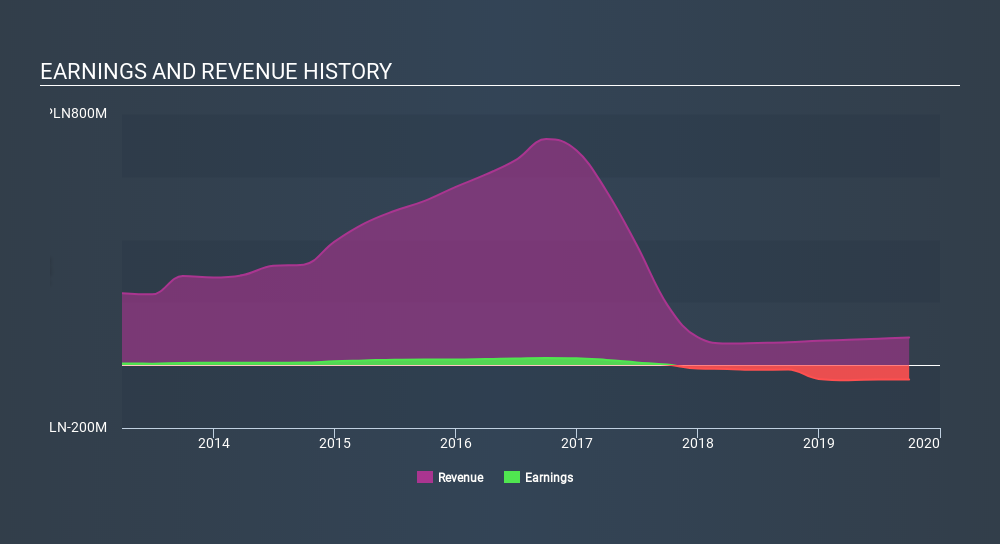

Over the last three years, Interma Trade's revenue dropped 89% per year. That's definitely a weaker result than most pre-profit companies report. The swift share price decline at an annual compound rate of 65%, reflects this weak fundamental performance. Never forget that loss making companies with falling revenue can and do cause losses for everyday investors. It's worth remembering that investors call buying a steeply falling share price 'catching a falling knife' because it is a dangerous pass time.

You can see how earnings and revenue have changed over time in the image below (click on the chart to see the exact values).

Take a more thorough look at Interma Trade's financial health with this free report on its balance sheet.

A Different Perspective

While the broader market lost about 15% in the twelve months, Interma Trade shareholders did even worse, losing 44%. Having said that, it's inevitable that some stocks will be oversold in a falling market. The key is to keep your eyes on the fundamental developments. Unfortunately, last year's performance may indicate unresolved challenges, given that it was worse than the annualised loss of 41% over the last half decade. We realise that Buffett has said investors should 'buy when there is blood on the streets', but we caution that investors should first be sure they are buying a high quality business. While it is well worth considering the different impacts that market conditions can have on the share price, there are other factors that are even more important. Like risks, for instance. Every company has them, and we've spotted 4 warning signs for Interma Trade (of which 3 are a bit concerning!) you should know about.

But note: Interma Trade may not be the best stock to buy. So take a peek at this free list of interesting companies with past earnings growth (and further growth forecast).

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on PL exchanges.

If you spot an error that warrants correction, please contact the editor at editorial-team@simplywallst.com. This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. Simply Wall St has no position in the stocks mentioned.

We aim to bring you long-term focused research analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Thank you for reading.

About WSE:ITM

Interma Trade

Interma Trade S.A. designs, manufactures, and distributes jewelry products made of gold, silver, and precious and synthetic stones.

Slightly overvalued with weak fundamentals.

Market Insights

Community Narratives