- Poland

- /

- Consumer Durables

- /

- WSE:DOM

Three Top Dividend Stocks To Consider

Reviewed by Simply Wall St

As global markets navigate mixed signals, with U.S. stocks ending the week on a varied note and European inflation nearing central bank targets, investors are increasingly looking for stability in their portfolios. Amid these fluctuating conditions, dividend stocks offer an attractive proposition by providing consistent income streams and potential long-term growth.

Top 10 Dividend Stocks

| Name | Dividend Yield | Dividend Rating |

| Guaranty Trust Holding (NGSE:GTCO) | 6.96% | ★★★★★★ |

| Intelligent Wave (TSE:4847) | 3.86% | ★★★★★★ |

| Premier Financial (NasdaqGS:PFC) | 5.08% | ★★★★★★ |

| KurimotoLtd (TSE:5602) | 4.93% | ★★★★★★ |

| Business Brain Showa-Ota (TSE:9658) | 4.19% | ★★★★★★ |

| FALCO HOLDINGS (TSE:4671) | 6.60% | ★★★★★★ |

| James Latham (AIM:LTHM) | 5.97% | ★★★★★★ |

| Swiss Life Holding (SWX:SLHN) | 4.75% | ★★★★★★ |

| GakkyushaLtd (TSE:9769) | 4.29% | ★★★★★★ |

| Banque Cantonale Vaudoise (SWX:BCVN) | 4.76% | ★★★★★★ |

Click here to see the full list of 2090 stocks from our Top Dividend Stocks screener.

Let's take a closer look at a couple of our picks from the screened companies.

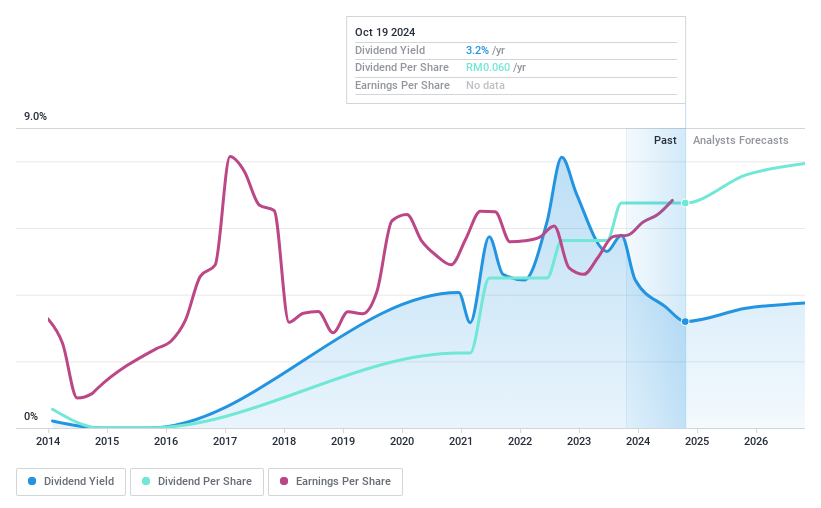

Eco World Development Group Berhad (KLSE:ECOWLD)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Eco World Development Group Berhad, with a market cap of MYR4.63 billion, is an investment holding company involved in property development and investment activities in Malaysia.

Operations: Eco World Development Group Berhad generates revenue primarily from property development, amounting to MYR2.41 billion.

Dividend Yield: 3.8%

Eco World Development Group Berhad's dividend payments have been volatile over the past decade, though they are well-covered by both earnings (payout ratio: 84.4%) and cash flows (cash payout ratio: 22.6%). Recent announcements include a first interim single-tier dividend of MYR 0.02 per share for FY2024 and the launch of QUANTUM, an industrial revenue pillar aimed at supporting Malaysia's digital transformation. However, its current yield (3.82%) is lower than the top 25% of Malaysian dividend payers.

- Click here to discover the nuances of Eco World Development Group Berhad with our detailed analytical dividend report.

- Insights from our recent valuation report point to the potential overvaluation of Eco World Development Group Berhad shares in the market.

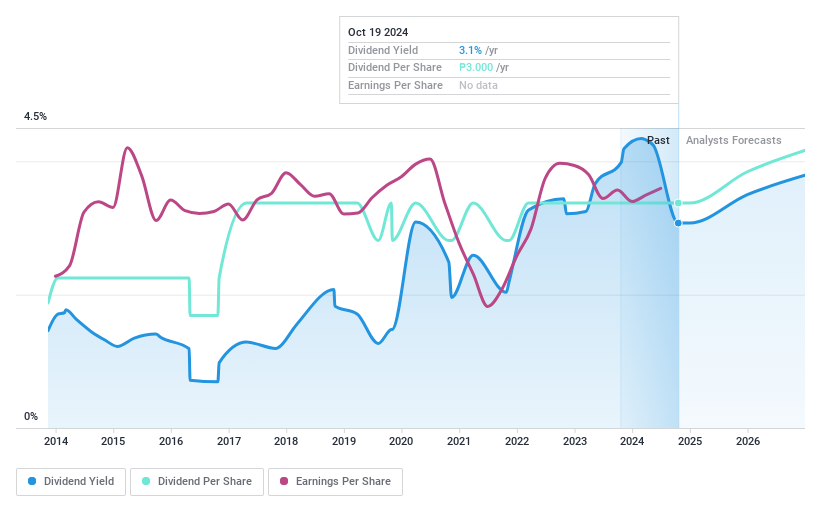

Security Bank (PSE:SECB)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Security Bank Corporation, along with its subsidiaries, offers a range of banking and financial services to both wholesale and retail clients in the Philippines, with a market cap of ₱49.70 billion.

Operations: Security Bank Corporation generates revenue from various segments, including Retail Banking (₱1.97 billion), Business Banking (₱1.05 billion), and Wholesale Banking (₱8.10 billion), while experiencing a loss in Financial Markets (-₱2.36 billion).

Dividend Yield: 4.3%

Security Bank's dividend payments have been volatile and unreliable over the past decade, but they are well-covered by earnings with a low payout ratio of 11.7%. Despite recent executive changes aimed at strengthening risk management, the bank faces challenges with a high level of bad loans (3.4%). Recent earnings show growth in net interest income and net income for H1 2024. However, its current dividend yield (4.35%) is lower than the top 25% of Philippine dividend payers.

- Get an in-depth perspective on Security Bank's performance by reading our dividend report here.

- Upon reviewing our latest valuation report, Security Bank's share price might be too pessimistic.

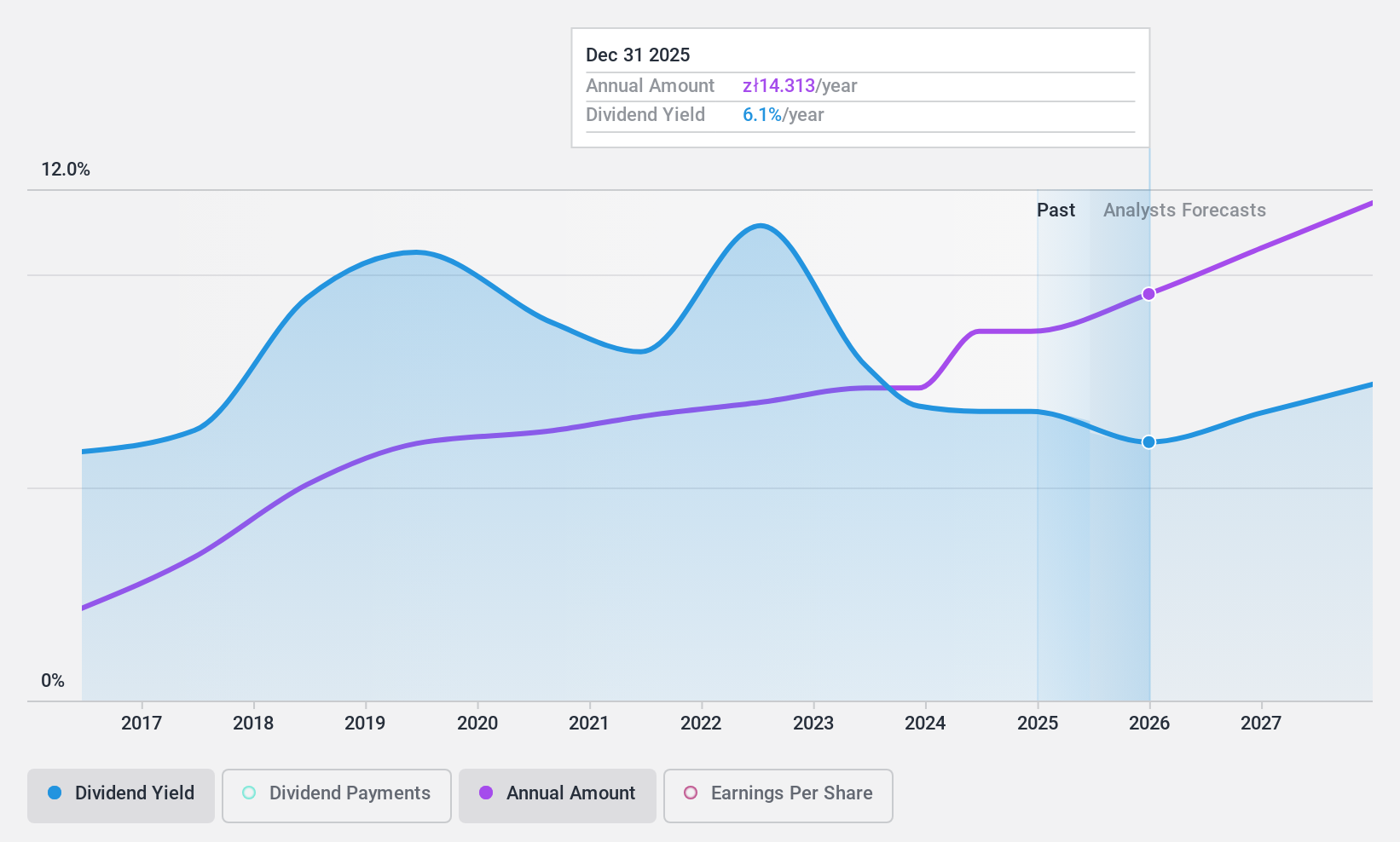

Dom Development (WSE:DOM)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Dom Development S.A., with a market cap of PLN4.51 billion, develops and sells residential and commercial real estate properties in Poland through its subsidiaries, also providing related support activities.

Operations: Dom Development S.A. generates PLN2.65 billion in revenue from its residential and commercial real estate development and sales activities.

Dividend Yield: 7.4%

Dom Development's dividend payments have been stable and growing over the past decade, supported by a low payout ratio of 35.7%. However, the dividends are not well covered by free cash flow with a high cash payout ratio of 161.2%. Recent earnings for H1 2024 show increased net income at PLN 231.05 million and sales at PLN 1.37 billion, indicating robust financial performance despite lower unit handovers compared to last year.

- Unlock comprehensive insights into our analysis of Dom Development stock in this dividend report.

- Our expertly prepared valuation report Dom Development implies its share price may be lower than expected.

Taking Advantage

- Navigate through the entire inventory of 2090 Top Dividend Stocks here.

- Have you diversified into these companies? Leverage the power of Simply Wall St's portfolio to keep a close eye on market movements affecting your investments.

- Enhance your investing ability with the Simply Wall St app and enjoy free access to essential market intelligence spanning every continent.

Contemplating Other Strategies?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About WSE:DOM

Dom Development

Engages in the development and sale of residential and commercial real estate properties, and related support activities in Poland.

Flawless balance sheet with solid track record and pays a dividend.

Similar Companies

Market Insights

Community Narratives