- Belgium

- /

- Electronic Equipment and Components

- /

- ENXTBR:BAR

European Dividend Stocks To Enhance Your Portfolio

Reviewed by Simply Wall St

Amid a backdrop of fluctuating economic indicators and geopolitical tensions, European markets have shown resilience, with the pan-European STOXX Europe 600 Index recently ending higher due to optimism surrounding potential trade deals. As investors navigate these complex conditions, dividend stocks can offer a stable income stream and enhance portfolio diversification, making them an attractive option in today's market environment.

Top 10 Dividend Stocks In Europe

| Name | Dividend Yield | Dividend Rating |

| Zurich Insurance Group (SWX:ZURN) | 4.46% | ★★★★★★ |

| Rubis (ENXTPA:RUI) | 7.18% | ★★★★★★ |

| OVB Holding (XTRA:O4B) | 4.76% | ★★★★★★ |

| Julius Bär Gruppe (SWX:BAER) | 4.76% | ★★★★★★ |

| Holcim (SWX:HOLN) | 4.99% | ★★★★★★ |

| HEXPOL (OM:HPOL B) | 4.62% | ★★★★★★ |

| ERG (BIT:ERG) | 5.40% | ★★★★★★ |

| Bredband2 i Skandinavien (OM:BRE2) | 4.15% | ★★★★★★ |

| Banque Cantonale Vaudoise (SWX:BCVN) | 4.65% | ★★★★★★ |

| Allianz (XTRA:ALV) | 4.50% | ★★★★★★ |

Click here to see the full list of 231 stocks from our Top European Dividend Stocks screener.

Here we highlight a subset of our preferred stocks from the screener.

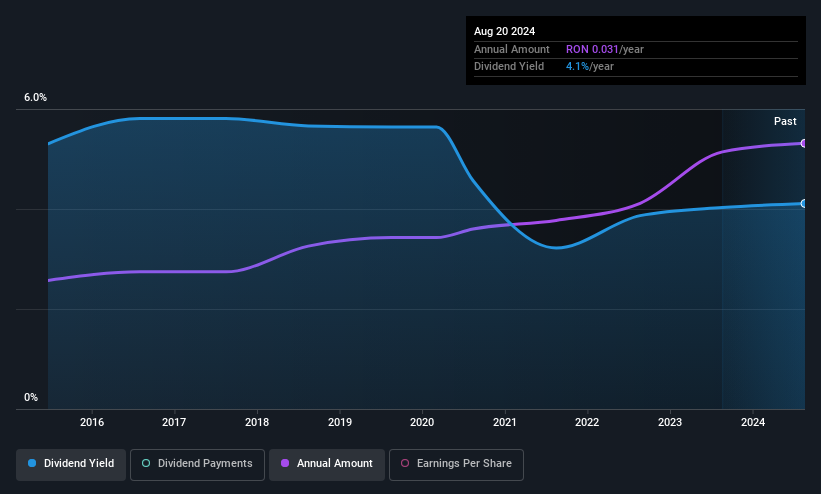

Biofarm (BVB:BIO)

Simply Wall St Dividend Rating: ★★★★★☆

Overview: Biofarm S.A. is a Romanian company that manufactures and sells medicines, with a market cap of RON882.89 million.

Operations: Biofarm S.A. generates its revenue primarily from the Pharmaceuticals segment, which accounts for RON310.33 million.

Dividend Yield: 3.5%

Biofarm's dividend yield of 3.46% is modest compared to top dividend payers in Romania, but its low payout ratio of 35.5% ensures dividends are well-covered by earnings and cash flows (48.4%). The company has consistently increased dividends over the past decade with little volatility, reflecting stability and reliability. Recent earnings growth supports this sustainability, with Q1 sales rising to RON 95.08 million from RON 71.52 million year-on-year, boosting net income significantly.

- Click here and access our complete dividend analysis report to understand the dynamics of Biofarm.

- Our valuation report here indicates Biofarm may be undervalued.

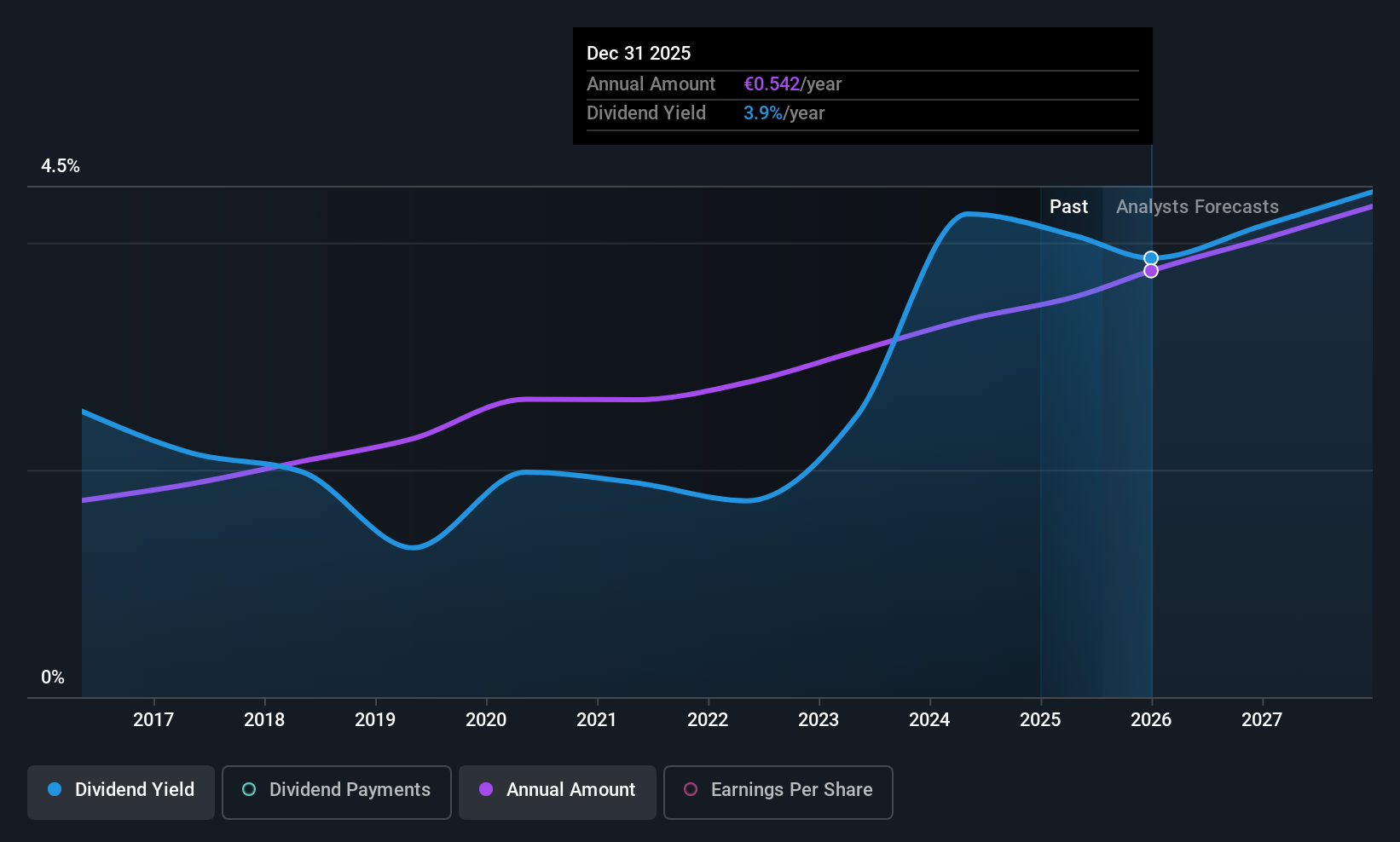

Barco (ENXTBR:BAR)

Simply Wall St Dividend Rating: ★★★★★☆

Overview: Barco NV, along with its subsidiaries, develops visualization solutions and collaboration and networking technologies for the entertainment, enterprise, and healthcare markets across the Americas, Europe, the Middle East, Africa, and Asia-Pacific with a market cap of €1.20 billion.

Operations: Barco's revenue segments comprise €254.08 million from Enterprise, €273.19 million from Healthcare, and €419.32 million from Entertainment.

Dividend Yield: 3.6%

Barco's dividend yield of 3.58% is modest relative to Belgium's top payers, but its payout ratio of 72.1% indicates dividends are well-covered by earnings and cash flows (42.5%). The company has consistently increased dividends over the past decade with stability, despite recent share price volatility. Recent earnings show improvement, with a significant rise in net income to €23.34 million for H1 2025, supporting dividend sustainability amidst strategic expansions like the HDR by Barco rollout in Europe and the U.S.

- Navigate through the intricacies of Barco with our comprehensive dividend report here.

- Upon reviewing our latest valuation report, Barco's share price might be too pessimistic.

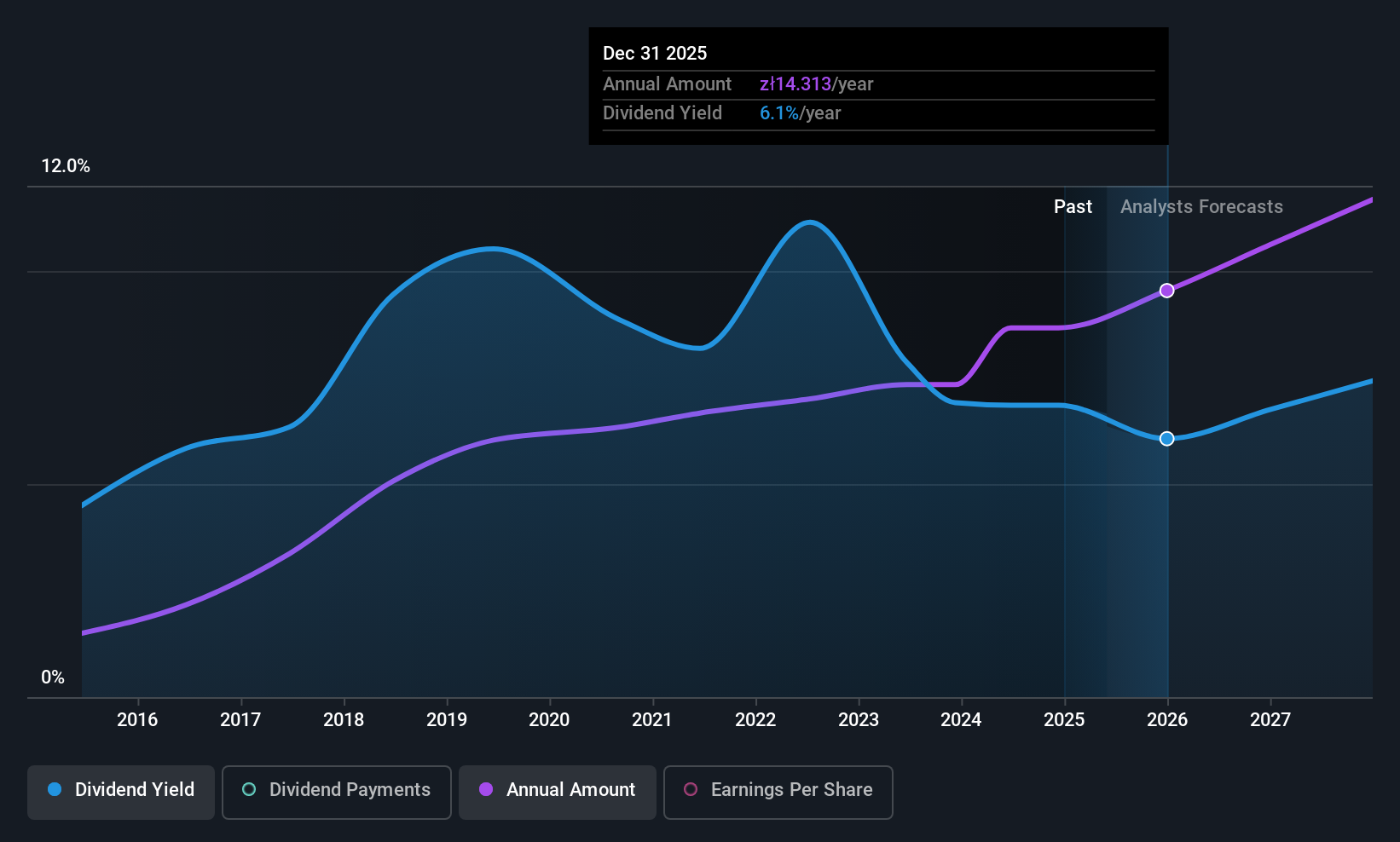

Dom Development (WSE:DOM)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Dom Development S.A., with a market cap of PLN6.28 billion, operates in Poland through its subsidiaries, focusing on the development and sale of residential and commercial real estate properties along with related support activities.

Operations: Dom Development S.A. generates revenue primarily from its Home Builders - Residential / Commercial segment, which accounts for PLN3.20 billion.

Dividend Yield: 5.3%

Dom Development's dividend yield of 5.34% falls short of Poland's top payers, with a high cash payout ratio (103.3%) indicating dividends are not well-covered by free cash flows, though earnings coverage is reasonable at a 65% payout ratio. The company has maintained stable and reliable dividend growth over the past decade despite these challenges. Recent Q1 2025 results show improved financial performance, with net income rising to PLN 148.37 million from PLN 137.23 million year-on-year, potentially supporting future payouts.

- Click to explore a detailed breakdown of our findings in Dom Development's dividend report.

- Our comprehensive valuation report raises the possibility that Dom Development is priced lower than what may be justified by its financials.

Where To Now?

- Click here to access our complete index of 231 Top European Dividend Stocks.

- Have you diversified into these companies? Leverage the power of Simply Wall St's portfolio to keep a close eye on market movements affecting your investments.

- Unlock the power of informed investing with Simply Wall St, your free guide to navigating stock markets worldwide.

Curious About Other Options?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Barco might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About ENXTBR:BAR

Barco

Develops visualization solutions, and collaboration and networking technologies for the entertainment, enterprise, and healthcare markets in the Americas, Europe, the Middle East, Africa, and the Asia-Pacific.

Solid track record with excellent balance sheet and pays a dividend.

Similar Companies

Market Insights

Community Narratives