- Poland

- /

- Consumer Durables

- /

- WSE:ADX

Further Upside For Adatex S.A. (WSE:ADX) Shares Could Introduce Price Risks After 124% Bounce

Adatex S.A. (WSE:ADX) shareholders have had their patience rewarded with a 124% share price jump in the last month. The last 30 days bring the annual gain to a very sharp 49%.

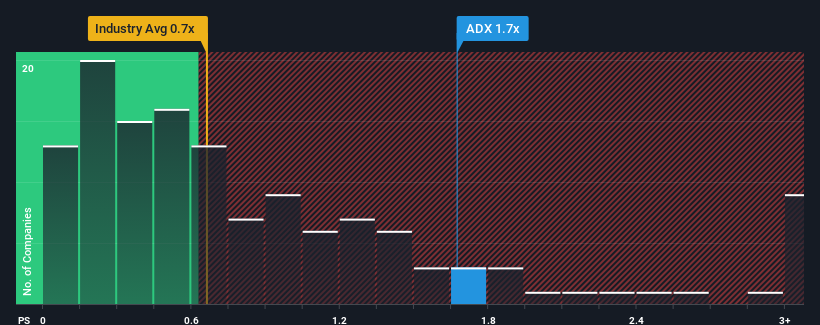

Even after such a large jump in price, there still wouldn't be many who think Adatex's price-to-sales (or "P/S") ratio of 1.7x is worth a mention when the median P/S in Poland's Consumer Durables industry is similar at about 1.4x. While this might not raise any eyebrows, if the P/S ratio is not justified investors could be missing out on a potential opportunity or ignoring looming disappointment.

Check out our latest analysis for Adatex

What Does Adatex's Recent Performance Look Like?

Recent times have been quite advantageous for Adatex as its revenue has been rising very briskly. It might be that many expect the strong revenue performance to wane, which has kept the share price, and thus the P/S ratio, from rising. Those who are bullish on Adatex will be hoping that this isn't the case, so that they can pick up the stock at a lower valuation.

We don't have analyst forecasts, but you can see how recent trends are setting up the company for the future by checking out our free report on Adatex's earnings, revenue and cash flow.What Are Revenue Growth Metrics Telling Us About The P/S?

The only time you'd be comfortable seeing a P/S like Adatex's is when the company's growth is tracking the industry closely.

Taking a look back first, we see that the company grew revenue by an impressive 82% last year. However, the latest three year period hasn't been as great in aggregate as it didn't manage to provide any growth at all. Therefore, it's fair to say that revenue growth has been inconsistent recently for the company.

Weighing the recent medium-term upward revenue trajectory against the broader industry's one-year forecast for contraction of 5.6% shows it's a great look while it lasts.

In light of this, it's peculiar that Adatex's P/S sits in line with the majority of other companies. Apparently some shareholders believe the recent performance is at its limits and have been accepting lower selling prices.

The Final Word

Adatex appears to be back in favour with a solid price jump bringing its P/S back in line with other companies in the industry We'd say the price-to-sales ratio's power isn't primarily as a valuation instrument but rather to gauge current investor sentiment and future expectations.

Our examination of Adatex revealed its growing revenue over the medium-term hasn't helped elevate its P/S above that of the industry, which is surprising given the industry is set to shrink. There could be some unobserved threats to revenue preventing the P/S ratio from outpacing the industry much like its revenue performance. One major risk is whether its revenue trajectory can keep outperforming under these tough industry conditions. At least the risk of a price drop looks to be subdued, but investors seem to think future revenue could see some volatility.

Before you settle on your opinion, we've discovered 4 warning signs for Adatex (1 is a bit unpleasant!) that you should be aware of.

If you're unsure about the strength of Adatex's business, why not explore our interactive list of stocks with solid business fundamentals for some other companies you may have missed.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About WSE:ADX

Adatex

Develops and sells multi-family, service, and commercial buildings in Poland.

Slight risk with mediocre balance sheet.

Market Insights

Community Narratives