- Poland

- /

- Professional Services

- /

- WSE:TXN

The Tax-Net (WSE:TXN) Share Price Is Up 86% And Shareholders Are Holding On

While Tax-Net S.A. (WSE:TXN) shareholders are probably generally happy, the stock hasn't had particularly good run recently, with the share price falling 16% in the last quarter. But over three years, the returns would have left most investors smiling In the last three years the share price is up, 86%: better than the market.

View our latest analysis for Tax-Net

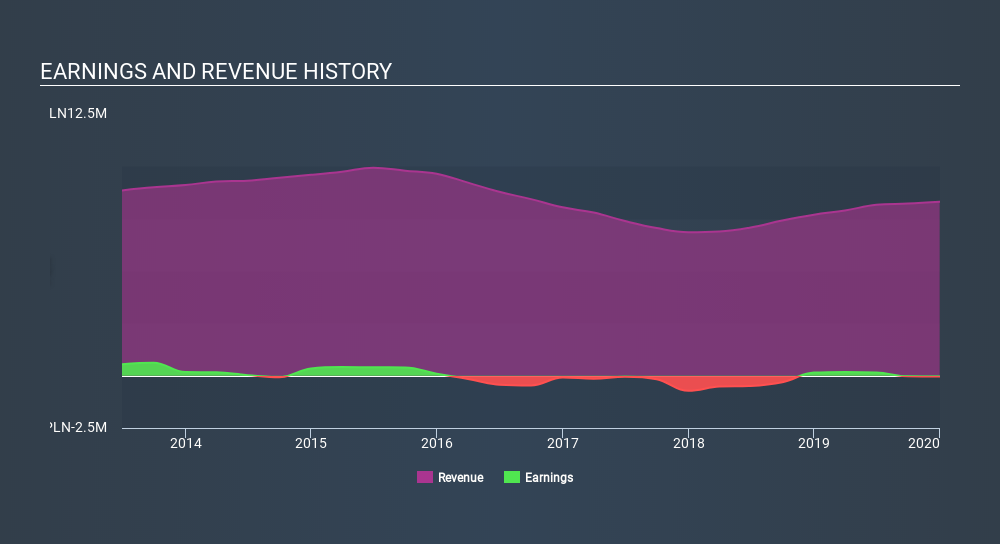

Given that Tax-Net didn't make a profit in the last twelve months, we'll focus on revenue growth to form a quick view of its business development. When a company doesn't make profits, we'd generally expect to see good revenue growth. As you can imagine, fast revenue growth, when maintained, often leads to fast profit growth.

In the last 3 years Tax-Net saw its revenue grow at 3.4% per year. That's not a very high growth rate considering it doesn't make profits. The modest growth is probably broadly reflected in the share price, which is up 23%, per year over 3 years. The real question is when the business will generate profits, and how quickly they will grow. In this sort of situation it can be worth putting the stock on your watchlist. If it can become profitable, then even moderate revenue growth could grow profits quickly.

You can see below how earnings and revenue have changed over time (discover the exact values by clicking on the image).

Take a more thorough look at Tax-Net's financial health with this free report on its balance sheet.

A Different Perspective

We're pleased to report that Tax-Net shareholders have received a total shareholder return of 26% over one year. Notably the five-year annualised TSR loss of 4.0% per year compares very unfavourably with the recent share price performance. The long term loss makes us cautious, but the short term TSR gain certainly hints at a brighter future. I find it very interesting to look at share price over the long term as a proxy for business performance. But to truly gain insight, we need to consider other information, too. For example, we've discovered 5 warning signs for Tax-Net (2 are potentially serious!) that you should be aware of before investing here.

If you like to buy stocks alongside management, then you might just love this free list of companies. (Hint: insiders have been buying them).

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on PL exchanges.

If you spot an error that warrants correction, please contact the editor at editorial-team@simplywallst.com. This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. Simply Wall St has no position in the stocks mentioned.

We aim to bring you long-term focused research analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Thank you for reading.

About WSE:TXN

Tax-Net

Provides accounting and tax financial advisory services in Poland.

Flawless balance sheet average dividend payer.

Market Insights

Community Narratives