- Poland

- /

- Commercial Services

- /

- WSE:DBE

Investors Appear Satisfied With DB Energy S.A.'s (WSE:DBE) Prospects As Shares Rocket 29%

DB Energy S.A. (WSE:DBE) shareholders would be excited to see that the share price has had a great month, posting a 29% gain and recovering from prior weakness. But not all shareholders will be feeling jubilant, since the share price is still down a very disappointing 35% in the last twelve months.

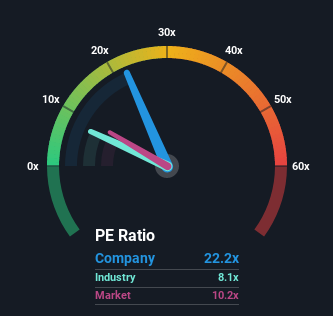

After such a large jump in price, DB Energy may be sending very bearish signals at the moment with a price-to-earnings (or "P/E") ratio of 22.2x, since almost half of all companies in Poland have P/E ratios under 10x and even P/E's lower than 5x are not unusual. Although, it's not wise to just take the P/E at face value as there may be an explanation why it's so lofty.

DB Energy has been doing a good job lately as it's been growing earnings at a solid pace. One possibility is that the P/E is high because investors think this respectable earnings growth will be enough to outperform the broader market in the near future. You'd really hope so, otherwise you're paying a pretty hefty price for no particular reason.

Check out our latest analysis for DB Energy

Does Growth Match The High P/E?

The only time you'd be truly comfortable seeing a P/E as steep as DB Energy's is when the company's growth is on track to outshine the market decidedly.

Taking a look back first, we see that the company grew earnings per share by an impressive 18% last year. The strong recent performance means it was also able to grow EPS by 305% in total over the last three years. Therefore, it's fair to say the earnings growth recently has been superb for the company.

Weighing the recent medium-term upward earnings trajectory against the broader market's one-year forecast for contraction of 0.08% shows it's a great look while it lasts.

With this information, we can see why DB Energy is trading at a high P/E compared to the market. Investors are willing to pay more for a stock they hope will buck the trend of the broader market going backwards. However, its current earnings trajectory will be very difficult to maintain against the headwinds other companies are facing at the moment.

The Bottom Line On DB Energy's P/E

The strong share price surge has got DB Energy's P/E rushing to great heights as well. Using the price-to-earnings ratio alone to determine if you should sell your stock isn't sensible, however it can be a practical guide to the company's future prospects.

As we suspected, our examination of DB Energy revealed its growing earnings over the medium-term are contributing to its high P/E, given the market is set to shrink. At this stage investors feel the potential for a deterioration in earnings isn't great enough to justify a lower P/E ratio. We still remain cautious about the company's ability to stay its recent course and swim against the current of the broader market turmoil. Otherwise, it's hard to see the share price falling strongly in the near future if its earnings performance persists.

Plus, you should also learn about these 3 warning signs we've spotted with DB Energy (including 1 which is significant).

It's important to make sure you look for a great company, not just the first idea you come across. So take a peek at this free list of interesting companies with strong recent earnings growth (and a P/E ratio below 20x).

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About WSE:DBE

Low with imperfect balance sheet.

Market Insights

Community Narratives