- Poland

- /

- Professional Services

- /

- WSE:BFT

Benefit Systems' (WSE:BFT) Anemic Earnings Might Be Worse Than You Think

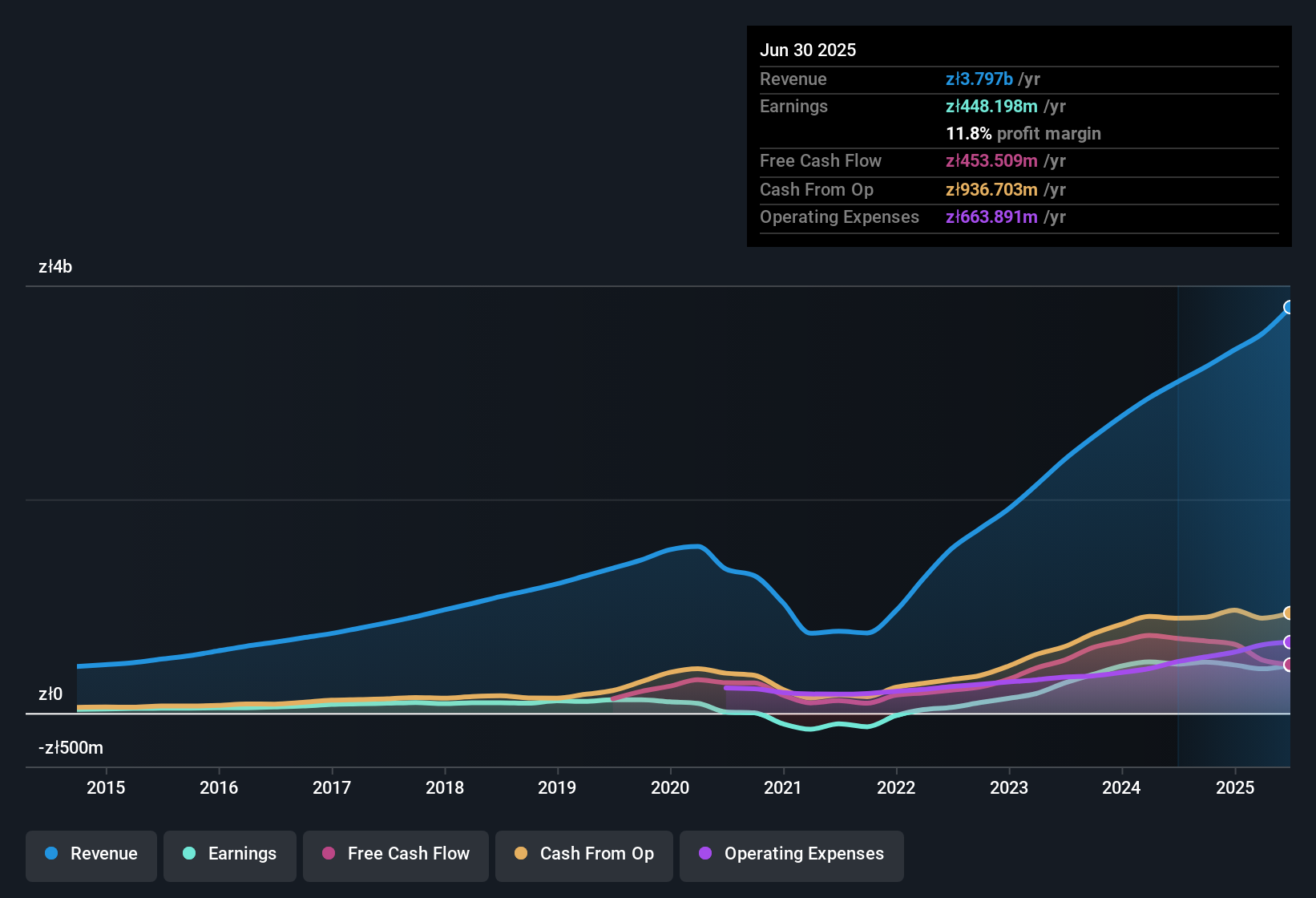

The subdued market reaction suggests that Benefit Systems S.A.'s (WSE:BFT) recent earnings didn't contain any surprises. Our analysis suggests that along with soft profit numbers, investors should be aware of some other underlying weaknesses in the numbers.

One essential aspect of assessing earnings quality is to look at how much a company is diluting shareholders. In fact, Benefit Systems increased the number of shares on issue by 11% over the last twelve months by issuing new shares. As a result, its net income is now split between a greater number of shares. Per share metrics like EPS help us understand how much actual shareholders are benefitting from the company's profits, while the net income level gives us a better view of the company's absolute size. You can see a chart of Benefit Systems' EPS by clicking here.

A Look At The Impact Of Benefit Systems' Dilution On Its Earnings Per Share (EPS)

Benefit Systems has improved its profit over the last three years, with an annualized gain of 742% in that time. In comparison, earnings per share only gained 714% over the same period. Net income was down 2.3% over the last twelve months. But the EPS result was even worse, with the company recording a decline of 4.7%. So you can see that the dilution has had a bit of an impact on shareholders.

In the long term, if Benefit Systems' earnings per share can increase, then the share price should too. However, if its profit increases while its earnings per share stay flat (or even fall) then shareholders might not see much benefit. For the ordinary retail shareholder, EPS is a great measure to check your hypothetical "share" of the company's profit.

That might leave you wondering what analysts are forecasting in terms of future profitability. Luckily, you can click here to see an interactive graph depicting future profitability, based on their estimates.

Our Take On Benefit Systems' Profit Performance

Benefit Systems issued shares during the year, and that means its EPS performance lags its net income growth. Therefore, it seems possible to us that Benefit Systems' true underlying earnings power is actually less than its statutory profit. But the good news is that its EPS growth over the last three years has been very impressive. At the end of the day, it's essential to consider more than just the factors above, if you want to understand the company properly. With this in mind, we wouldn't consider investing in a stock unless we had a thorough understanding of the risks. Every company has risks, and we've spotted 1 warning sign for Benefit Systems you should know about.

Today we've zoomed in on a single data point to better understand the nature of Benefit Systems' profit. But there is always more to discover if you are capable of focussing your mind on minutiae. For example, many people consider a high return on equity as an indication of favorable business economics, while others like to 'follow the money' and search out stocks that insiders are buying. So you may wish to see this free collection of companies boasting high return on equity, or this list of stocks with high insider ownership.

Valuation is complex, but we're here to simplify it.

Discover if Benefit Systems might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About WSE:BFT

Benefit Systems

Provides non-pay employee benefits solutions in Poland, Czech Republic, Slovakia, Bulgaria, Croatia, and Turkey.

High growth potential and good value.

Market Insights

Community Narratives