For beginners, it can seem like a good idea (and an exciting prospect) to buy a company that tells a good story to investors, even if it currently lacks a track record of revenue and profit. Unfortunately, these high risk investments often have little probability of ever paying off, and many investors pay a price to learn their lesson. While a well funded company may sustain losses for years, it will need to generate a profit eventually, or else investors will move on and the company will wither away.

In contrast to all that, many investors prefer to focus on companies like Mirbud (WSE:MRB), which has not only revenues, but also profits. Even if this company is fairly valued by the market, investors would agree that generating consistent profits will continue to provide Mirbud with the means to add long-term value to shareholders.

Check out the opportunities and risks within the PL Construction industry.

Mirbud's Improving Profits

Over the last three years, Mirbud has grown earnings per share (EPS) at as impressive rate from a relatively low point, resulting in a three year percentage growth rate that isn't particularly indicative of expected future performance. As a result, we'll zoom in on growth over the last year, instead. Mirbud's EPS has risen over the last 12 months, growing from zł1.06 to zł1.28. That's a 21% gain; respectable growth in the broader scheme of things.

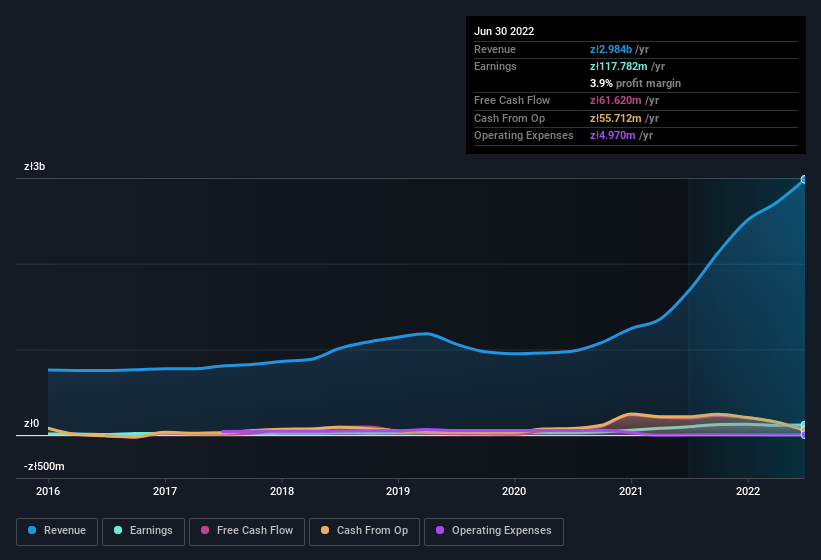

It's often helpful to take a look at earnings before interest and tax (EBIT) margins, as well as revenue growth, to get another take on the quality of the company's growth. While Mirbud did well to grow revenue over the last year, EBIT margins were dampened at the same time. If EBIT margins are able to stay balanced and this revenue growth continues, then we should see brighter days ahead.

The chart below shows how the company's bottom and top lines have progressed over time. To see the actual numbers, click on the chart.

Mirbud isn't a huge company, given its market capitalisation of zł332m. That makes it extra important to check on its balance sheet strength.

Are Mirbud Insiders Aligned With All Shareholders?

Many consider high insider ownership to be a strong sign of alignment between the leaders of a company and the ordinary shareholders. So as you can imagine, the fact that Mirbud insiders own a significant number of shares certainly is appealing. Owning 45% of the company, insiders have plenty riding on the performance of the the share price. This should be a welcoming sign for investors because it suggests that the people making the decisions are also impacted by their choices. With that sort of holding, insiders have about zł151m riding on the stock, at current prices. That's nothing to sneeze at!

Is Mirbud Worth Keeping An Eye On?

One positive for Mirbud is that it is growing EPS. That's nice to see. For those who are looking for a little more than this, the high level of insider ownership enhances our enthusiasm for this growth. These two factors are a huge highlight for the company which should be a strong contender your watchlists. Still, you should learn about the 3 warning signs we've spotted with Mirbud.

The beauty of investing is that you can invest in almost any company you want. But if you prefer to focus on stocks that have demonstrated insider buying, here is a list of companies with insider buying in the last three months.

Please note the insider transactions discussed in this article refer to reportable transactions in the relevant jurisdiction.

Mobile Infrastructure for Defense and Disaster

The next wave in robotics isn't humanoid. Its fully autonomous towers delivering 5G, ISR, and radar in under 30 minutes, anywhere.

Get the investor briefing before the next round of contracts

Sponsored On Behalf of CiTechNew: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About WSE:MRB

Mirbud

Operates as a general contractor in the construction industry in Poland.

Excellent balance sheet and slightly overvalued.

Market Insights

Weekly Picks

Early mover in a fast growing industry. Likely to experience share price volatility as they scale

A case for CA$31.80 (undiluted), aka 8,616% upside from CA$0.37 (an 86 bagger!).

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Recently Updated Narratives

Airbnb Stock: Platform Growth in a World of Saturation and Scrutiny

Clarivate Stock: When Data Becomes the Backbone of Innovation and Law

Adobe Stock: AI-Fueled ARR Growth Pushes Guidance Higher, But Cost Pressures Loom

Popular Narratives

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026

MicroVision will explode future revenue by 380.37% with a vision towards success

Trending Discussion