- Poland

- /

- Industrials

- /

- WSE:GKI

Grupa Kapitalowa IMMOBILE (WSE:GKI) Share Prices Have Dropped 30% In The Last Three Years

It's nice to see the Grupa Kapitalowa IMMOBILE S.A. (WSE:GKI) share price up 14% in a week. But that cannot eclipse the less-than-impressive returns over the last three years. After all, the share price is down 30% in the last three years, significantly under-performing the market.

View our latest analysis for Grupa Kapitalowa IMMOBILE

Because Grupa Kapitalowa IMMOBILE made a loss in the last twelve months, we think the market is probably more focussed on revenue and revenue growth, at least for now. Generally speaking, companies without profits are expected to grow revenue every year, and at a good clip. Some companies are willing to postpone profitability to grow revenue faster, but in that case one does expect good top-line growth.

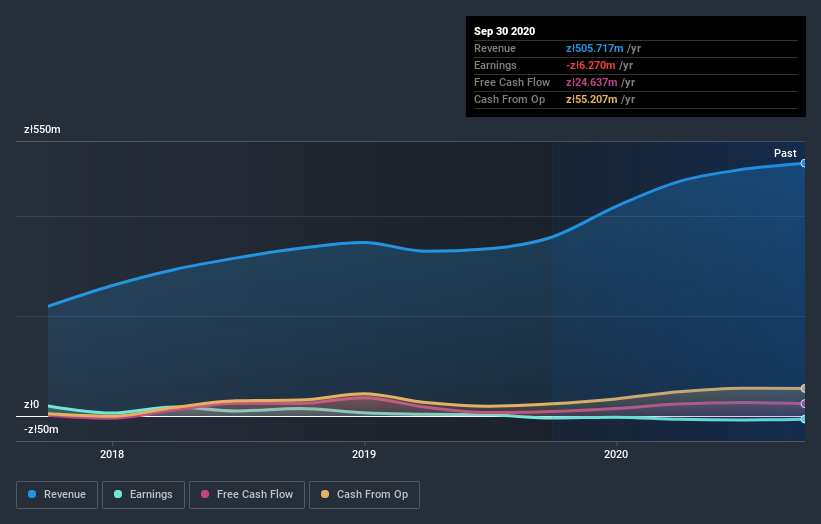

In the last three years, Grupa Kapitalowa IMMOBILE saw its revenue grow by 24% per year, compound. That is faster than most pre-profit companies. While its revenue increased, the share price dropped at a rate of 9% per year. That seems like an unlucky result for holders. It's possible that the prior share price assumed unrealistically high future growth. Before considering a purchase, investors should consider how quickly expenses are growing, relative to revenue.

The company's revenue and earnings (over time) are depicted in the image below (click to see the exact numbers).

You can see how its balance sheet has strengthened (or weakened) over time in this free interactive graphic.

What About Dividends?

As well as measuring the share price return, investors should also consider the total shareholder return (TSR). Whereas the share price return only reflects the change in the share price, the TSR includes the value of dividends (assuming they were reinvested) and the benefit of any discounted capital raising or spin-off. So for companies that pay a generous dividend, the TSR is often a lot higher than the share price return. As it happens, Grupa Kapitalowa IMMOBILE's TSR for the last 3 years was -26%, which exceeds the share price return mentioned earlier. This is largely a result of its dividend payments!

A Different Perspective

We're pleased to report that Grupa Kapitalowa IMMOBILE shareholders have received a total shareholder return of 3.8% over one year. Of course, that includes the dividend. That certainly beats the loss of about 0.6% per year over the last half decade. The long term loss makes us cautious, but the short term TSR gain certainly hints at a brighter future. I find it very interesting to look at share price over the long term as a proxy for business performance. But to truly gain insight, we need to consider other information, too. Even so, be aware that Grupa Kapitalowa IMMOBILE is showing 3 warning signs in our investment analysis , and 2 of those are potentially serious...

Of course, you might find a fantastic investment by looking elsewhere. So take a peek at this free list of companies we expect will grow earnings.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on PL exchanges.

If you’re looking to trade Grupa Kapitalowa IMMOBILE, open an account with the lowest-cost* platform trusted by professionals, Interactive Brokers. Their clients from over 200 countries and territories trade stocks, options, futures, forex, bonds and funds worldwide from a single integrated account. Promoted

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

About WSE:GKI

Grupa Kapitalowa IMMOBILE

Operates in the industry, construction and development, hotel industry, clothing industry, and automation and power engineering in Poland and internationally.

Solid track record low.

Market Insights

Community Narratives