Optimistic Investors Push Feerum S.A. (WSE:FEE) Shares Up 29% But Growth Is Lacking

Feerum S.A. (WSE:FEE) shareholders would be excited to see that the share price has had a great month, posting a 29% gain and recovering from prior weakness. The last 30 days bring the annual gain to a very sharp 84%.

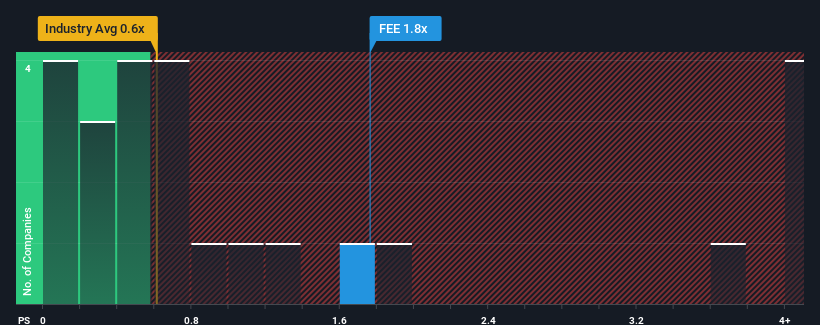

Following the firm bounce in price, when almost half of the companies in Poland's Machinery industry have price-to-sales ratios (or "P/S") below 0.6x, you may consider Feerum as a stock probably not worth researching with its 1.8x P/S ratio. However, the P/S might be high for a reason and it requires further investigation to determine if it's justified.

Our free stock report includes 3 warning signs investors should be aware of before investing in Feerum. Read for free now.Check out our latest analysis for Feerum

What Does Feerum's P/S Mean For Shareholders?

For example, consider that Feerum's financial performance has been poor lately as its revenue has been in decline. One possibility is that the P/S is high because investors think the company will still do enough to outperform the broader industry in the near future. However, if this isn't the case, investors might get caught out paying too much for the stock.

Although there are no analyst estimates available for Feerum, take a look at this free data-rich visualisation to see how the company stacks up on earnings, revenue and cash flow.Do Revenue Forecasts Match The High P/S Ratio?

Feerum's P/S ratio would be typical for a company that's expected to deliver solid growth, and importantly, perform better than the industry.

Retrospectively, the last year delivered a frustrating 7.4% decrease to the company's top line. This means it has also seen a slide in revenue over the longer-term as revenue is down 45% in total over the last three years. Accordingly, shareholders would have felt downbeat about the medium-term rates of revenue growth.

In contrast to the company, the rest of the industry is expected to grow by 0.7% over the next year, which really puts the company's recent medium-term revenue decline into perspective.

With this information, we find it concerning that Feerum is trading at a P/S higher than the industry. It seems most investors are ignoring the recent poor growth rate and are hoping for a turnaround in the company's business prospects. There's a very good chance existing shareholders are setting themselves up for future disappointment if the P/S falls to levels more in line with the recent negative growth rates.

What We Can Learn From Feerum's P/S?

Feerum's P/S is on the rise since its shares have risen strongly. While the price-to-sales ratio shouldn't be the defining factor in whether you buy a stock or not, it's quite a capable barometer of revenue expectations.

We've established that Feerum currently trades on a much higher than expected P/S since its recent revenues have been in decline over the medium-term. When we see revenue heading backwards and underperforming the industry forecasts, we feel the possibility of the share price declining is very real, bringing the P/S back into the realm of reasonability. Unless the the circumstances surrounding the recent medium-term improve, it wouldn't be wrong to expect a a difficult period ahead for the company's shareholders.

It's always necessary to consider the ever-present spectre of investment risk. We've identified 3 warning signs with Feerum (at least 1 which is a bit concerning), and understanding them should be part of your investment process.

If strong companies turning a profit tickle your fancy, then you'll want to check out this free list of interesting companies that trade on a low P/E (but have proven they can grow earnings).

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About WSE:FEE

Feerum

Engages in the designing and building of various drying and storage facilities.

Excellent balance sheet with limited growth.

Market Insights

Community Narratives