- Poland

- /

- Electrical

- /

- WSE:APS

Here's Why Automatyka-Pomiary-Sterowanie (WSE:APS) Has Caught The Eye Of Investors

Investors are often guided by the idea of discovering 'the next big thing', even if that means buying 'story stocks' without any revenue, let alone profit. Unfortunately, these high risk investments often have little probability of ever paying off, and many investors pay a price to learn their lesson. Loss-making companies are always racing against time to reach financial sustainability, so investors in these companies may be taking on more risk than they should.

Despite being in the age of tech-stock blue-sky investing, many investors still adopt a more traditional strategy; buying shares in profitable companies like Automatyka-Pomiary-Sterowanie (WSE:APS). While profit isn't the sole metric that should be considered when investing, it's worth recognising businesses that can consistently produce it.

Check out our latest analysis for Automatyka-Pomiary-Sterowanie

How Quickly Is Automatyka-Pomiary-Sterowanie Increasing Earnings Per Share?

If a company can keep growing earnings per share (EPS) long enough, its share price should eventually follow. So it makes sense that experienced investors pay close attention to company EPS when undertaking investment research. It certainly is nice to see that Automatyka-Pomiary-Sterowanie has managed to grow EPS by 20% per year over three years. If the company can sustain that sort of growth, we'd expect shareholders to come away satisfied.

Top-line growth is a great indicator that growth is sustainable, and combined with a high earnings before interest and taxation (EBIT) margin, it's a great way for a company to maintain a competitive advantage in the market. On the one hand, Automatyka-Pomiary-Sterowanie's EBIT margins fell over the last year, but on the other hand, revenue grew. If EBIT margins are able to stay balanced and this revenue growth continues, then we should see brighter days ahead.

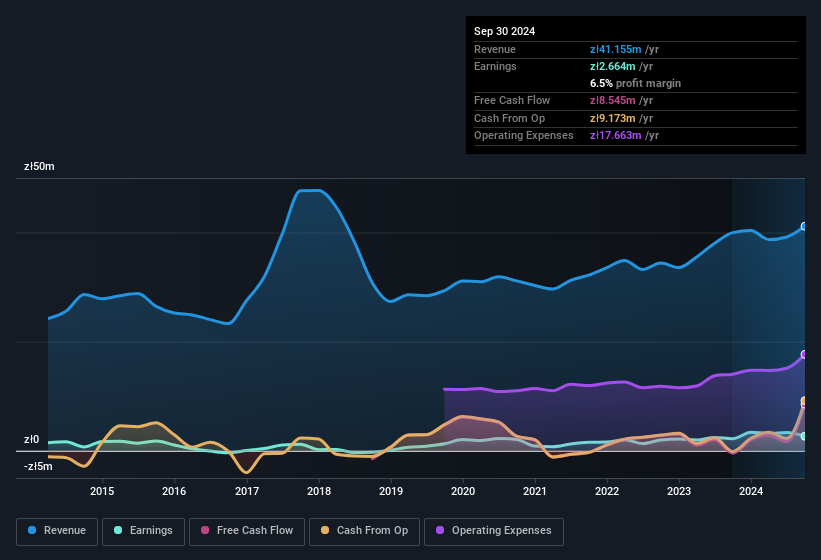

In the chart below, you can see how the company has grown earnings and revenue, over time. For finer detail, click on the image.

Since Automatyka-Pomiary-Sterowanie is no giant, with a market capitalisation of zł35m, you should definitely check its cash and debt before getting too excited about its prospects.

Are Automatyka-Pomiary-Sterowanie Insiders Aligned With All Shareholders?

Seeing insiders owning a large portion of the shares on issue is often a good sign. Their incentives will be aligned with the investors and there's less of a probability in a sudden sell-off that would impact the share price. So we're pleased to report that Automatyka-Pomiary-Sterowanie insiders own a meaningful share of the business. To be exact, company insiders hold 58% of the company, so their decisions have a significant impact on their investments. This makes it apparent they will be incentivised to plan for the long term - a positive for shareholders with a sit and hold strategy. Of course, Automatyka-Pomiary-Sterowanie is a very small company, with a market cap of only zł35m. So this large proportion of shares owned by insiders only amounts to zł20m. This isn't an overly large holding but it should still keep the insiders motivated to deliver the best outcomes for shareholders.

Is Automatyka-Pomiary-Sterowanie Worth Keeping An Eye On?

If you believe that share price follows earnings per share you should definitely be delving further into Automatyka-Pomiary-Sterowanie's strong EPS growth. With EPS growth rates like that, it's hardly surprising to see company higher-ups place confidence in the company through continuing to hold a significant investment. Fast growth and confident insiders should be enough to warrant further research, so it would seem that it's a good stock to follow. We don't want to rain on the parade too much, but we did also find 4 warning signs for Automatyka-Pomiary-Sterowanie (2 make us uncomfortable!) that you need to be mindful of.

While opting for stocks without growing earnings and absent insider buying can yield results, for investors valuing these key metrics, here is a carefully selected list of companies in PL with promising growth potential and insider confidence.

Please note the insider transactions discussed in this article refer to reportable transactions in the relevant jurisdiction.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About WSE:APS

Automatyka-Pomiary-Sterowanie

Provides various services in the fields of industrial automation and electrical works in Poland.

Flawless balance sheet with solid track record and pays a dividend.

Market Insights

Community Narratives

Recently Updated Narratives

Astor Enerji will surge with a fair value of $140.43 in the next 3 years

Proximus: The State-Backed Backup Plan with 7% Gross Yield and 15% Currency Upside.

A case for for IMPACT Silver Corp (TSXV:IPT) to reach USD $4.52 (CAD $6.16) in 2026 (23 bagger in 1 year) and USD $5.76 (CAD $7.89) by 2030

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026