Introducing Powszechna Kasa Oszczednosci Bank Polski Spólka Akcyjna (WSE:PKO), A Stock That Climbed 59% In The Last Year

If you want to compound wealth in the stock market, you can do so by buying an index fund. But if you pick the right individual stocks, you could make more than that. To wit, the Powszechna Kasa Oszczednosci Bank Polski Spólka Akcyjna (WSE:PKO) share price is 59% higher than it was a year ago, much better than the market return of around 31% (not including dividends) in the same period. That's a solid performance by our standards! On the other hand, longer term shareholders have had a tougher run, with the stock falling 5.9% in three years.

See our latest analysis for Powszechna Kasa Oszczednosci Bank Polski Spólka Akcyjna

In his essay The Superinvestors of Graham-and-Doddsville Warren Buffett described how share prices do not always rationally reflect the value of a business. One imperfect but simple way to consider how the market perception of a company has shifted is to compare the change in the earnings per share (EPS) with the share price movement.

During the last year Powszechna Kasa Oszczednosci Bank Polski Spólka Akcyjna saw its earnings per share (EPS) drop below zero. While some may see this as temporary, we're a skeptical bunch, and so we're a little surprised to see the share price go up. We might get a clue to explain the share price move by looking to other metrics.

Powszechna Kasa Oszczednosci Bank Polski Spólka Akcyjna's revenue actually dropped 52% over last year. So using a snapshot of key business metrics doesn't give us a good picture of why the market is bidding up the stock.

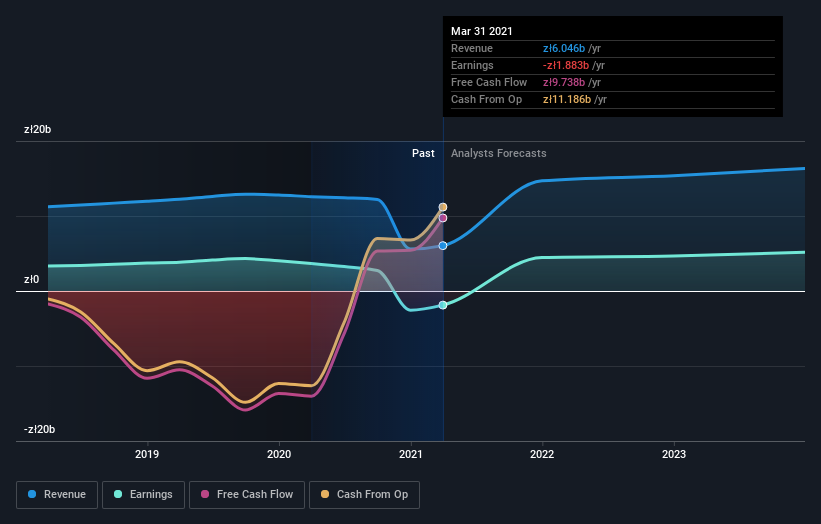

You can see below how earnings and revenue have changed over time (discover the exact values by clicking on the image).

Powszechna Kasa Oszczednosci Bank Polski Spólka Akcyjna is a well known stock, with plenty of analyst coverage, suggesting some visibility into future growth. You can see what analysts are predicting for Powszechna Kasa Oszczednosci Bank Polski Spólka Akcyjna in this interactive graph of future profit estimates.

A Different Perspective

It's good to see that Powszechna Kasa Oszczednosci Bank Polski Spólka Akcyjna has rewarded shareholders with a total shareholder return of 59% in the last twelve months. That's better than the annualised return of 10% over half a decade, implying that the company is doing better recently. Given the share price momentum remains strong, it might be worth taking a closer look at the stock, lest you miss an opportunity. You might want to assess this data-rich visualization of its earnings, revenue and cash flow.

If you like to buy stocks alongside management, then you might just love this free list of companies. (Hint: insiders have been buying them).

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on PL exchanges.

When trading Powszechna Kasa Oszczednosci Bank Polski Spólka Akcyjna or any other investment, use the platform considered by many to be the Professional's Gateway to the Worlds Market, Interactive Brokers. You get the lowest-cost* trading on stocks, options, futures, forex, bonds and funds worldwide from a single integrated account. Promoted

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

About WSE:PKO

Powszechna Kasa Oszczednosci Bank Polski Spólka Akcyjna

Provides various banking products and services in Poland and internationally.

Undervalued with excellent balance sheet and pays a dividend.