As European markets navigate a mixed landscape with the pan-European STOXX Europe 600 Index experiencing slight declines and major indexes showing varied performances, investors are keenly observing the implications of stable interest rates from the European Central Bank and near-target inflation levels. In this environment, identifying promising small-cap stocks that can thrive despite broader market fluctuations becomes crucial, as these companies often possess unique growth potential and resilience amidst economic shifts.

Top 10 Undiscovered Gems With Strong Fundamentals In Europe

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| Alantra Partners | NA | -6.09% | -33.39% | ★★★★★★ |

| Sparta | NA | nan | nan | ★★★★★☆ |

| Freetrailer Group | 0.01% | 22.96% | 31.56% | ★★★★★☆ |

| Evergent Investments | 3.82% | 10.46% | 23.17% | ★★★★★☆ |

| va-Q-tec | 43.54% | 8.03% | -34.33% | ★★★★★☆ |

| Zespól Elektrocieplowni Wroclawskich KOGENERACJA | 13.23% | 20.22% | 17.99% | ★★★★★☆ |

| Deutsche Balaton | 4.58% | -18.46% | -16.14% | ★★★★★☆ |

| VNV Global | 15.38% | -18.33% | -18.19% | ★★★★★☆ |

| ABG Sundal Collier Holding | 35.58% | -7.59% | -18.30% | ★★★★☆☆ |

| Practic | NA | 4.86% | 6.64% | ★★★★☆☆ |

Let's dive into some prime choices out of from the screener.

Caisse Régionale de Crédit Agricole du Morbihan (ENXTPA:CMO)

Simply Wall St Value Rating: ★★★★★★

Overview: Caisse Régionale de Crédit Agricole du Morbihan offers a range of banking products and services to diverse customer segments in France, including individuals, professionals, and local authorities, with a market capitalization of approximately €545.55 million.

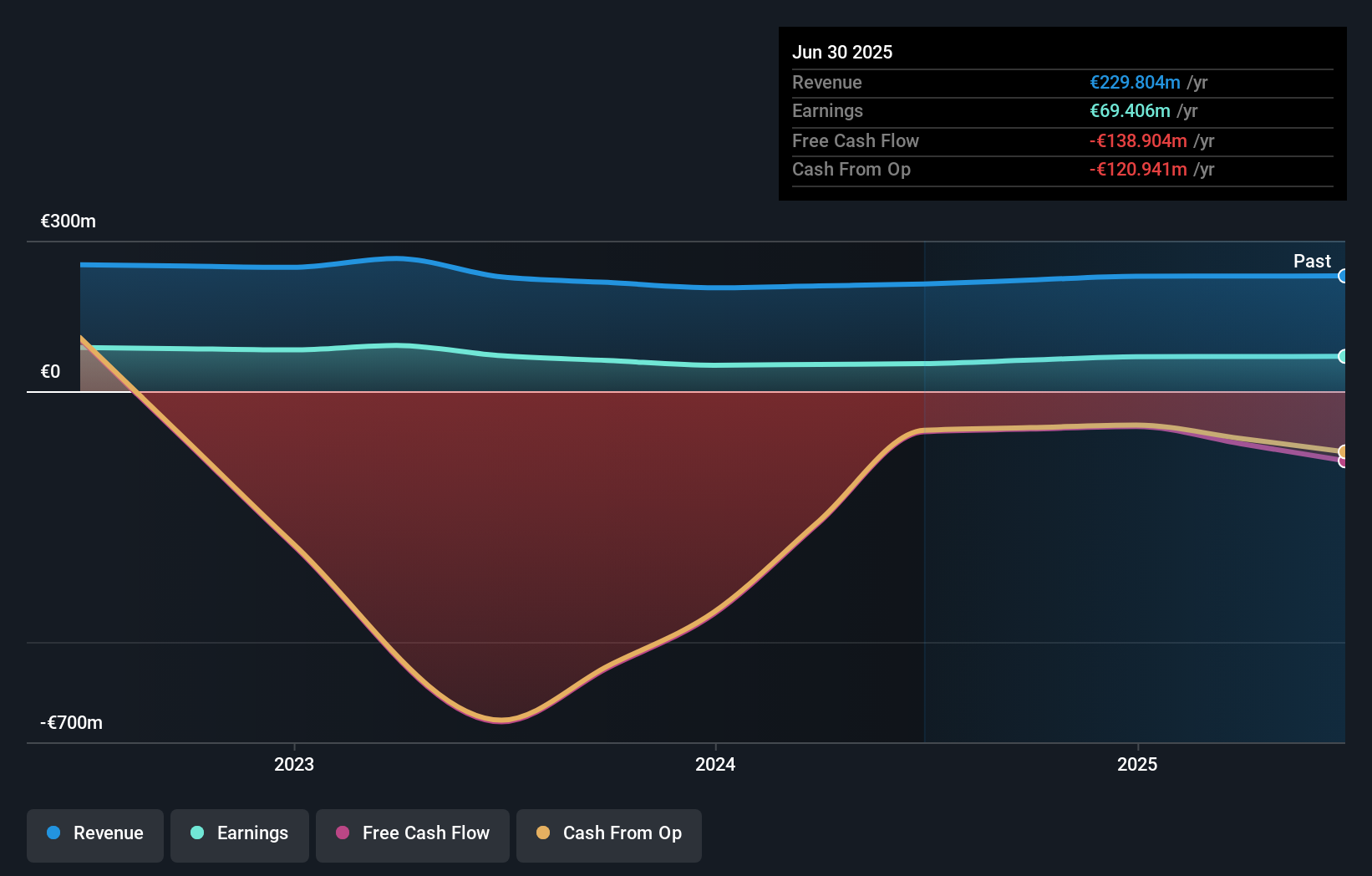

Operations: Caisse Régionale de Crédit Agricole du Morbihan generates revenue primarily from its retail banking segment, which accounts for approximately €229.80 million.

With €13.8B in total assets and €2.2B in equity, Caisse Régionale de Crédit Agricole du Morbihan stands out for its solid financial footing. The bank's reliance on low-risk funding sources, with 96% of liabilities from customer deposits, underscores its stability. Total deposits reach €11.1B against loans of €11.4B, indicating a robust lending position with an appropriate bad loan ratio of 1.8%. Earnings have surged by 26%, outpacing the industry average significantly and reflecting high-quality earnings performance despite recent share price volatility over the past three months.

Pexip Holding (OB:PEXIP)

Simply Wall St Value Rating: ★★★★★★

Overview: Pexip Holding ASA is a video technology company that offers a comprehensive video conferencing platform and digital infrastructure across the Americas, Europe, the Middle East, Africa, and the Asia Pacific, with a market capitalization of NOK6.56 billion.

Operations: Pexip generates revenue primarily from the sale of collaboration services, amounting to NOK1.19 billion. The company's financial performance is characterized by its focus on this core revenue stream within the video technology sector.

Pexip Holding, a nimble player in the video technology space, is capitalizing on the growing demand for secure video conferencing solutions. The company has strategically reduced its debt to equity ratio from 0.5% to 0.1% over five years, reflecting financial prudence. Its recent profitability and high-quality earnings are bolstered by strategic partnerships and AI enhancements. Despite facing stiff competition from larger firms, analysts forecast a promising annual revenue growth of 10.4%, with profit margins expected to rise from 14.8% to 19.9%. Recently, Pexip completed a share buyback of approximately NOK100 million for about 1.65% of its shares, signaling confidence in its valuation amidst market challenges and opportunities ahead.

Bank Ochrony Srodowiska (WSE:BOS)

Simply Wall St Value Rating: ★★★★☆☆

Overview: Bank Ochrony Srodowiska S.A. offers a range of banking products and services in Poland, with a market capitalization of PLN 1.14 billion.

Operations: The bank generates revenue primarily from its SME, Micro and Retail Division (PLN 269.05 million), followed by the Corporate Division (PLN 238.63 million) and Treasury and Investment Activity (PLN 257.63 million). Brokerage Activity contributes PLN 206.90 million to the overall revenue stream.

With total assets of PLN23.5B and equity at PLN2.3B, Bank Ochrony Srodowiska stands out with a price-to-earnings ratio of 10.4x, below the Polish market average. Its earnings surged by 49.8% last year, surpassing the industry growth rate of 17%. Despite having a high level of bad loans at 10.9%, the bank's funding is primarily low risk, with customer deposits making up 91% of liabilities. The allowance for bad loans is low at 75%, which might be concerning for some investors but reflects its strategy in managing credit risks effectively within its portfolio.

- Click here and access our complete health analysis report to understand the dynamics of Bank Ochrony Srodowiska.

Evaluate Bank Ochrony Srodowiska's historical performance by accessing our past performance report.

Key Takeaways

- Click through to start exploring the rest of the 321 European Undiscovered Gems With Strong Fundamentals now.

- Got skin in the game with these stocks? Elevate how you manage them by using Simply Wall St's portfolio, where intuitive tools await to help optimize your investment outcomes.

- Take control of your financial future using Simply Wall St, offering free, in-depth knowledge of international markets to every investor.

Looking For Alternative Opportunities?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Bank Ochrony Srodowiska might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About WSE:BOS

Bank Ochrony Srodowiska

Provides various banking products and services in Poland.

Solid track record with adequate balance sheet.

Market Insights

Community Narratives