Last Update 19 Dec 25

Fair value Increased 13%PEXIP: Future Outlook Will Balance Margin Gains With Higher Earnings Multiple Assumptions

Analysts have raised their price target on Pexip Holding to NOK 77.50 from NOK 68.33, citing slightly lower growth expectations, which are offset by improved profit margin assumptions and a higher anticipated future P/E multiple.

Valuation Changes

- Fair Value Estimate has risen moderately, from NOK 68.33 to NOK 77.50.

- Discount Rate is unchanged at 7.70 percent.

- Revenue Growth has been trimmed slightly, from 11.30 percent to about 11.11 percent.

- Net Profit Margin has increased modestly, from 23.57 percent to about 23.92 percent.

- Future P/E multiple has risen meaningfully, from about 22.3x to 25.0x, indicating higher expected valuation levels.

Key Takeaways

- Heightened demand for secure, customizable video solutions and interoperability is driving strong customer growth, revenue expansion, and improved recurring revenue mix for Pexip.

- Strategic partnerships, AI-driven enhancements, and advanced pricing models position Pexip for increased margins, operational leverage, and ongoing market momentum.

- Intensifying industry competition, technological advancements by larger players, and shifting customer preferences threaten Pexip's ability to sustain growth, profitability, and market relevance.

Catalysts

About Pexip Holding- A video technology company, provides end-to-end video conferencing platform and digital infrastructure in the Americas, Europe, the Middle East, Africa, and the Asia Pacific.

- Growing focus by governments and regulated industries on data sovereignty, privacy, and compliance is driving strong demand for Pexip's Secure and Custom solutions, as evidenced by robust ARR growth (27% YoY). This is likely to expand the addressable market and accelerate top-line revenue growth as geopolitical tensions and new regulatory frameworks boost the need for secure, on-premise, and customizable video communications.

- The sustained rise of remote and hybrid work, along with increasingly complex IT environments, is cementing multi-platform interoperability as a core requirement for large organizations. Pexip's unique integration capabilities and recent contract renewals with key tech partners support higher customer retention, growing recurring revenues, and an improving ARR mix.

- Pexip's growing pipeline and major contract wins with public sector and health care clients reflect long-term secular shifts toward enterprise-grade security and deployment flexibility. This tailwind is likely to result in continued strong net customer acquisition, supporting both revenue and earnings expansion.

- Enhanced partnership models and contract renegotiations-in particular, new variable pricing contracts with key partners-are expected to deliver higher revenues and gross margins over time, improving operational leverage and boosting net margins as volumes scale.

- Investment in interoperability and AI-driven product enhancements positions Pexip to capture upsell opportunities and respond to increasing client expectations for intelligent features. Expected launches and pipeline build-up for Google Meet and Teams Rooms on Android can drive incremental ARR growth and margin expansion in 2026 and beyond.

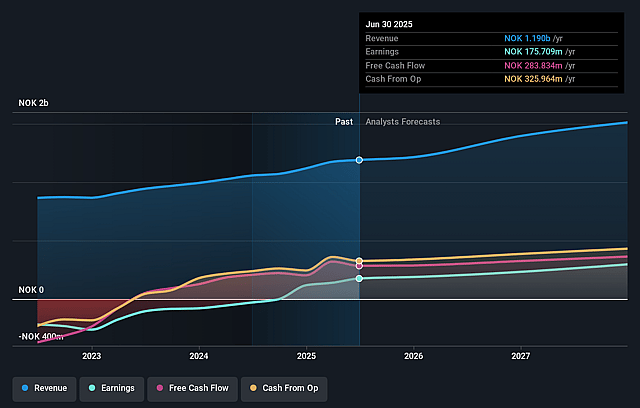

Pexip Holding Future Earnings and Revenue Growth

Assumptions

How have these above catalysts been quantified?- Analysts are assuming Pexip Holding's revenue will grow by 10.4% annually over the next 3 years.

- Analysts assume that profit margins will increase from 14.8% today to 19.9% in 3 years time.

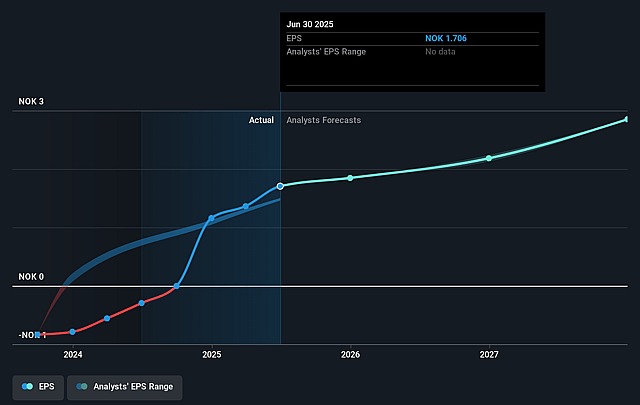

- Analysts expect earnings to reach NOK 318.9 million (and earnings per share of NOK 2.85) by about September 2028, up from NOK 175.7 million today.

- In order for the above numbers to justify the analysts price target, the company would need to trade at a PE ratio of 31.5x on those 2028 earnings, down from 37.4x today. This future PE is lower than the current PE for the NO Software industry at 36.9x.

- Analysts expect the number of shares outstanding to grow by 6.81% per year for the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 7.62%, as per the Simply Wall St company report.

Pexip Holding Future Earnings Per Share Growth

Risks

What could happen that would invalidate this narrative?- The rapid commoditization of video communication platforms, driven by increasing integration of similar tools into large, consolidated technology ecosystems (e.g., Microsoft Teams, Google Workspace), could intensify price competition and margin pressure, potentially limiting Pexip's ability to grow revenues and defend profitability over the long term.

- Reliance on continuous product differentiation in a highly competitive and evolving industry poses a risk-persistent difficulty distinguishing Pexip's offerings from those of larger players with greater resources may lead to increased customer churn and reduced pricing power, with negative impacts on recurring revenues and net margins.

- The company's moderate scale compared to major industry participants constrains its ability to achieve substantial operational leverage, making it sensitive to rising customer acquisition and R&D costs required to maintain pace with technological advancements-potentially inhibiting earnings growth and sustained margin expansion.

- Accelerating advancements in AI-enabled meeting features by larger competitors threaten to outpace Pexip's innovation capacity, risking loss of market share and longer-term revenue decline if their solutions become less attractive or relevant to enterprise buyers.

- Trends toward integrated, end-to-end enterprise productivity suites elevate customer preference for single-vendor solutions, which may marginalize specialized providers like Pexip, leading to reduced addressable market and exerting downward pressure on both revenue growth and long-term earnings potential.

Valuation

How have all the factors above been brought together to estimate a fair value?- The analysts have a consensus price target of NOK65.0 for Pexip Holding based on their expectations of its future earnings growth, profit margins and other risk factors. However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of NOK80.0, and the most bearish reporting a price target of just NOK50.0.

- In order for you to agree with the analyst's consensus, you'd need to believe that by 2028, revenues will be NOK1.6 billion, earnings will come to NOK318.9 million, and it would be trading on a PE ratio of 31.5x, assuming you use a discount rate of 7.6%.

- Given the current share price of NOK64.2, the analyst price target of NOK65.0 is 1.2% higher. The relatively low difference between the current share price and the analyst consensus price target indicates that they believe on average, the company is fairly priced.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

Have other thoughts on Pexip Holding?

Create your own narrative on this stock, and estimate its Fair Value using our Valuator tool.

Create NarrativeHow well do narratives help inform your perspective?

Disclaimer

AnalystConsensusTarget is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by AnalystConsensusTarget are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. Simply Wall St may provide the securities issuer or related entities with website advertising services for a fee, on an arm's length basis. These relationships have no impact on the way we conduct our business, the content we host, or how our content is served to users. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that AnalystConsensusTarget's analysis may not factor in the latest price-sensitive company announcements or qualitative material.