- Switzerland

- /

- Machinery

- /

- SWX:SUN

3 European Dividend Stocks Yielding Up To 9.6%

Reviewed by Simply Wall St

As the European markets navigate a landscape of mixed economic signals, with the pan-European STOXX Europe 600 Index seeing slight gains amidst dovish comments from U.S. Fed Chair Jerome Powell, investors are increasingly focusing on income-generating opportunities like dividend stocks. In this environment, selecting stocks that offer robust dividend yields can be an attractive strategy for those looking to balance potential market volatility with steady income streams.

Top 10 Dividend Stocks In Europe

| Name | Dividend Yield | Dividend Rating |

| Zurich Insurance Group (SWX:ZURN) | 4.37% | ★★★★★★ |

| Telekom Austria (WBAG:TKA) | 4.39% | ★★★★★☆ |

| Scandinavian Tobacco Group (CPSE:STG) | 9.80% | ★★★★★★ |

| Holcim (SWX:HOLN) | 4.54% | ★★★★★★ |

| HEXPOL (OM:HPOL B) | 5.18% | ★★★★★★ |

| DKSH Holding (SWX:DKSH) | 4.15% | ★★★★★★ |

| Cembra Money Bank (SWX:CMBN) | 4.69% | ★★★★★★ |

| Bravida Holding (OM:BRAV) | 4.02% | ★★★★★★ |

| Banque Cantonale Vaudoise (SWX:BCVN) | 4.72% | ★★★★★☆ |

| Banca Popolare di Sondrio (BIT:BPSO) | 5.91% | ★★★★★☆ |

Click here to see the full list of 223 stocks from our Top European Dividend Stocks screener.

Let's uncover some gems from our specialized screener.

Consti Oyj (HLSE:CONSTI)

Simply Wall St Dividend Rating: ★★★★★☆

Overview: Consti Oyj operates in Finland, offering renovation contracting and technical building services, with a market cap of €86.25 million.

Operations: Consti Oyj generates revenue primarily from its General Contractors segment, amounting to €328.69 million.

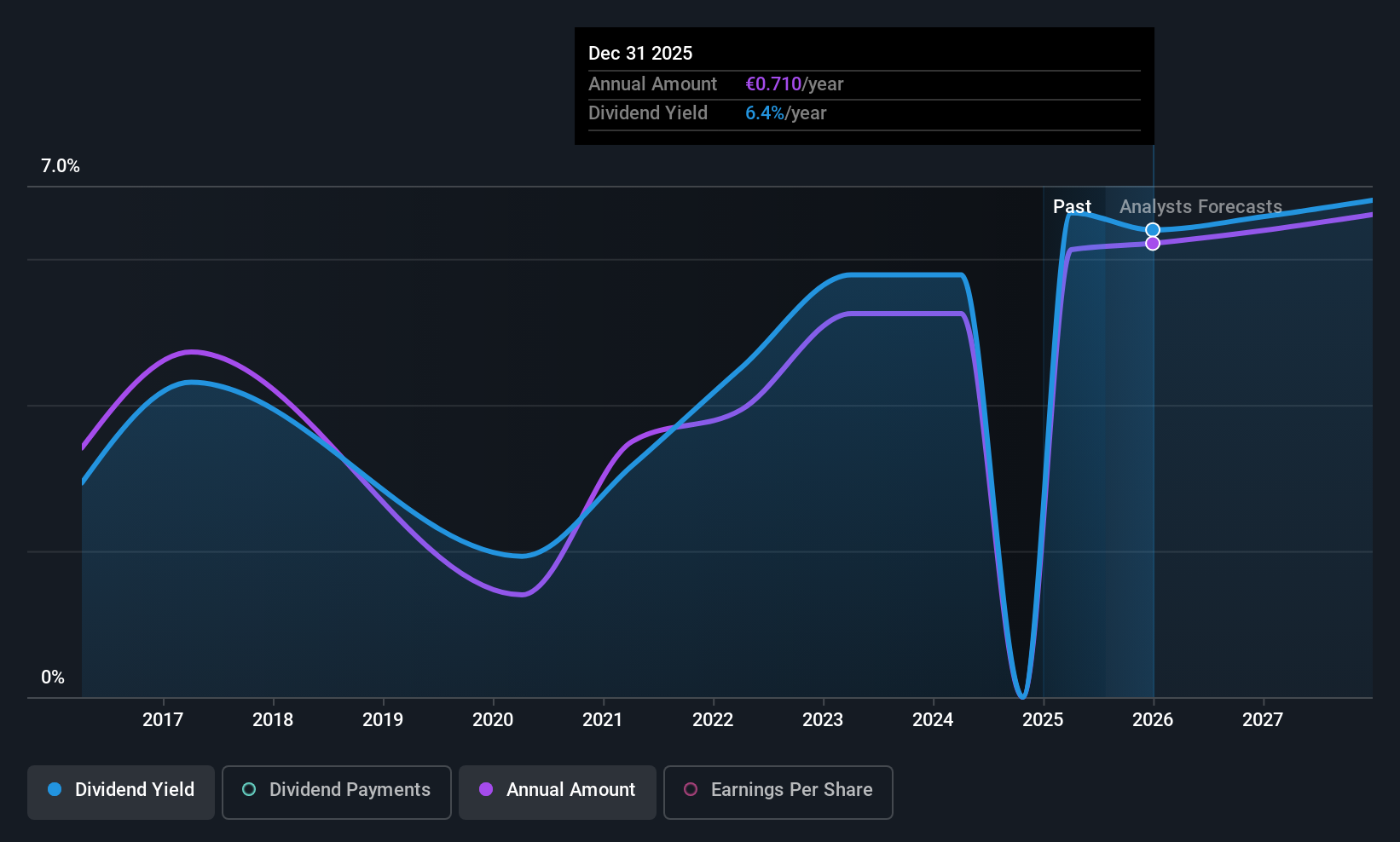

Dividend Yield: 6.4%

Consti Oyj's dividend is compelling due to its high yield of 6.42%, placing it in the top 25% of Finnish dividend payers. The dividends are covered by both earnings and cash flows, with payout ratios of 84.5% and 87.9%, respectively, indicating sustainability despite a volatile track record over the past decade. Trading at a significant discount to its estimated fair value, Consti presents potential value for investors seeking income in European markets.

- Dive into the specifics of Consti Oyj here with our thorough dividend report.

- Insights from our recent valuation report point to the potential undervaluation of Consti Oyj shares in the market.

Sulzer (SWX:SUN)

Simply Wall St Dividend Rating: ★★★★★☆

Overview: Sulzer Ltd specializes in developing and selling products and services for fluid engineering and chemical processing applications globally, with a market cap of CHF4.45 billion.

Operations: Sulzer Ltd's revenue is derived from three main segments: Flow at CHF1.49 billion, Chemtech at CHF772.10 million, and Services at CHF1.31 billion.

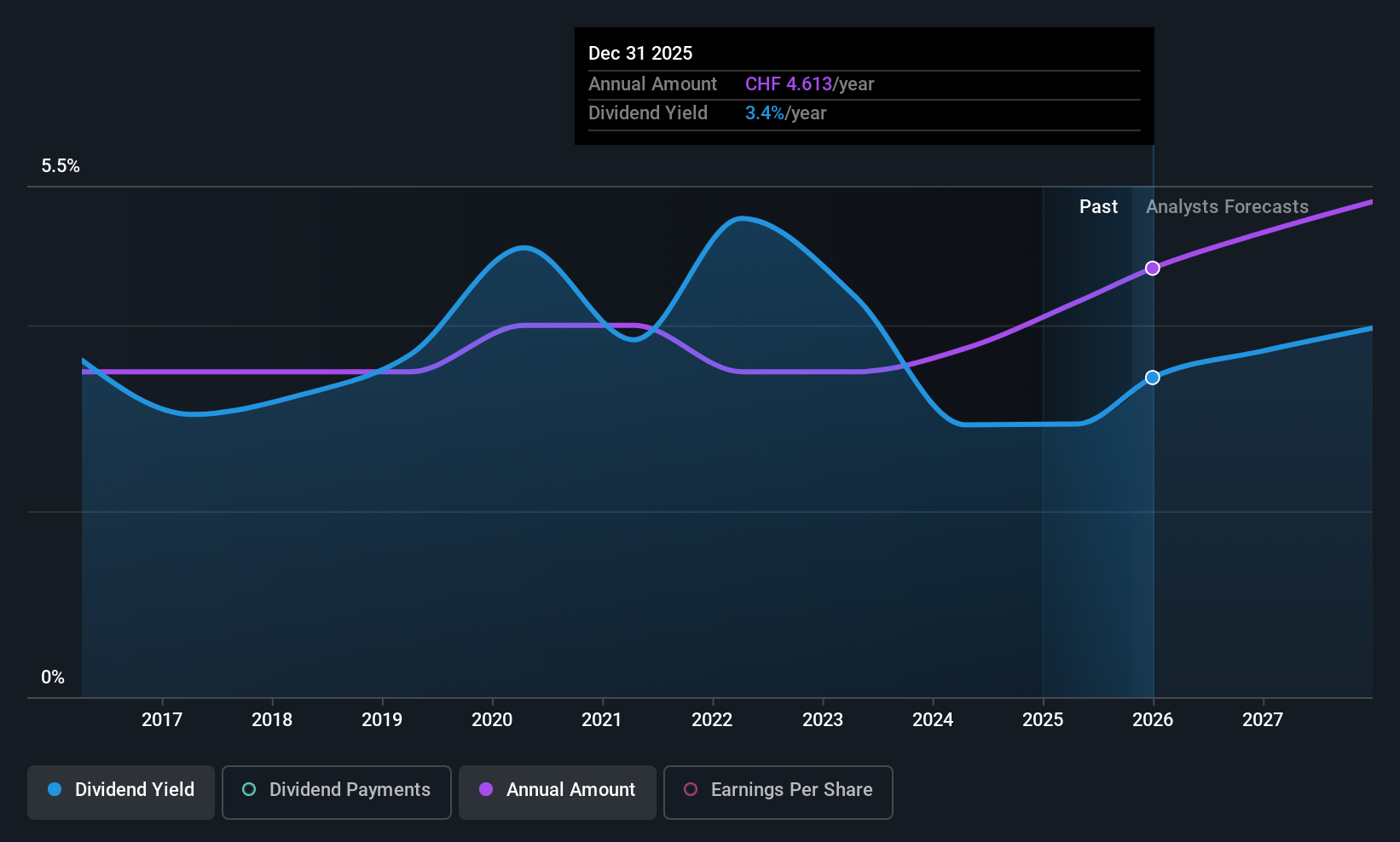

Dividend Yield: 3.2%

Sulzer offers a stable dividend with a yield of 3.22%, though it falls short of the top tier in the Swiss market. The company maintains reliable payments supported by earnings and cash flows, with payout ratios of 52.7% and 65.8%, respectively, ensuring sustainability. Sulzer's dividends have grown consistently over the past decade, indicating potential for income-focused investors despite trading at a significant discount to its estimated fair value by analysts.

- Unlock comprehensive insights into our analysis of Sulzer stock in this dividend report.

- Our expertly prepared valuation report Sulzer implies its share price may be lower than expected.

Bank Handlowy w Warszawie (WSE:BHW)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Bank Handlowy w Warszawie S.A., along with its subsidiaries, offers a variety of banking services to individual and corporate clients both in Poland and internationally, with a market capitalization of PLN13.88 billion.

Operations: Bank Handlowy w Warszawie S.A. generates revenue through its Consumer Bank segment, which accounts for PLN1.30 billion, and its Institutional Banking segment, contributing PLN3.18 billion.

Dividend Yield: 9.7%

Bank Handlowy w Warszawie offers a high dividend yield of 9.67%, placing it among the top 25% in Poland, but its sustainability is questionable due to an expected payout ratio of 95% in three years. Recent earnings showed a decline, with net income dropping to PLN 600.53 million for H1 2025. Despite past growth, dividends have been volatile and not reliably covered by earnings, compounded by a high bad loans ratio of 3%.

- Click here and access our complete dividend analysis report to understand the dynamics of Bank Handlowy w Warszawie.

- Our comprehensive valuation report raises the possibility that Bank Handlowy w Warszawie is priced lower than what may be justified by its financials.

Key Takeaways

- Click this link to deep-dive into the 223 companies within our Top European Dividend Stocks screener.

- Hold shares in these firms? Setup your portfolio in Simply Wall St to seamlessly track your investments and receive personalized updates on your portfolio's performance.

- Take control of your financial future using Simply Wall St, offering free, in-depth knowledge of international markets to every investor.

Ready For A Different Approach?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SWX:SUN

Sulzer

Develops and sells products and services for fluid engineering and chemical processing applications worldwide.

Very undervalued with flawless balance sheet and pays a dividend.

Similar Companies

Market Insights

Community Narratives