Alior Bank S.A. (WSE:ALR) has caught the attention of institutional investors who hold a sizeable 49% stake

Key Insights

- Significantly high institutional ownership implies Alior Bank's stock price is sensitive to their trading actions

- A total of 3 investors have a majority stake in the company with 50% ownership

- Analyst forecasts along with ownership data serve to give a strong idea about prospects for a business

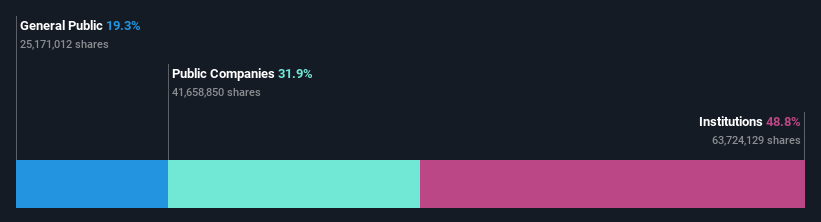

A look at the shareholders of Alior Bank S.A. (WSE:ALR) can tell us which group is most powerful. With 49% stake, institutions possess the maximum shares in the company. In other words, the group stands to gain the most (or lose the most) from their investment into the company.

Since institutional have access to huge amounts of capital, their market moves tend to receive a lot of scrutiny by retail or individual investors. As a result, a sizeable amount of institutional money invested in a firm is generally viewed as a positive attribute.

In the chart below, we zoom in on the different ownership groups of Alior Bank.

Check out our latest analysis for Alior Bank

What Does The Institutional Ownership Tell Us About Alior Bank?

Institutions typically measure themselves against a benchmark when reporting to their own investors, so they often become more enthusiastic about a stock once it's included in a major index. We would expect most companies to have some institutions on the register, especially if they are growing.

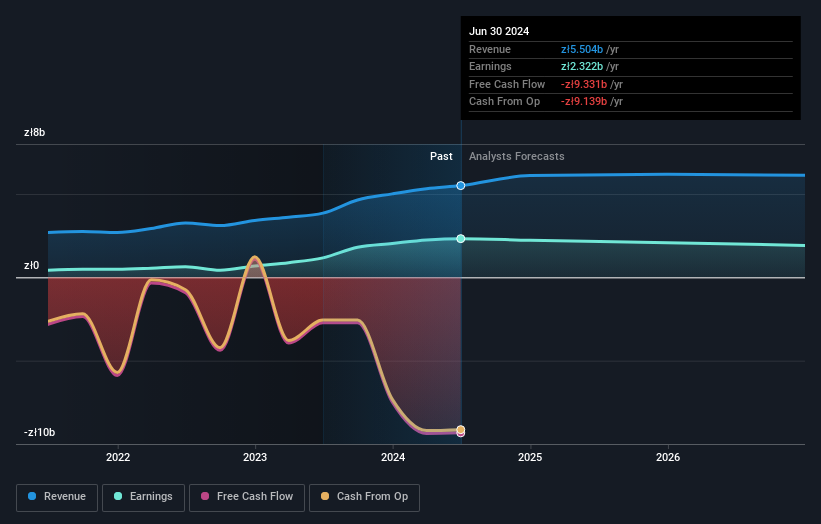

As you can see, institutional investors have a fair amount of stake in Alior Bank. This suggests some credibility amongst professional investors. But we can't rely on that fact alone since institutions make bad investments sometimes, just like everyone does. It is not uncommon to see a big share price drop if two large institutional investors try to sell out of a stock at the same time. So it is worth checking the past earnings trajectory of Alior Bank, (below). Of course, keep in mind that there are other factors to consider, too.

Alior Bank is not owned by hedge funds. Powszechny Zaklad Ubezpieczen SA is currently the largest shareholder, with 32% of shares outstanding. In comparison, the second and third largest shareholders hold about 9.4% and 8.8% of the stock.

A more detailed study of the shareholder registry showed us that 3 of the top shareholders have a considerable amount of ownership in the company, via their 50% stake.

While studying institutional ownership for a company can add value to your research, it is also a good practice to research analyst recommendations to get a deeper understand of a stock's expected performance. There are a reasonable number of analysts covering the stock, so it might be useful to find out their aggregate view on the future.

Insider Ownership Of Alior Bank

While the precise definition of an insider can be subjective, almost everyone considers board members to be insiders. The company management answer to the board and the latter should represent the interests of shareholders. Notably, sometimes top-level managers are on the board themselves.

Most consider insider ownership a positive because it can indicate the board is well aligned with other shareholders. However, on some occasions too much power is concentrated within this group.

Our data cannot confirm that board members are holding shares personally. Not all jurisdictions have the same rules around disclosing insider ownership, and it is possible we have missed something, here. So you can click here learn more about the CEO.

General Public Ownership

With a 19% ownership, the general public, mostly comprising of individual investors, have some degree of sway over Alior Bank. While this group can't necessarily call the shots, it can certainly have a real influence on how the company is run.

Public Company Ownership

We can see that public companies hold 32% of the Alior Bank shares on issue. It's hard to say for sure but this suggests they have entwined business interests. This might be a strategic stake, so it's worth watching this space for changes in ownership.

Next Steps:

It's always worth thinking about the different groups who own shares in a company. But to understand Alior Bank better, we need to consider many other factors. Be aware that Alior Bank is showing 1 warning sign in our investment analysis , you should know about...

Ultimately the future is most important. You can access this free report on analyst forecasts for the company.

NB: Figures in this article are calculated using data from the last twelve months, which refer to the 12-month period ending on the last date of the month the financial statement is dated. This may not be consistent with full year annual report figures.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About WSE:ALR

Alior Bank

Provides banking products and services for individuals, businesses, and enterprises in Poland.

Very undervalued with solid track record.