Undiscovered Gems Three Promising Stocks To Watch This September 2024

Reviewed by Simply Wall St

As global markets face heightened volatility and economic slowdown concerns, the S&P 500 has experienced its most significant weekly decline in 18 months. Amid this turbulent backdrop, small-cap stocks have shown resilience, presenting unique opportunities for discerning investors. In such an environment, identifying a promising stock involves looking beyond short-term market fluctuations to find companies with strong fundamentals and growth potential. Here are three undiscovered gems that stand out this September 2024.

Top 10 Undiscovered Gems With Strong Fundamentals

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| Petrol d.d | 42.18% | 17.56% | -0.49% | ★★★★★★ |

| Mobile Telecommunications | NA | 3.85% | -0.40% | ★★★★★★ |

| Impellam Group | 31.12% | -5.43% | -6.86% | ★★★★★★ |

| Ovostar Union | 0.01% | 10.19% | 49.85% | ★★★★★★ |

| Nofoth Food Products | NA | 14.41% | 31.88% | ★★★★★★ |

| Tianyun International Holdings | 10.09% | -5.59% | -9.92% | ★★★★★★ |

| MAPFRE Middlesea | NA | 14.56% | 1.77% | ★★★★★☆ |

| Central Cooperative Bank AD | 4.88% | 4.12% | 8.95% | ★★★★☆☆ |

| A2B Australia | 15.83% | -7.78% | 25.44% | ★★★★☆☆ |

| Wilson | 64.79% | 30.09% | 68.29% | ★★★★☆☆ |

Underneath we present a selection of stocks filtered out by our screen.

Pakistan Tobacco (KASE:PAKT)

Simply Wall St Value Rating: ★★★★★★

Overview: Pakistan Tobacco Company Limited manufactures and sells cigarettes, tobacco, velo, and vuse in Pakistan and internationally with a market cap of PKR 234.74 billion.

Operations: The company generates revenue primarily from its cigarette manufacturing segment, which contributed PKR 122.02 billion.

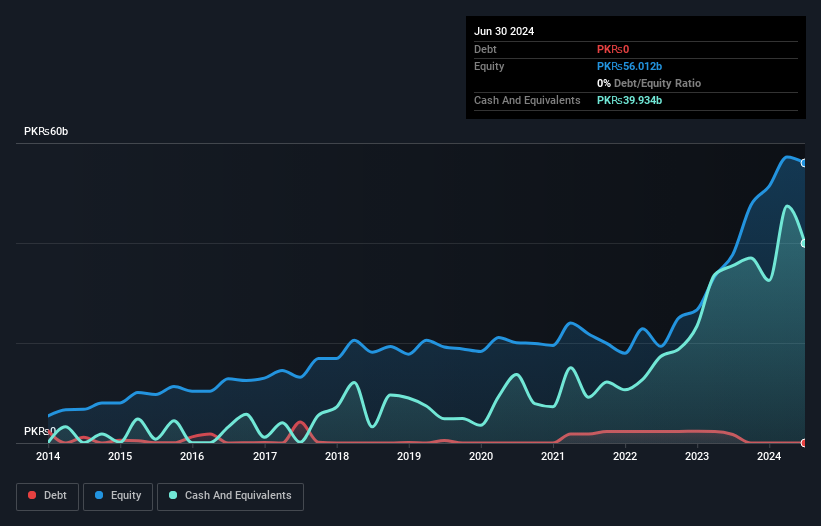

Pakistan Tobacco's recent performance highlights its potential as an undiscovered gem. The company reported second-quarter sales of PKR 107.16 billion, up from PKR 74.74 billion a year ago, with net income rising to PKR 5.86 billion from PKR 4.30 billion. Its price-to-earnings ratio of 8.1x is below the industry average of 12.1x, indicating good value for investors. With no debt and earnings growth at 21%, Pakistan Tobacco outpaces the industry’s -4% growth rate, showcasing robust financial health and operational efficiency.

- Click to explore a detailed breakdown of our findings in Pakistan Tobacco's health report.

Understand Pakistan Tobacco's track record by examining our Past report.

FBN Holdings (NGSE:FBNH)

Simply Wall St Value Rating: ★★★★☆☆

Overview: FBN Holdings Plc, along with its subsidiaries, offers commercial banking, investment banking, corporate banking, and other financial services across Nigeria, the United Kingdom, and the rest of Africa with a market cap of ₦947.64 billion.

Operations: The primary revenue stream for FBN Holdings Plc is its Commercial Banking Group, generating ₦1.30 billion. The company has a market cap of ₦947.64 billion.

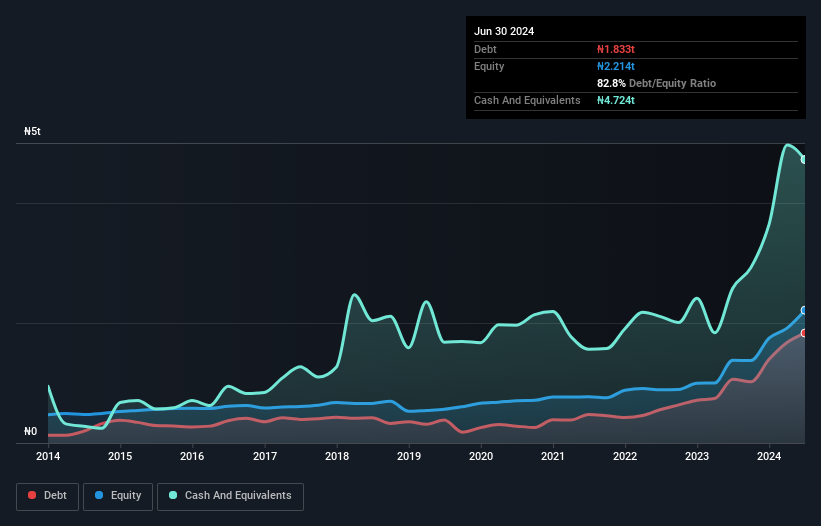

FBNH boasts total assets of NGN23,425.5B and equity of NGN2,213.5B, with deposits at NGN17,786.9B and loans totaling NGN9,056.2B. The company has a high non-performing loan ratio (4.9%) but a low allowance for bad loans (85%). Despite an 82% earnings growth last year, it lagged behind the industry’s 121%. Recent results show net income for Q2 was NGN155.91M compared to last year's NGN136.94M; EPS rose from 5.19 to 10.11 over six months.

- Delve into the full analysis health report here for a deeper understanding of FBN Holdings.

Assess FBN Holdings' past performance with our detailed historical performance reports.

LuxNet (TPEX:4979)

Simply Wall St Value Rating: ★★★★★★

Overview: LuxNet Corporation, with a market cap of NT$18.17 billion, manufactures, processes, and sells electric and optical communication components in Taiwan.

Operations: The company's primary revenue stream comes from its Optical Communication System Active Components segment, generating NT$3.35 billion.

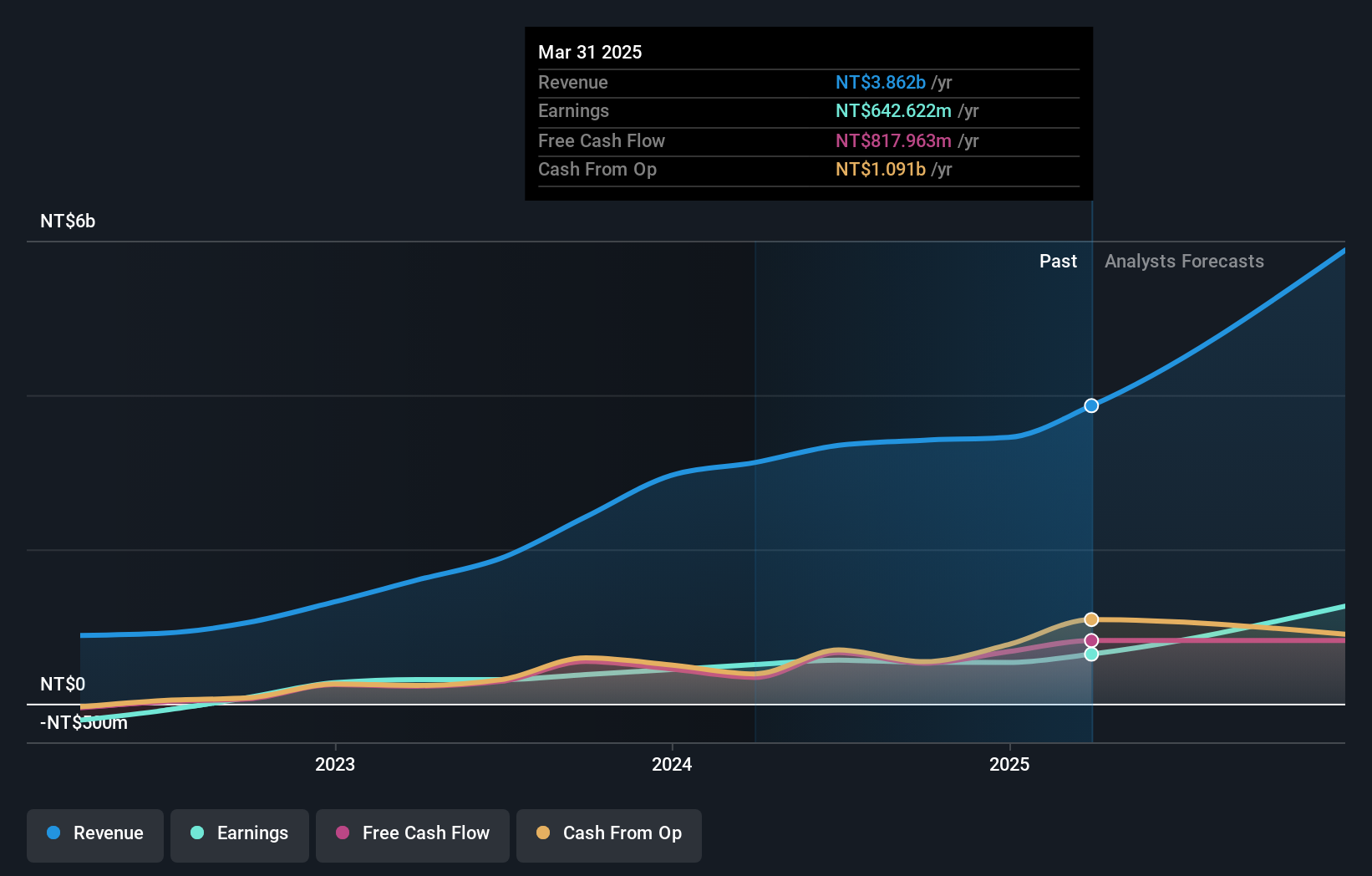

LuxNet has shown impressive growth, with earnings surging 81% over the past year, outpacing the Communications industry’s 4.1%. The company reported Q2 sales of TWD 801.27 million and net income of TWD 139.42 million, compared to TWD 577.92 million and TWD 82.08 million last year respectively. LuxNet remains debt-free, a significant improvement from five years ago when its debt to equity ratio was at 77.5%. Despite recent shareholder dilution and high share price volatility, future earnings are forecasted to grow by approximately 22% annually.

- Click here to discover the nuances of LuxNet with our detailed analytical health report.

Evaluate LuxNet's historical performance by accessing our past performance report.

Turning Ideas Into Actions

- Explore the 4840 names from our Undiscovered Gems With Strong Fundamentals screener here.

- Are any of these part of your asset mix? Tap into the analytical power of Simply Wall St's portfolio to get a 360-degree view on how they're shaping up.

- Simply Wall St is your key to unlocking global market trends, a free user-friendly app for forward-thinking investors.

Interested In Other Possibilities?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About KASE:PAKT

Pakistan Tobacco

Manufactures and sells, tobacco, velo, and vuse in Pakistan and internationally.

Excellent balance sheet with proven track record.

Market Insights

Community Narratives