Undiscovered Gems With Promising Potential For November 2024

Reviewed by Simply Wall St

As global markets navigate the uncertainties surrounding the incoming Trump administration's policies, small-cap stocks have been particularly sensitive to shifts in economic indicators and broader market sentiment. With indices like the S&P 600 experiencing fluctuations, investors are increasingly seeking opportunities in lesser-known stocks that may offer potential growth amid these dynamic conditions. Identifying a promising stock often involves assessing its adaptability to changing regulatory landscapes and its capacity for innovation within its sector, especially as these factors become more pronounced under current market influences.

Top 10 Undiscovered Gems With Strong Fundamentals

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| Impellam Group | 31.12% | -5.43% | -6.86% | ★★★★★★ |

| Ovostar Union | 0.01% | 10.19% | 49.85% | ★★★★★★ |

| Industrias del Cobre Sociedad Anónima | NA | 19.08% | 22.33% | ★★★★★★ |

| Tianyun International Holdings | 10.09% | -5.59% | -9.92% | ★★★★★★ |

| MAPFRE Middlesea | NA | 14.56% | 1.77% | ★★★★★☆ |

| Steamships Trading | 33.60% | 4.17% | 3.90% | ★★★★★☆ |

| Compañía Electro Metalúrgica | 71.27% | 12.50% | 19.90% | ★★★★☆☆ |

| La Positiva Seguros y Reaseguros | 0.04% | 8.59% | 27.31% | ★★★★☆☆ |

| Wilson | 64.79% | 30.09% | 68.29% | ★★★★☆☆ |

| A2B Australia | 15.83% | -7.78% | 25.44% | ★★★★☆☆ |

Let's uncover some gems from our specialized screener.

SP New Energy (PSE:SPNEC)

Simply Wall St Value Rating: ★★★★★★

Overview: SP New Energy Corporation is engaged in the production of electricity and has a market capitalization of ₱52.58 billion.

Operations: SP New Energy generates revenue primarily from the production of electricity. The company has a market capitalization of ₱52.58 billion.

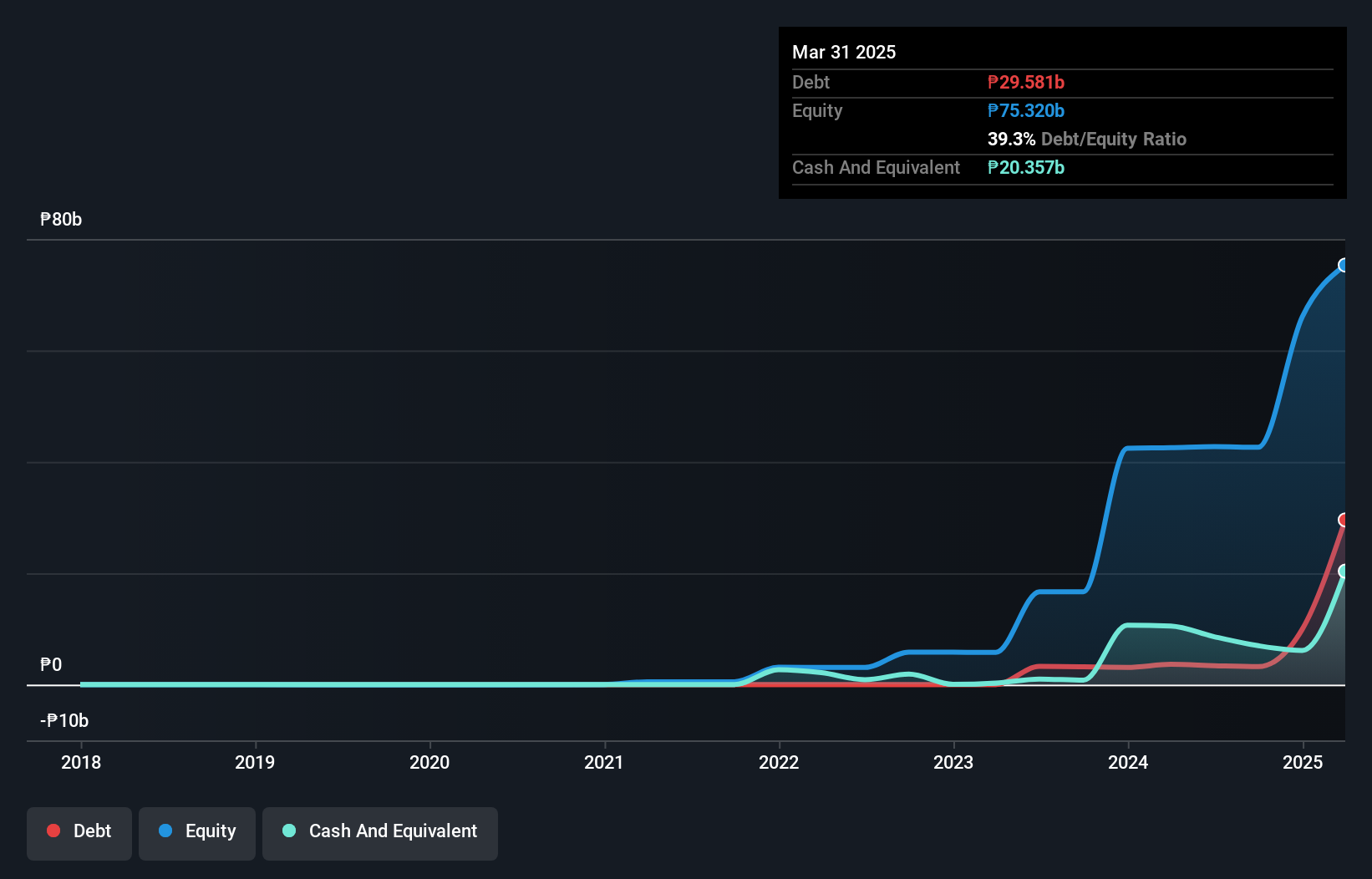

SP New Energy, a burgeoning player in the renewable sector, recently turned profitable, contrasting sharply with the industry’s -26.8% earnings growth. Despite this achievement, recent reports show a net loss of PHP 252 million for Q3 2024 and PHP 131 million over nine months. Shareholders faced dilution last year, yet SPNEC's financial health appears robust with cash surpassing total debt and positive free cash flow recorded at PHP 895 million as of September 2024. Strategic moves include a significant stake acquisition by Meralco PowerGen for PHP 7.5 billion and potential partnerships to solidify its market position further.

- Click here to discover the nuances of SP New Energy with our detailed analytical health report.

Explore historical data to track SP New Energy's performance over time in our Past section.

Shanxi Yongdong Chemistry Industry (SZSE:002753)

Simply Wall St Value Rating: ★★★★☆☆

Overview: Shanxi Yongdong Chemistry Industry Co., Ltd. operates in the chemical sector, focusing on the production and distribution of chemical raw materials and products both domestically and internationally, with a market capitalization of approximately CN¥2.52 billion.

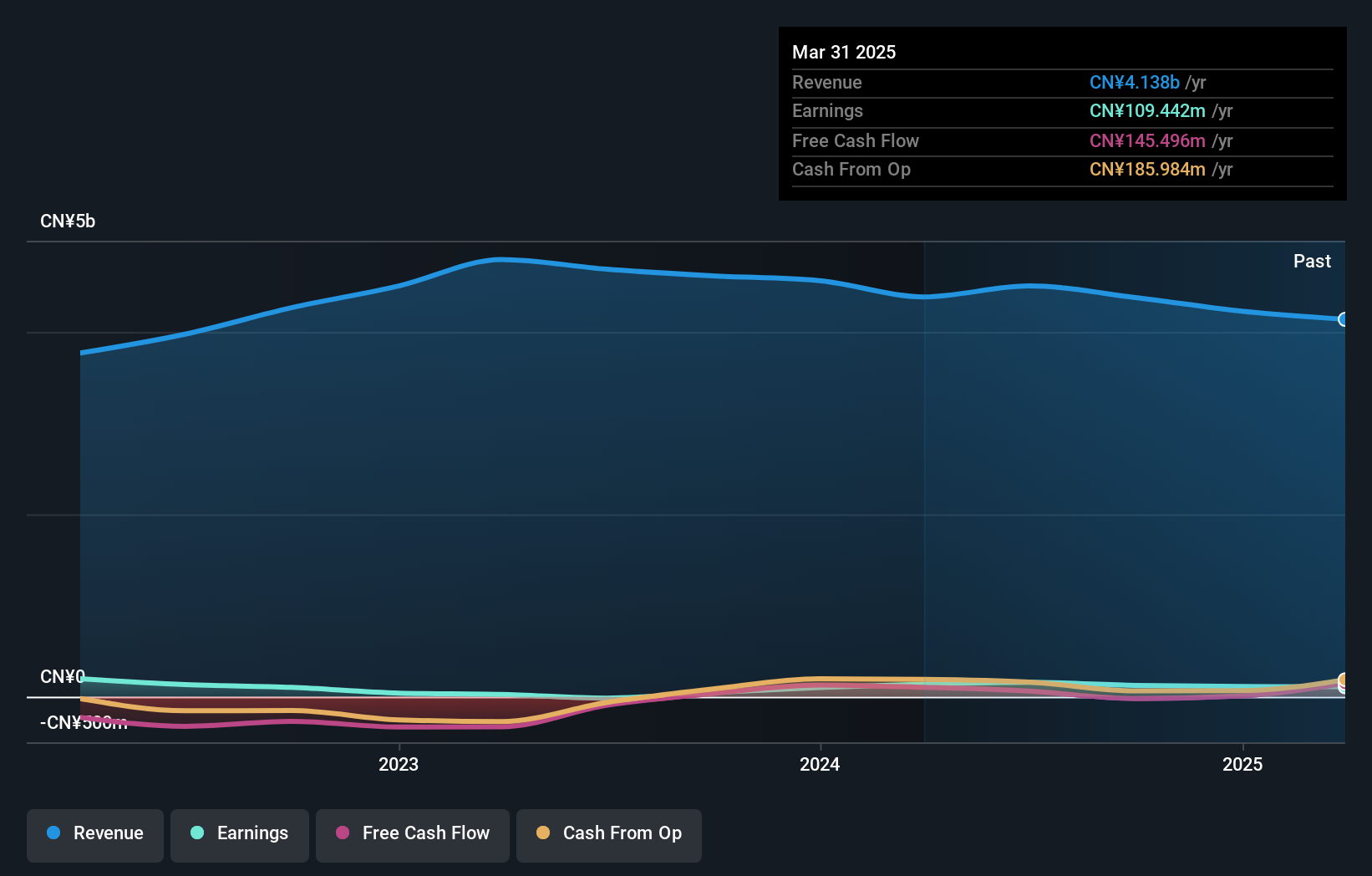

Operations: Shanxi Yongdong Chemistry Industry generates revenue primarily from its chemical raw materials and products manufacturing segment, amounting to CN¥4.38 billion. The company's market capitalization is approximately CN¥2.52 billion.

Shanxi Yongdong Chemistry Industry, a smaller player in the chemicals sector, has demonstrated notable earnings growth of 175.5% over the past year, significantly outpacing the industry average of -5.3%. The firm's net debt to equity ratio stands at a satisfactory 29.1%, indicating manageable leverage levels. Despite a decline in sales from CNY 3,351.07 million to CNY 3,165.59 million for the nine months ending September 2024 compared to last year, net income rose from CNY 59.32 million to CNY 82.11 million during the same period, reflecting improved profitability and operational efficiency within its market space.

TENPOS HOLDINGSLtd (TSE:2751)

Simply Wall St Value Rating: ★★★★★☆

Overview: TENPOS HOLDINGS Co., Ltd. operates kitchenware and equipment stores in Japan with a market capitalization of ¥41.45 billion.

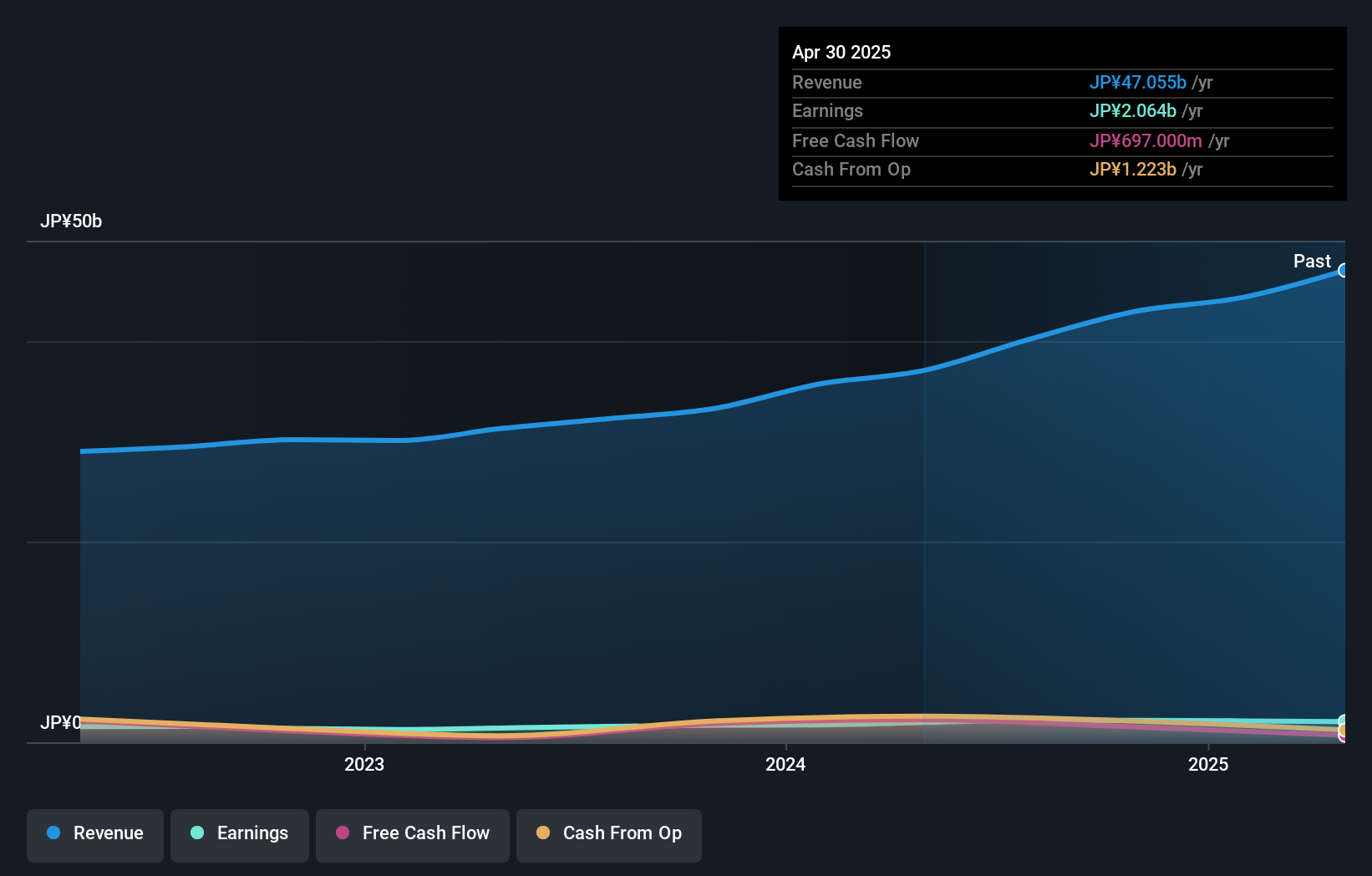

Operations: TENPOS HOLDINGS generates revenue primarily from its Product Sales Business, which accounts for ¥25.15 billion, followed by the Food and Sub-Contracted Catering segment at ¥11.65 billion, and Information Services Business contributing ¥4.25 billion.

In the bustling world of trade distributors, TENPOS HOLDINGS stands out with its impressive earnings growth of 39.6% over the past year, outpacing the industry average of 1.8%. The company recently joined the S&P Global BMI Index, highlighting its growing recognition. Financially robust, it has more cash than total debt and covers interest payments with EBIT a whopping 1451 times over. Trading at a value 8.3% below fair estimate suggests potential for investors seeking value opportunities in this sector. Despite an increase in debt to equity ratio from zero to 15% over five years, profitability remains strong with positive free cash flow evident throughout recent periods.

- Get an in-depth perspective on TENPOS HOLDINGSLtd's performance by reading our health report here.

Gain insights into TENPOS HOLDINGSLtd's past trends and performance with our Past report.

Make It Happen

- Unlock more gems! Our Undiscovered Gems With Strong Fundamentals screener has unearthed 4624 more companies for you to explore.Click here to unveil our expertly curated list of 4627 Undiscovered Gems With Strong Fundamentals.

- Already own these companies? Bring clarity to your investment decisions by linking up your portfolio with Simply Wall St, where you can monitor all the vital signs of your stocks effortlessly.

- Unlock the power of informed investing with Simply Wall St, your free guide to navigating stock markets worldwide.

Contemplating Other Strategies?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SZSE:002753

Shanxi Yongdong Chemistry Industry

Engages in the manufacture and sale of chemical raw materials and chemical products in China and internationally.

Excellent balance sheet second-rate dividend payer.

Market Insights

Community Narratives