- Taiwan

- /

- Electronic Equipment and Components

- /

- TPEX:3491

Discovering Undiscovered Gems on None Exchange January 2025

Reviewed by Simply Wall St

As global markets react to easing core inflation in the U.S. and robust bank earnings, major indices like the S&P 500 and Russell 2000 have seen significant gains, reflecting a positive sentiment shift despite mixed economic signals such as lagging retail sales and rising jobless claims. In this dynamic environment, identifying promising small-cap stocks can be particularly rewarding, as these companies often offer unique growth opportunities that may not yet be fully recognized by the broader market.

Top 10 Undiscovered Gems With Strong Fundamentals

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| Omega Flex | NA | 0.39% | 2.57% | ★★★★★★ |

| Wilson Bank Holding | NA | 7.87% | 8.22% | ★★★★★★ |

| SALUS Ljubljana d. d | 13.55% | 13.11% | 9.95% | ★★★★★★ |

| Ovostar Union | 0.01% | 10.19% | 49.85% | ★★★★★★ |

| MAPFRE Middlesea | NA | 14.56% | 1.77% | ★★★★★☆ |

| ASA Gold and Precious Metals | NA | 7.11% | -35.88% | ★★★★★☆ |

| Sparta | NA | -5.54% | -15.40% | ★★★★★☆ |

| Pure Cycle | 5.15% | -2.61% | -6.23% | ★★★★★☆ |

| Arab Banking Corporation (B.S.C.) | 213.15% | 18.58% | 29.63% | ★★★★☆☆ |

| BOSQAR d.d | 94.35% | 39.11% | 23.56% | ★★★★☆☆ |

Let's uncover some gems from our specialized screener.

SP New Energy (PSE:SPNEC)

Simply Wall St Value Rating: ★★★★★★

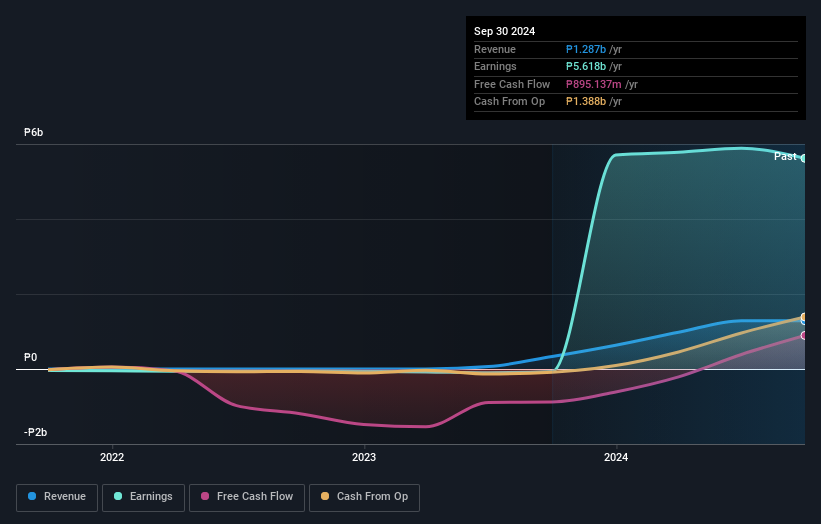

Overview: SP New Energy Corporation focuses on electricity production and has a market capitalization of ₱58.59 billion.

Operations: The primary revenue stream for SP New Energy Corporation comes from its Sp Tarlac segment, generating ₱468.51 million. Adjustments contribute an additional ₱7.19 million to the overall revenue figures, while a significant segment adjustment of ₱811.77 million is noted in the financials.

SP New Energy, a small cap player in the renewable sector, has shown notable progress. The company now boasts positive shareholder equity after five years of negative figures and holds more cash than its total debt. Recently profitable, SPNEC's earnings growth surpasses the industry's -26.2% benchmark. Despite these strides, recent reports indicate a net loss of PHP 252 million for Q3 2024 against last year's PHP 14 million profit, with sales at PHP 268 million. The board is considering strategic moves like terminating a power supply agreement and pledging shares for financing projects to enhance future growth prospects.

- Delve into the full analysis health report here for a deeper understanding of SP New Energy.

Gain insights into SP New Energy's historical performance by reviewing our past performance report.

Actions Technology (SHSE:688049)

Simply Wall St Value Rating: ★★★★★★

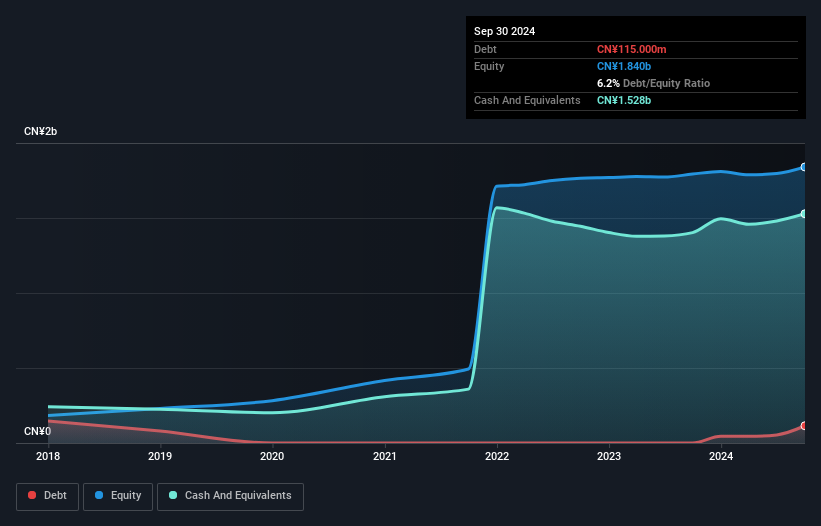

Overview: Actions Technology Co., Ltd. is a fabless semiconductor company that designs and produces system-on-chips (SoCs) for portable multimedia products in China, with a market cap of CN¥6.71 billion.

Operations: Actions Technology generates revenue primarily from its semiconductor segment, amounting to CN¥610.57 million. The company's financial performance is highlighted by a focus on this key revenue stream within the semiconductor industry.

Actions Technology, a smaller player in the semiconductor industry, has shown impressive performance with earnings growth of 71.2% over the past year, significantly outpacing the industry's 12.1%. The company reported sales of CNY 466.67 million for nine months ending September 2024, up from CNY 376.2 million the previous year, while net income increased to CNY 70.91 million from CNY 46.93 million. Despite a volatile share price recently and a one-off gain of CN¥26.1M affecting results, Actions Technology remains profitable with free cash flow positivity and reduced debt-to-equity ratio from 7.5% to 6.2% over five years, suggesting financial stability amidst industry fluctuations.

- Take a closer look at Actions Technology's potential here in our health report.

Evaluate Actions Technology's historical performance by accessing our past performance report.

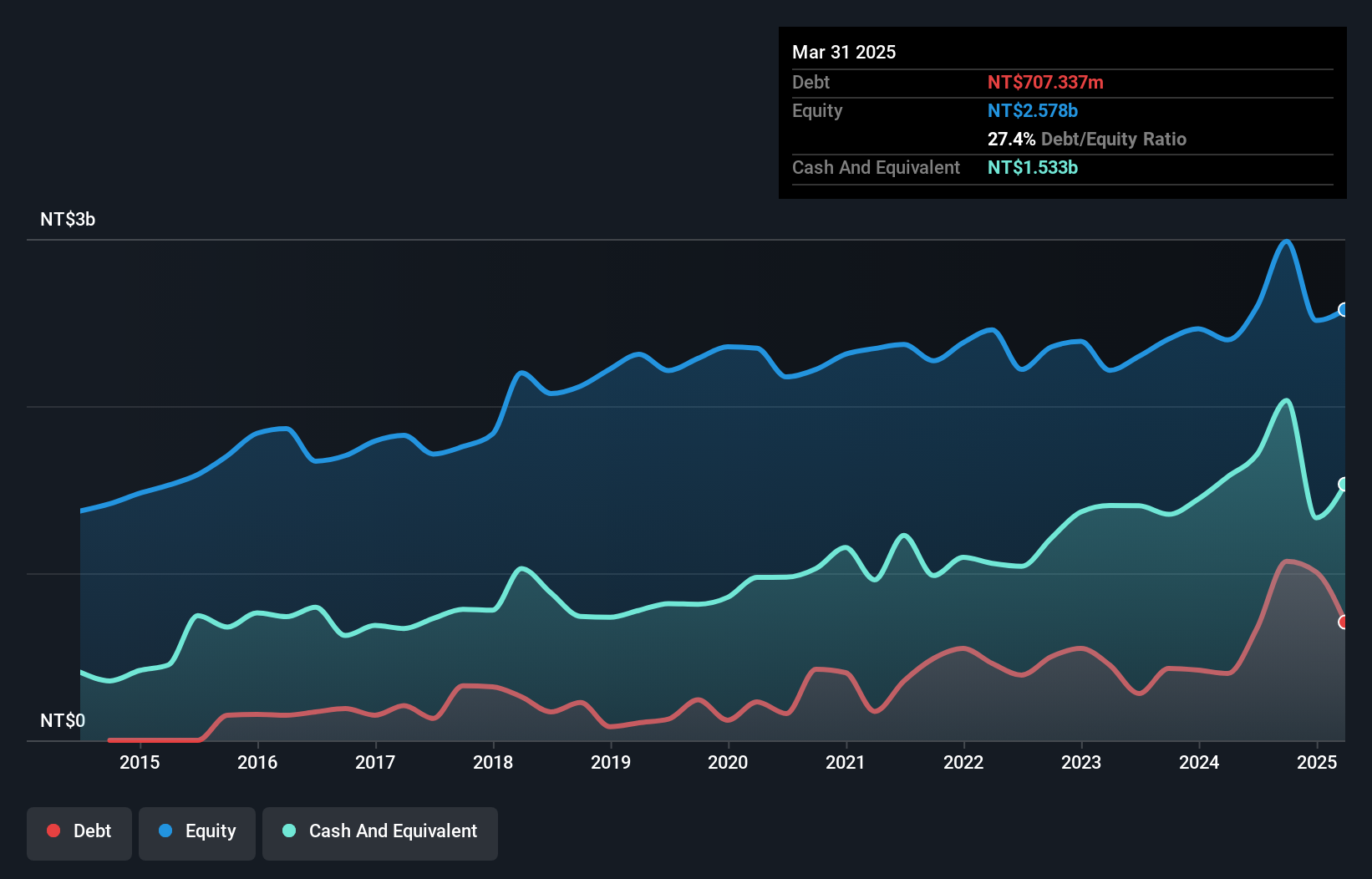

Universal Microwave Technology (TPEX:3491)

Simply Wall St Value Rating: ★★★★★☆

Overview: Universal Microwave Technology, Inc. operates in the microwave and millimeter wave wireless communication industry across Taiwan, China, Asia, Europe, the United States, and Oceania with a market capitalization of NT$28.92 billion.

Operations: Universal Microwave Technology generates revenue primarily from its Microwave/Millimeter Wave Products and Radio Frequency Products, contributing NT$1.26 billion and NT$1.06 billion respectively. The Communications Network Engineering Services segment adds NT$214.58 million to the company's revenue streams.

Universal Microwave Technology, a small player in the tech space, has seen impressive growth with earnings soaring by 108.7% over the past year, outpacing the electronic industry average of 6.6%. The company reported third-quarter sales at TWD 639.64 million and net income of TWD 132.43 million, reflecting significant improvements from last year’s figures of TWD 375.53 million and TWD 45.94 million respectively. Despite a volatile share price recently, its debt-to-equity ratio has increased to 35.9% over five years but remains manageable as it holds more cash than total debt and generates positive free cash flow.

Taking Advantage

- Click through to start exploring the rest of the 4655 Undiscovered Gems With Strong Fundamentals now.

- Already own these companies? Link your portfolio to Simply Wall St and get alerts on any new warning signs to your stocks.

- Elevate your portfolio with Simply Wall St, the ultimate app for investors seeking global market coverage.

Curious About Other Options?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TPEX:3491

Universal Microwave Technology

Operates in microwave/mmwave wireless communication industry in Taiwan, China, Asia, Europe, the United States, and Oceania.

Outstanding track record with high growth potential.

Market Insights

Community Narratives