- Philippines

- /

- Electric Utilities

- /

- PSE:FPH

3 Reliable Dividend Stocks Yielding Up To 4.8%

Reviewed by Simply Wall St

As global markets navigate a complex landscape marked by fluctuating interest rates, AI competition fears, and geopolitical tensions, investors are increasingly seeking stability amid volatility. Dividend stocks offer a potential refuge by providing consistent income streams even when market conditions are unpredictable. In this environment, identifying reliable dividend stocks becomes crucial for those looking to balance growth with income generation.

Top 10 Dividend Stocks

| Name | Dividend Yield | Dividend Rating |

| Guaranty Trust Holding (NGSE:GTCO) | 6.06% | ★★★★★★ |

| Peoples Bancorp (NasdaqGS:PEBO) | 4.98% | ★★★★★★ |

| Wuliangye YibinLtd (SZSE:000858) | 4.05% | ★★★★★★ |

| CAC Holdings (TSE:4725) | 4.57% | ★★★★★★ |

| Citizens & Northern (NasdaqCM:CZNC) | 5.33% | ★★★★★★ |

| Southside Bancshares (NYSE:SBSI) | 4.66% | ★★★★★★ |

| China South Publishing & Media Group (SHSE:601098) | 4.01% | ★★★★★★ |

| Guangxi LiuYao Group (SHSE:603368) | 3.41% | ★★★★★★ |

| HUAYU Automotive Systems (SHSE:600741) | 4.46% | ★★★★★★ |

| Nihon Parkerizing (TSE:4095) | 4.01% | ★★★★★★ |

Click here to see the full list of 1980 stocks from our Top Dividend Stocks screener.

Below we spotlight a couple of our favorites from our exclusive screener.

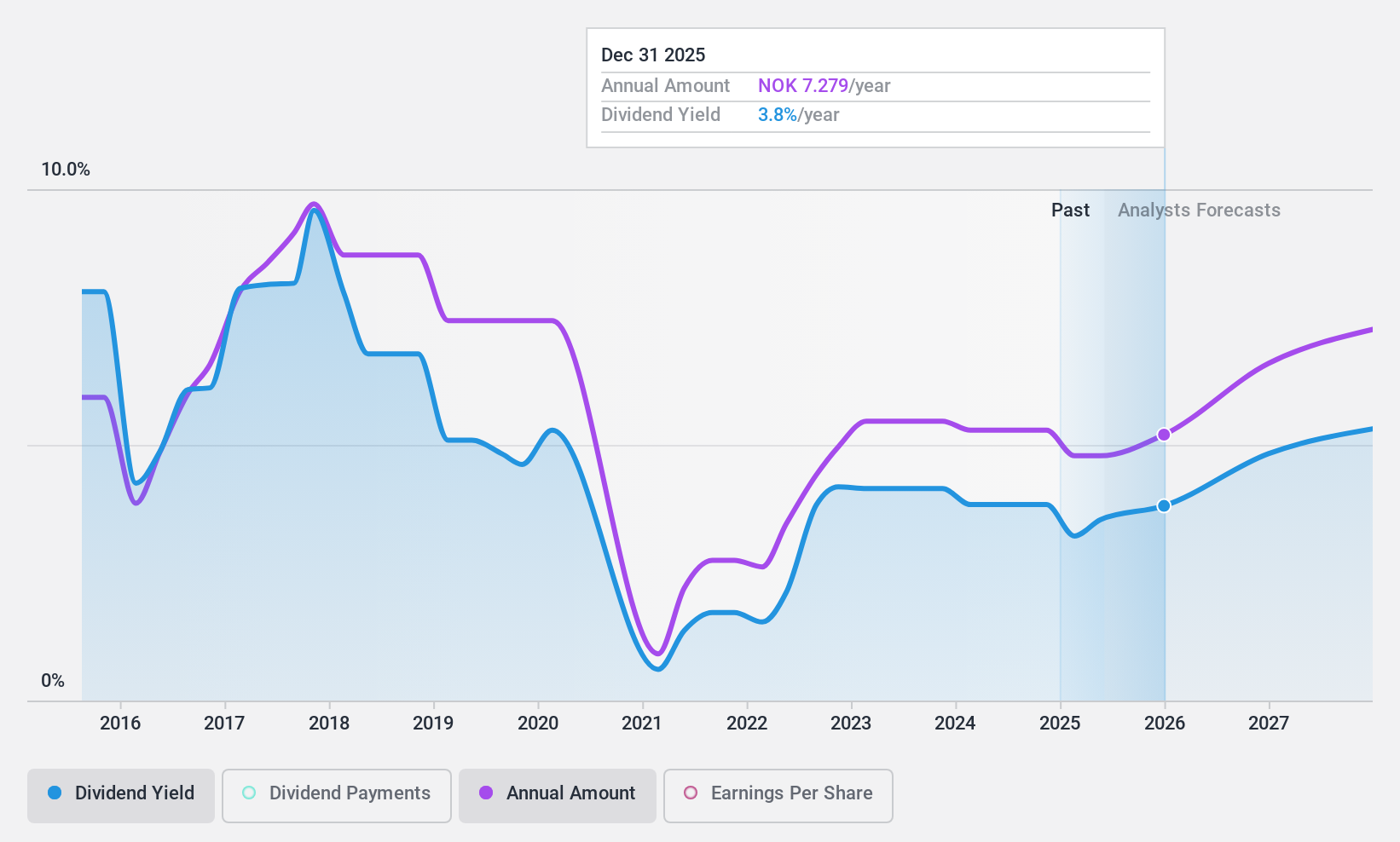

Mowi (OB:MOWI)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Mowi ASA is a seafood company that farms, produces, and supplies Atlantic salmon products globally, with a market cap of NOK117.54 billion.

Operations: Mowi ASA's revenue segments include Feed (€1.11 billion), Farming (€3.46 billion), Sales & Marketing - Markets (€3.90 billion), and Sales and Marketing - Consumer Products (€3.68 billion).

Dividend Yield: 3.3%

Mowi's dividend payments are covered by earnings and cash flows, with a payout ratio of 69.1% and a cash payout ratio of 59.7%, respectively. However, its dividend history is unstable and has been volatile over the past decade. Despite an increase in dividends over ten years, Mowi's yield is relatively low compared to top-tier Norwegian dividend payers. Recent growth in harvest volumes and increased ownership in Nova Sea could influence future financial stability for dividends.

- Dive into the specifics of Mowi here with our thorough dividend report.

- According our valuation report, there's an indication that Mowi's share price might be on the cheaper side.

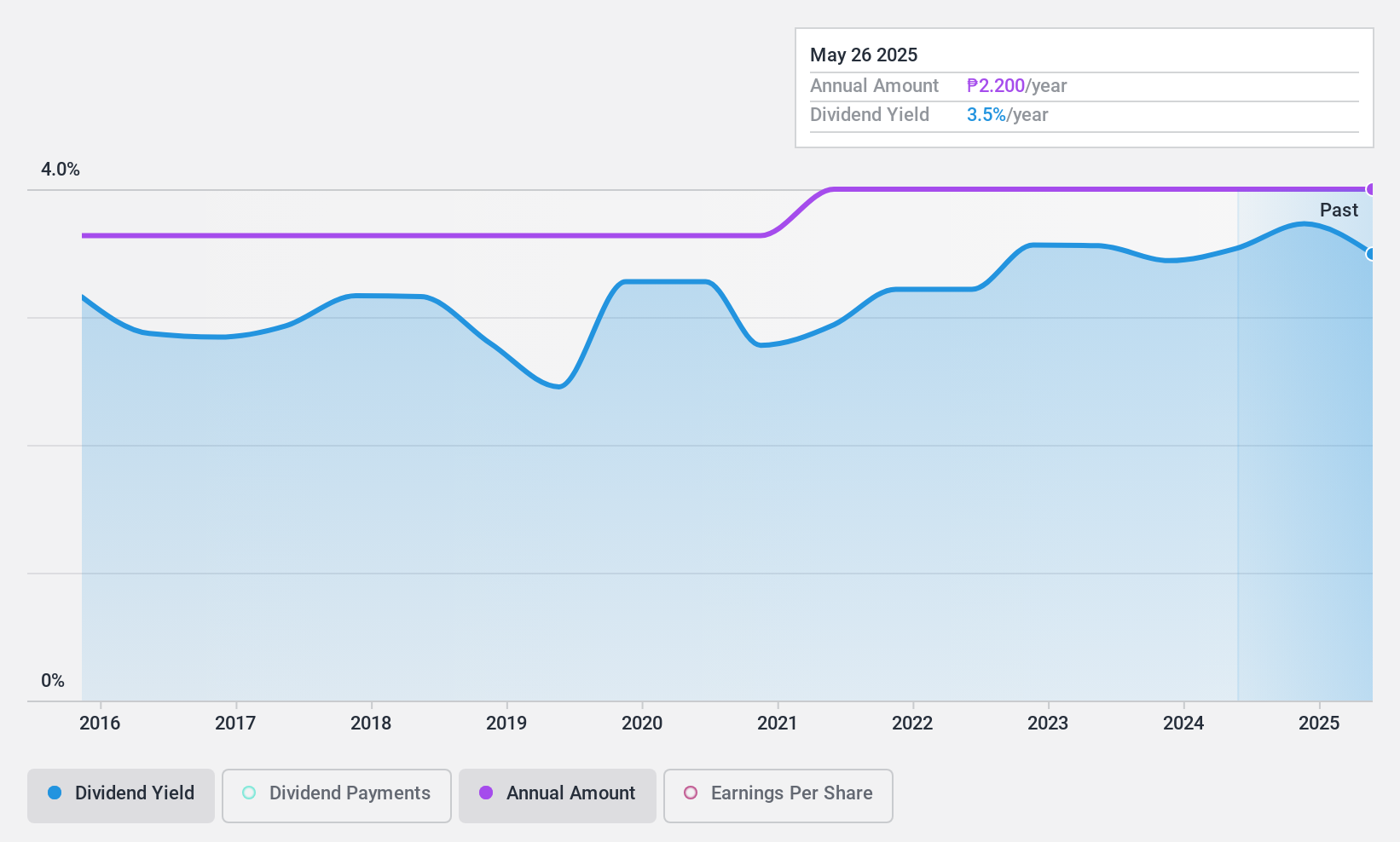

First Philippine Holdings (PSE:FPH)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: First Philippine Holdings Corporation operates in power generation, real estate development, energy solutions, and construction in the Philippines with a market cap of ₱27.72 billion.

Operations: First Philippine Holdings Corporation's revenue primarily comes from power generation (₱137.65 billion), real estate development (₱17.64 billion), construction and other services (₱15.41 billion), and energy solutions (₱5.15 billion).

Dividend Yield: 3.7%

First Philippine Holdings' dividends are well-covered by earnings due to a low payout ratio of 7.4%, although the lack of free cash flow coverage raises sustainability concerns. The dividend yield of 3.67% is lower than top-tier payers in the Philippines, yet it has shown reliable growth over the past decade. Recent executive changes and a decline in net income could impact future performance, but dividends have remained stable with recent affirmations at PHP 1.10 per share.

- Click to explore a detailed breakdown of our findings in First Philippine Holdings' dividend report.

- Upon reviewing our latest valuation report, First Philippine Holdings' share price might be too pessimistic.

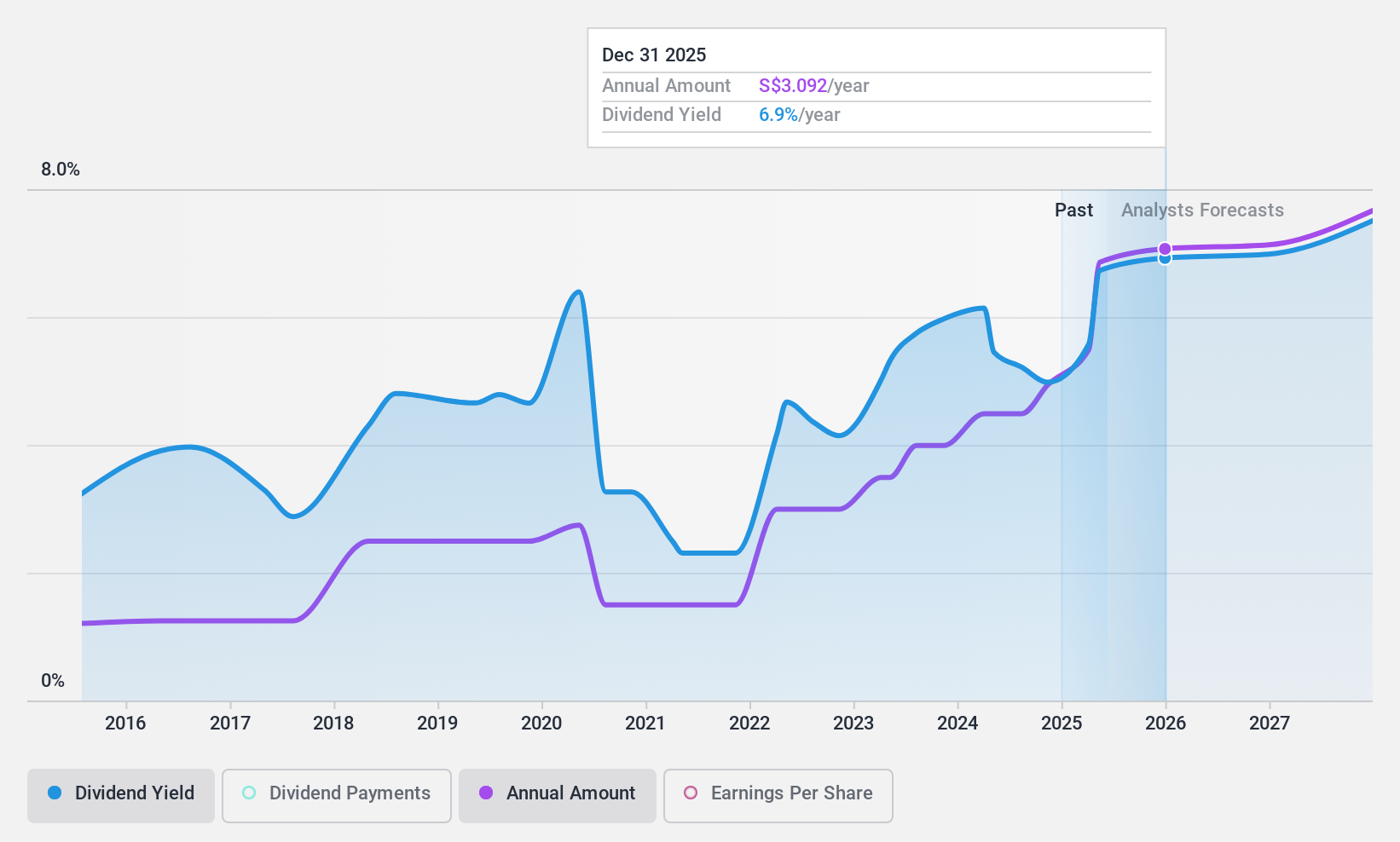

DBS Group Holdings (SGX:D05)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: DBS Group Holdings Ltd is a leading financial services provider offering commercial banking and financial services across Singapore, Hong Kong, Greater China, South and Southeast Asia, and internationally, with a market cap of SGD125.82 billion.

Operations: DBS Group Holdings Ltd generates revenue through its commercial banking and financial services operations in Singapore, Hong Kong, the rest of Greater China, South and Southeast Asia, and other international markets.

Dividend Yield: 4.9%

DBS Group Holdings' dividend yield of 4.87% is below Singapore's top-tier payers, but dividends are covered by earnings with a 55.2% payout ratio and forecasted to remain sustainable at 65%. Despite past volatility in dividend payments, recent affirmations suggest stability, supported by robust Q3 net income of S$3.03 billion. A share buyback program worth S$3 billion enhances shareholder value while ongoing M&A discussions may impact future financial dynamics and dividend reliability.

- Get an in-depth perspective on DBS Group Holdings' performance by reading our dividend report here.

- Our valuation report here indicates DBS Group Holdings may be undervalued.

Make It Happen

- Get an in-depth perspective on all 1980 Top Dividend Stocks by using our screener here.

- Invested in any of these stocks? Simplify your portfolio management with Simply Wall St and stay ahead with our alerts for any critical updates on your stocks.

- Take control of your financial future using Simply Wall St, offering free, in-depth knowledge of international markets to every investor.

Looking For Alternative Opportunities?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About PSE:FPH

First Philippine Holdings

Engages in the power generation, real estate development, energy solutions, construction, and others business in the Philippines.

Excellent balance sheet established dividend payer.

Market Insights

Community Narratives