- Philippines

- /

- Banks

- /

- PSE:SECB

Undervalued Small Caps With Insider Actions In Global For October 2025

Reviewed by Simply Wall St

In October 2025, the global markets have shown resilience with U.S. small-cap indices like the Russell 2000 and S&P MidCap 400 outperforming their large-cap peers, despite ongoing geopolitical tensions and economic uncertainties. As inflation trends lower than expected and business activity accelerates, investors are increasingly focusing on small-cap stocks that demonstrate strong fundamentals and potential for growth in this dynamic environment.

Top 10 Undervalued Small Caps With Insider Buying Globally

| Name | PE | PS | Discount to Fair Value | Value Rating |

|---|---|---|---|---|

| Speedy Hire | NA | 0.3x | 30.31% | ★★★★★☆ |

| Morguard North American Residential Real Estate Investment Trust | 5.0x | 1.7x | 25.00% | ★★★★★☆ |

| GDI Integrated Facility Services | 18.9x | 0.3x | 0.83% | ★★★★☆☆ |

| BWP Trust | 10.3x | 13.4x | 12.69% | ★★★★☆☆ |

| Hung Hing Printing Group | NA | 0.4x | 43.46% | ★★★★☆☆ |

| Sagicor Financial | 6.9x | 0.4x | -68.74% | ★★★★☆☆ |

| Senior | 24.8x | 0.8x | 25.93% | ★★★★☆☆ |

| Bumitama Agri | 11.4x | 1.6x | 44.05% | ★★★☆☆☆ |

| Ever Sunshine Services Group | 6.6x | 0.4x | -432.60% | ★★★☆☆☆ |

| Chinasoft International | 24.9x | 0.8x | -1382.42% | ★★★☆☆☆ |

Let's take a closer look at a couple of our picks from the screened companies.

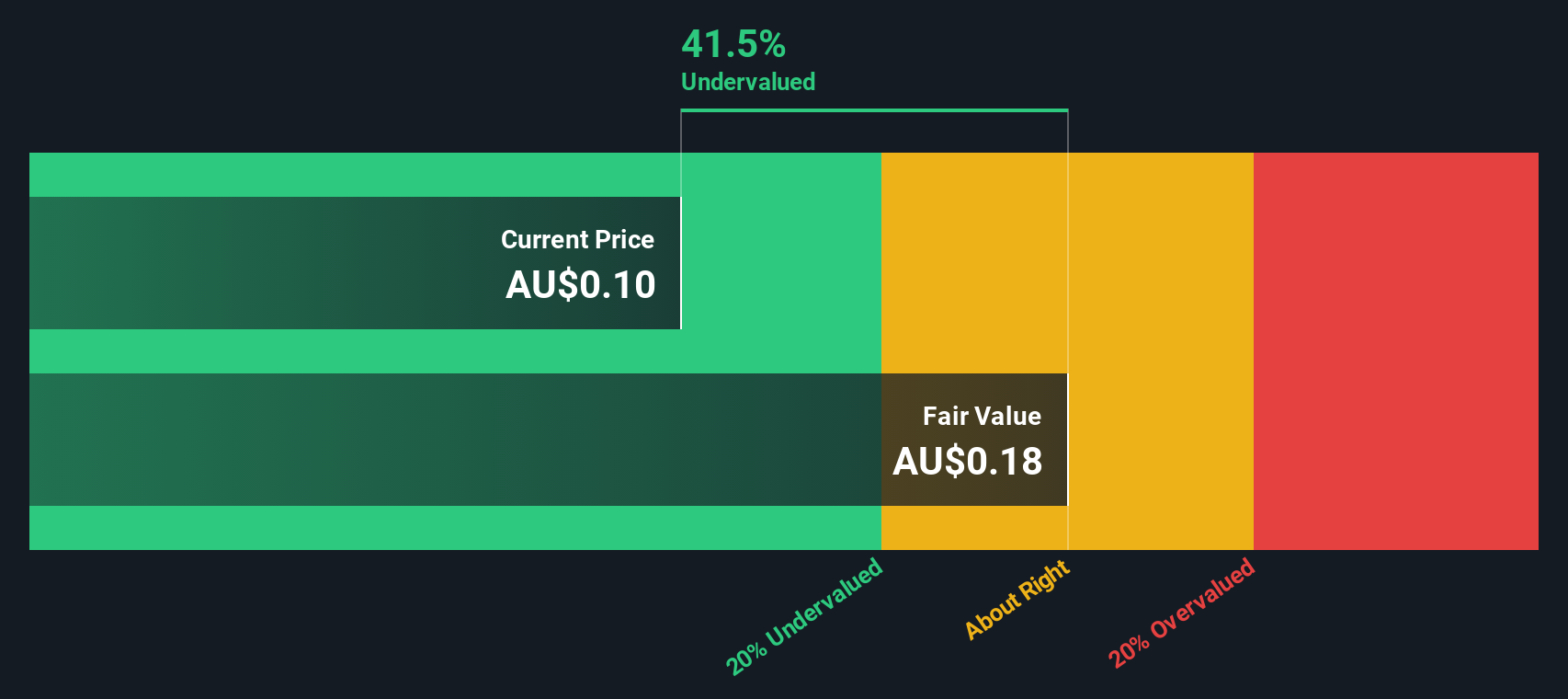

AMA Group (ASX:AMA)

Simply Wall St Value Rating: ★★★★★★

Overview: AMA Group is a company involved in the automotive industry, focusing on vehicle collision repair services and parts supply, with a market capitalization of A$1.2 billion.

Operations: The company's revenue streams are primarily driven by Capital Smart and Ama Collision, contributing significantly to its total revenue. Operating expenses have been a major component of the cost structure, with General & Administrative Expenses consistently forming a large portion. The gross profit margin has shown variability, peaking at 56.98% in recent periods after fluctuations over time. Net income margins have experienced significant negative trends in several periods, highlighting challenges in profitability despite revenue growth.

PE: -64.1x

AMA Group, a smaller company in its industry, recently reported full-year sales of A$1.01 billion for June 2025, up from A$933 million the previous year. Despite a net loss of A$7.47 million, this is an improvement from last year's A$7.63 million loss. Insider confidence is evident as insiders have been purchasing shares throughout 2025, indicating potential belief in future growth prospects. Earnings are anticipated to grow by 68% annually despite reliance on higher-risk external borrowing for funding.

- Click here to discover the nuances of AMA Group with our detailed analytical valuation report.

Gain insights into AMA Group's historical performance by reviewing our past performance report.

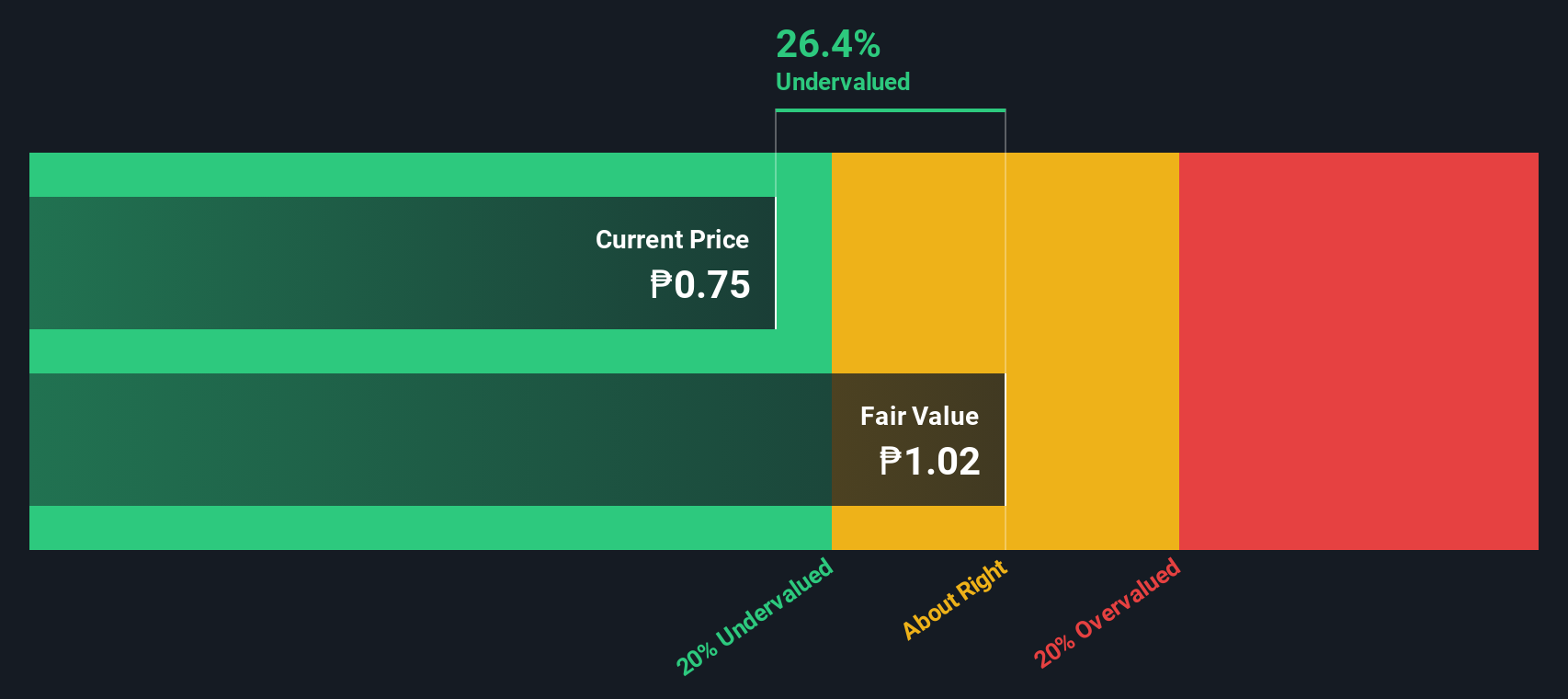

Filinvest Land (PSE:FLI)

Simply Wall St Value Rating: ★★★★☆☆

Overview: Filinvest Land is a real estate company engaged in leasing and real estate operations, with a market capitalization of ₱22.67 billion.

Operations: The company's revenue streams are primarily driven by leasing operations and real estate operations, with the latter contributing significantly more. Over recent periods, the gross profit margin has shown an upward trend, reaching 53.27% in March 2025. Operating expenses include significant allocations to sales and marketing as well as general and administrative costs.

PE: 4.1x

Filinvest Land, a smaller stock with potential value, recently reported mixed earnings for the second quarter of 2025. Sales rose to PHP 2.04 billion from PHP 1.91 billion year-over-year, but net income dipped slightly to PHP 909 million from PHP 1 billion. Despite its reliance on external borrowing for funding, insider confidence is evident through recent share purchases by executives. Leadership changes include Ana Venus A. Mejia as COO and Mary Averose D. Valderrama's promotion within the residential business unit, signaling strategic shifts aimed at future growth in real estate development.

- Dive into the specifics of Filinvest Land here with our thorough valuation report.

Review our historical performance report to gain insights into Filinvest Land's's past performance.

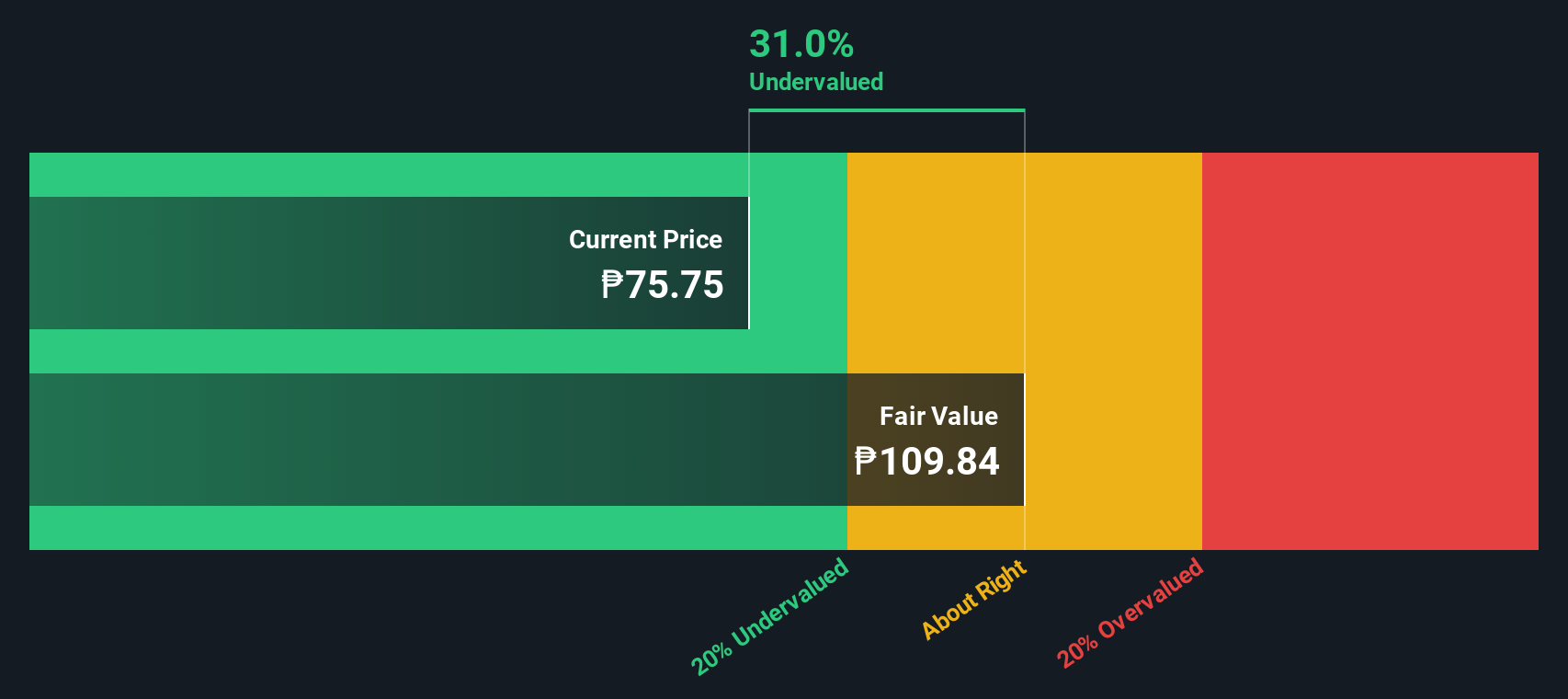

Security Bank (PSE:SECB)

Simply Wall St Value Rating: ★★★★★★

Overview: Security Bank operates as a financial institution providing retail banking, business banking, financial markets services, and wholesale banking, with a market capitalization of ₱109.82 billion.

Operations: Retail Banking is the primary revenue stream, generating ₱27.53 billion, followed by Wholesale Banking at ₱16.02 billion. The company has experienced fluctuations in its net income margin over time, with a recent figure of 22.22%. Operating expenses have been substantial, with general and administrative expenses reaching up to ₱15.60 billion in the latest period analyzed.

PE: 4.5x

Security Bank's recent insider confidence is evident as John David G. Yap acquired 55,040 shares, signaling potential value perception. The bank reported a net income of PHP 3 billion for Q2 2025, up from PHP 2.8 billion the previous year, with earnings per share rising to PHP 4.02 from PHP 3.73. Despite challenges like a high bad loans ratio at 2.9%, the bank's strategic leadership transition and dividend declaration of P1.50 per share suggest positive future prospects amidst its growth trajectory and industry positioning.

- Unlock comprehensive insights into our analysis of Security Bank stock in this valuation report.

Gain insights into Security Bank's past trends and performance with our Past report.

Where To Now?

- Delve into our full catalog of 118 Undervalued Global Small Caps With Insider Buying here.

- Already own these companies? Link your portfolio to Simply Wall St and get alerts on any new warning signs to your stocks.

- Take control of your financial future using Simply Wall St, offering free, in-depth knowledge of international markets to every investor.

Contemplating Other Strategies?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Mobile Infrastructure for Defense and Disaster

The next wave in robotics isn't humanoid. Its fully autonomous towers delivering 5G, ISR, and radar in under 30 minutes, anywhere.

Get the investor briefing before the next round of contracts

Sponsored On Behalf of CiTechNew: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About PSE:SECB

Security Bank

Provides banking and financial products and services to wholesale and retail clients in the Philippines.

Very undervalued with proven track record and pays a dividend.

Similar Companies

Market Insights

Weekly Picks

Early mover in a fast growing industry. Likely to experience share price volatility as they scale

A case for CA$31.80 (undiluted), aka 8,616% upside from CA$0.37 (an 86 bagger!).

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Recently Updated Narratives

Meta’s Bold Bet on AI Pays Off

ADP Stock: Solid Fundamentals, But AI Investments Test Its Margin Resilience

Visa Stock: The Toll Booth at the Center of Global Commerce

Popular Narratives

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026

The AI Infrastructure Giant Grows Into Its Valuation

Trending Discussion