As global markets experience an upswing, with major indices like the S&P 500 reaching new heights amid optimism over trade policies and AI investments, investors are increasingly looking for stable income sources in a fluctuating economic landscape. In such an environment, dividend stocks can offer a reliable stream of income, making them attractive options for those seeking to balance growth potential with consistent returns.

Top 10 Dividend Stocks

| Name | Dividend Yield | Dividend Rating |

| Tsubakimoto Chain (TSE:6371) | 4.27% | ★★★★★★ |

| Wuliangye YibinLtd (SZSE:000858) | 3.66% | ★★★★★★ |

| Yamato Kogyo (TSE:5444) | 4.11% | ★★★★★★ |

| Padma Oil (DSE:PADMAOIL) | 7.45% | ★★★★★★ |

| GakkyushaLtd (TSE:9769) | 4.44% | ★★★★★★ |

| China South Publishing & Media Group (SHSE:601098) | 4.04% | ★★★★★★ |

| Citizens & Northern (NasdaqCM:CZNC) | 5.41% | ★★★★★★ |

| FALCO HOLDINGS (TSE:4671) | 6.71% | ★★★★★★ |

| E J Holdings (TSE:2153) | 4.04% | ★★★★★★ |

| Premier Financial (NasdaqGS:PFC) | 4.54% | ★★★★★★ |

Click here to see the full list of 1981 stocks from our Top Dividend Stocks screener.

Here we highlight a subset of our preferred stocks from the screener.

DMCI Holdings (PSE:DMC)

Simply Wall St Dividend Rating: ★★★★★☆

Overview: DMCI Holdings, Inc. operates in general construction, coal and nickel mining, power generation, real estate development, water concession, and manufacturing both in the Philippines and internationally with a market cap of ₱150.57 billion.

Operations: DMCI Holdings, Inc. generates revenue from its subsidiaries in real estate development (₱11.55 billion) and mining (₱2.43 billion).

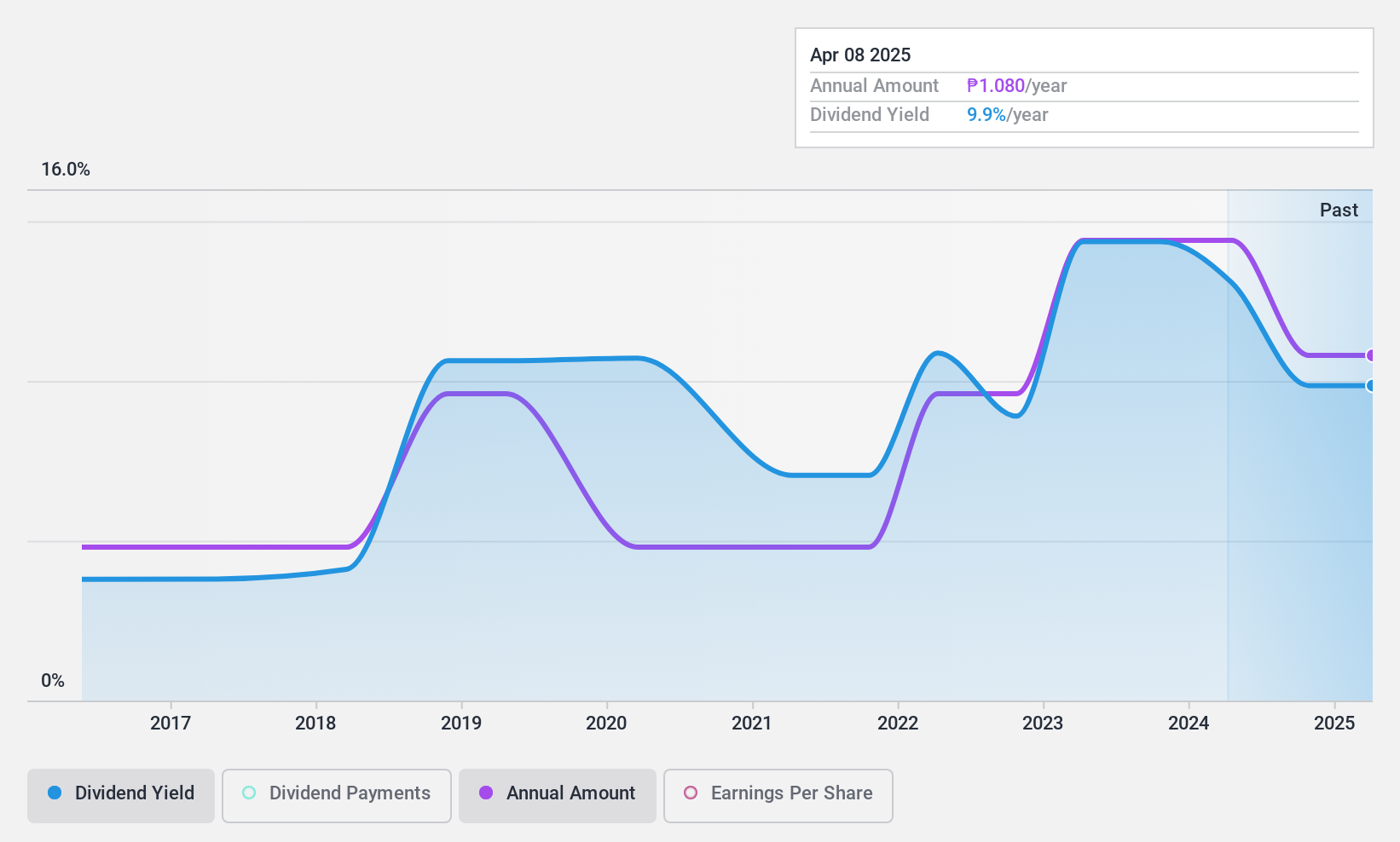

Dividend Yield: 8.3%

DMCI Holdings' dividend profile shows a mixed picture. While the company offers an attractive dividend yield of 8.29%, placing it among the top 25% of dividend payers in the Philippines, its dividends have been volatile over the past decade. The payout ratio is low at 30.1%, indicating dividends are well-covered by earnings and cash flows, suggesting sustainability despite historical unreliability. Recent expansions in mining operations may impact future financial stability and dividend consistency positively or negatively.

- Click to explore a detailed breakdown of our findings in DMCI Holdings' dividend report.

- The analysis detailed in our DMCI Holdings valuation report hints at an deflated share price compared to its estimated value.

TMBThanachart Bank (SET:TTB)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: TMBThanachart Bank Public Company Limited, along with its subsidiaries, offers a range of commercial banking products and services to individuals, SMEs, and corporate clients mainly in Thailand, with a market cap of THB182.15 billion.

Operations: TMBThanachart Bank Public Company Limited generates revenue through its diverse range of commercial banking products and services aimed at individual, SME, and corporate clients in Thailand.

Dividend Yield: 6.4%

TMBThanachart Bank's dividend profile presents certain challenges. Despite a reasonable payout ratio of 56.1% indicating coverage by earnings, dividends have been volatile over the past decade, affecting reliability. The bank's dividend yield of 6.42% is below top-tier payers in Thailand. Recent earnings growth and the THB 30 billion fixed-income offering may influence future stability and sustainability, but high non-performing loans at 3.1% pose potential risks to financial health and dividend consistency.

- Delve into the full analysis dividend report here for a deeper understanding of TMBThanachart Bank.

- According our valuation report, there's an indication that TMBThanachart Bank's share price might be on the cheaper side.

Business Brain Showa-Ota (TSE:9658)

Simply Wall St Dividend Rating: ★★★★★☆

Overview: Business Brain Showa-Ota Inc. offers consulting and system development solutions in Japan, with a market cap of ¥24.53 billion.

Operations: Business Brain Showa-Ota Inc.'s revenue is derived from its consulting and system development solutions in Japan.

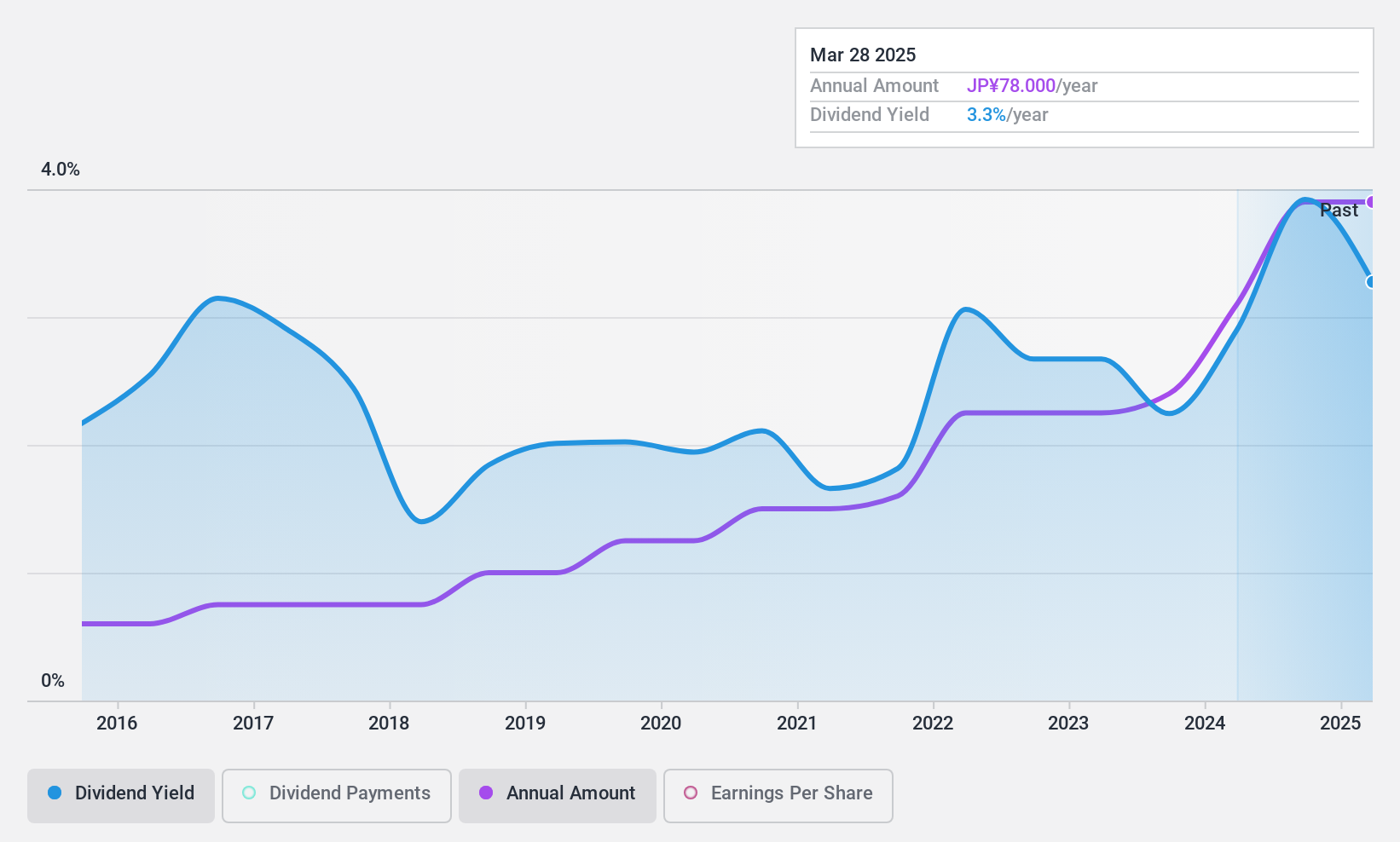

Dividend Yield: 3.7%

Business Brain Showa-Ota's dividend profile is marked by stability and reliability, with dividends growing consistently over the past decade. The company's payout ratio of 44.1% suggests dividends are well-covered by earnings, while a cash payout ratio of 37% indicates strong coverage by cash flows. Although trading slightly below its estimated fair value, its dividend yield of 3.69% is modest compared to top-tier payers in Japan, yet remains attractive for consistent income seekers.

- Take a closer look at Business Brain Showa-Ota's potential here in our dividend report.

- Our valuation report here indicates Business Brain Showa-Ota may be undervalued.

Turning Ideas Into Actions

- Dive into all 1981 of the Top Dividend Stocks we have identified here.

- Are these companies part of your investment strategy? Use Simply Wall St to consolidate your holdings into a portfolio and gain insights with our comprehensive analysis tools.

- Join a community of smart investors by using Simply Wall St. It's free and delivers expert-level analysis on worldwide markets.

Curious About Other Options?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Business Brain Showa-Ota might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSE:9658

Business Brain Showa-Ota

Provides consulting and system development solutions in Japan.

Flawless balance sheet established dividend payer.

Market Insights

Community Narratives