- New Zealand

- /

- Electric Utilities

- /

- NZSE:CEN

Contact Energy (NZSE:CEN) Will Pay A Larger Dividend Than Last Year At NZ$0.1612

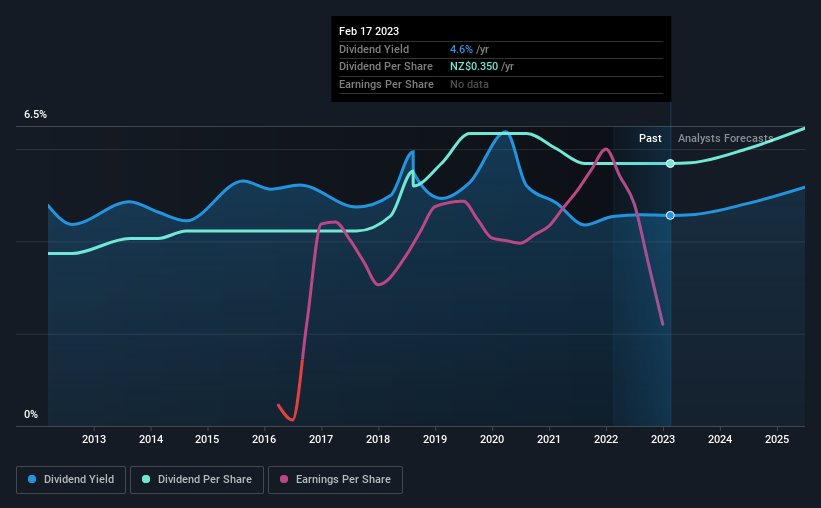

Contact Energy Limited (NZSE:CEN) has announced that it will be increasing its dividend from last year's comparable payment on the 30th of March to NZ$0.1612. This takes the annual payment to 4.6% of the current stock price, which is about average for the industry.

See our latest analysis for Contact Energy

Contact Energy Doesn't Earn Enough To Cover Its Payments

We like to see a healthy dividend yield, but that is only helpful to us if the payment can continue. Based on the last payment, earnings were actually smaller than the dividend, and the company was actually spending more cash than it was making. This high of a dividend payment could start to put pressure on the balance sheet in the future.

Over the next year, EPS is forecast to grow rapidly. If the dividend continues along recent trends, we estimate the payout ratio could reach 153%, which is unsustainable.

Contact Energy Has A Solid Track Record

The company has a sustained record of paying dividends with very little fluctuation. Since 2013, the annual payment back then was NZ$0.23, compared to the most recent full-year payment of NZ$0.35. This means that it has been growing its distributions at 4.3% per annum over that time. Slow and steady dividend growth might not sound that exciting, but dividends have been stable for ten years, which we think makes this a fairly attractive offer.

Dividend Growth Potential Is Shaky

Some investors will be chomping at the bit to buy some of the company's stock based on its dividend history. However, initial appearances might be deceiving. Over the past five years, it looks as though Contact Energy's EPS has declined at around 14% a year. Dividend payments are likely to come under some pressure unless EPS can pull out of the nosedive it is in. Over the next year, however, earnings are actually predicted to rise, but we would still be cautious until a track record of earnings growth can be built.

The Dividend Could Prove To Be Unreliable

In summary, while it's always good to see the dividend being raised, we don't think Contact Energy's payments are rock solid. We can't deny that the payments have been very stable, but we are a little bit worried about the very high payout ratio. This company is not in the top tier of income providing stocks.

Market movements attest to how highly valued a consistent dividend policy is compared to one which is more unpredictable. However, there are other things to consider for investors when analysing stock performance. Just as an example, we've come across 3 warning signs for Contact Energy you should be aware of, and 2 of them are potentially serious. Looking for more high-yielding dividend ideas? Try our collection of strong dividend payers.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NZSE:CEN

Contact Energy

Generates and sells electricity and natural gas in New Zealand.

Slight and fair value.

Similar Companies

Market Insights

Community Narratives