- New Zealand

- /

- Logistics

- /

- NZSE:FRW

If EPS Growth Is Important To You, Freightways Group (NZSE:FRW) Presents An Opportunity

For beginners, it can seem like a good idea (and an exciting prospect) to buy a company that tells a good story to investors, even if it currently lacks a track record of revenue and profit. Unfortunately, these high risk investments often have little probability of ever paying off, and many investors pay a price to learn their lesson. Loss making companies can act like a sponge for capital - so investors should be cautious that they're not throwing good money after bad.

If this kind of company isn't your style, you like companies that generate revenue, and even earn profits, then you may well be interested in Freightways Group (NZSE:FRW). While this doesn't necessarily speak to whether it's undervalued, the profitability of the business is enough to warrant some appreciation - especially if its growing.

How Fast Is Freightways Group Growing Its Earnings Per Share?

Even modest earnings per share growth (EPS) can create meaningful value, when it is sustained reliably from year to year. So it's easy to see why many investors focus in on EPS growth. Freightways Group boosted its trailing twelve month EPS from NZ$0.40 to NZ$0.45, in the last year. There's little doubt shareholders would be happy with that 13% gain.

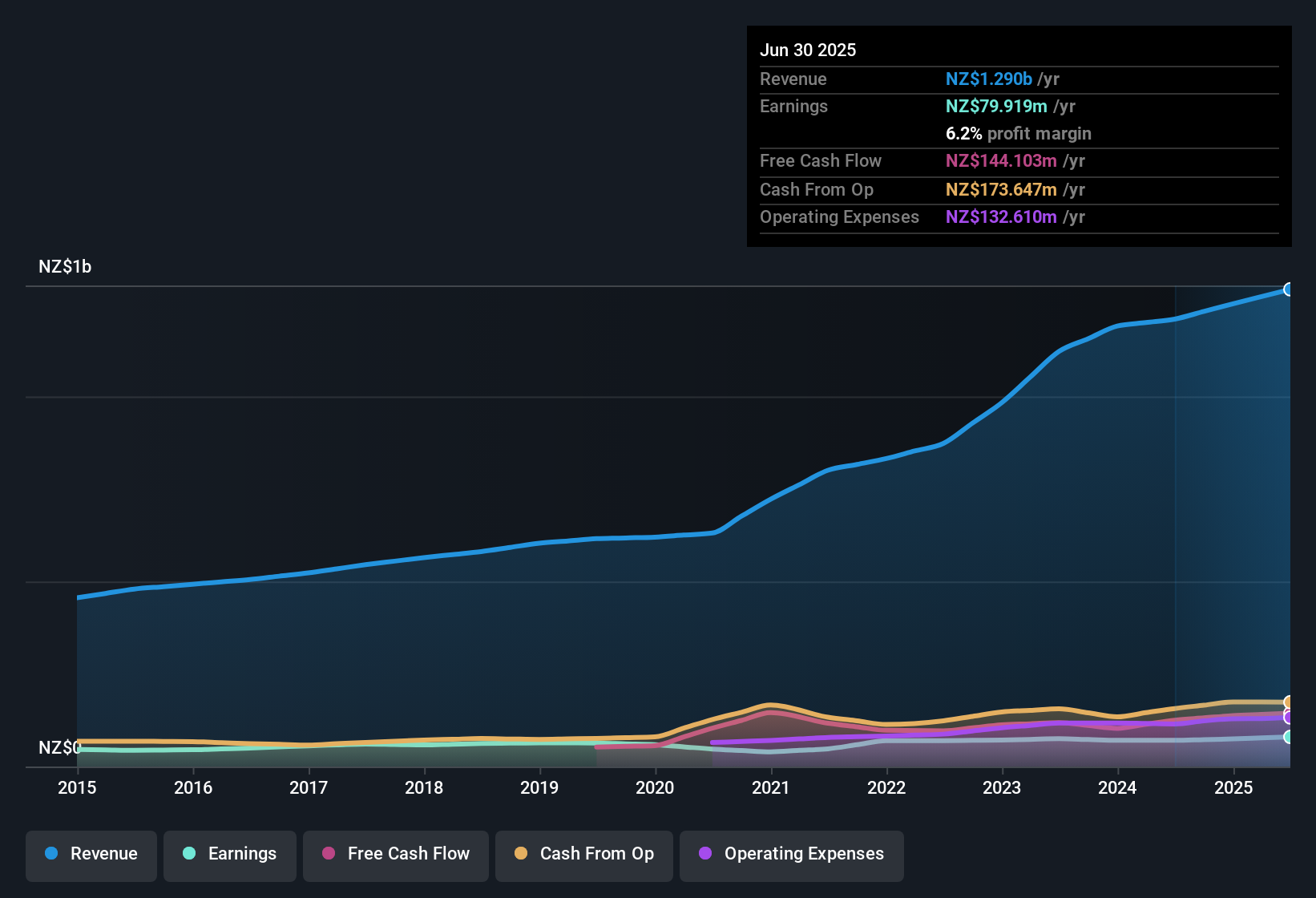

One way to double-check a company's growth is to look at how its revenue, and earnings before interest and tax (EBIT) margins are changing. Freightways Group maintained stable EBIT margins over the last year, all while growing revenue 6.7% to NZ$1.3b. That's encouraging news for the company!

You can take a look at the company's revenue and earnings growth trend, in the chart below. For finer detail, click on the image.

Check out our latest analysis for Freightways Group

While we live in the present moment, there's little doubt that the future matters most in the investment decision process. So why not check this interactive chart depicting future EPS estimates, for Freightways Group?

Are Freightways Group Insiders Aligned With All Shareholders?

Insider interest in a company always sparks a bit of intrigue and many investors are on the lookout for companies where insiders are putting their money where their mouth is. Because often, the purchase of stock is a sign that the buyer views it as undervalued. Of course, we can never be sure what insiders are thinking, we can only judge their actions.

We haven't seen any insiders selling Freightways Group shares, in the last year. Add in the fact that Grant Devonport, the Independent Non-Executive Director of the company, paid NZ$73k for shares at around NZ$10.45 each. It seems that at least one insider is prepared to show the market there is potential within Freightways Group.

On top of the insider buying, it's good to see that Freightways Group insiders have a valuable investment in the business. To be specific, they have NZ$30m worth of shares. That shows significant buy-in, and may indicate conviction in the business strategy. Despite being just 1.1% of the company, the value of that investment is enough to show insiders have plenty riding on the venture.

While insiders are apparently happy to hold and accumulate shares, that is just part of the big picture. That's because on our analysis the CEO, Mark Troughear, is paid less than the median for similar sized companies. Our analysis has discovered that the median total compensation for the CEOs of companies like Freightways Group with market caps between NZ$1.7b and NZ$5.6b is about NZ$1.8m.

The Freightways Group CEO received NZ$1.6m in compensation for the year ending June 2025. That comes in below the average for similar sized companies and seems pretty reasonable. CEO remuneration levels are not the most important metric for investors, but when the pay is modest, that does support enhanced alignment between the CEO and the ordinary shareholders. It can also be a sign of a culture of integrity, in a broader sense.

Does Freightways Group Deserve A Spot On Your Watchlist?

One positive for Freightways Group is that it is growing EPS. That's nice to see. Better yet, insiders are significant shareholders, and have been buying more shares. That makes the company a prime candidate for your watchlist - and arguably a research priority. It is worth noting though that we have found 1 warning sign for Freightways Group that you need to take into consideration.

There are plenty of other companies that have insiders buying up shares. So if you like the sound of Freightways Group, you'll probably love this curated collection of companies in NZ that have an attractive valuation alongside insider buying in the last three months.

Please note the insider transactions discussed in this article refer to reportable transactions in the relevant jurisdiction.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NZSE:FRW

Freightways Group

Provides express package and business mail, and information management services in New Zealand, Australia, and internationally.

Proven track record with moderate growth potential.

Similar Companies

Market Insights

Community Narratives